Statutory Guidelines [Appendix A(5) Tres. Regs 1.46B and 1.46B-1 to B-5] regarding designated settlement funds and qualified settlement funds.

Indiana Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5

Description

How to fill out Designated Settlement Funds Treasury Regulations 1.468 And 1.468B.1 Through 1.468B.5?

Are you presently inside a situation in which you need to have paperwork for both business or personal purposes just about every day time? There are tons of authorized record web templates available on the Internet, but getting types you can rely is not straightforward. US Legal Forms gives a huge number of form web templates, much like the Indiana Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5, that happen to be written to meet federal and state specifications.

When you are previously acquainted with US Legal Forms web site and get a merchant account, simply log in. Next, you are able to obtain the Indiana Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5 design.

Should you not provide an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the form you will need and make sure it is for the correct metropolis/state.

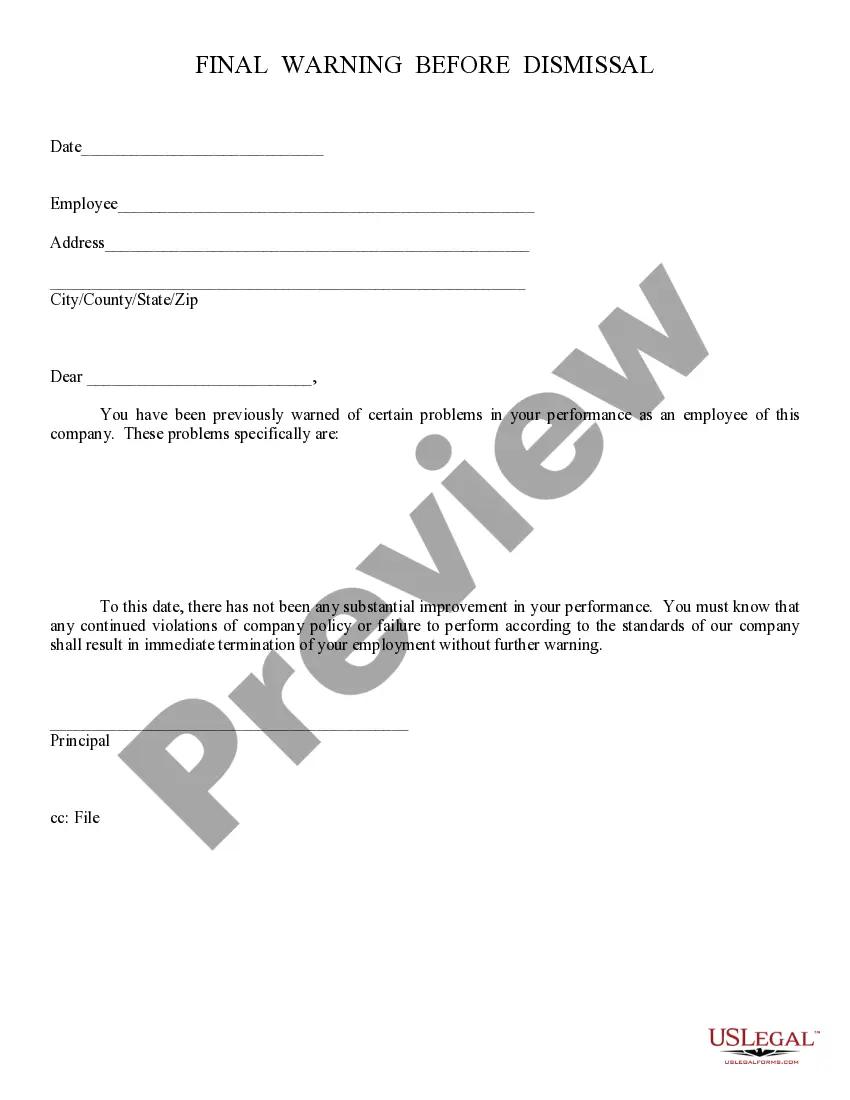

- Use the Review option to check the shape.

- Look at the information to actually have selected the appropriate form.

- In the event the form is not what you`re looking for, take advantage of the Research field to discover the form that meets your needs and specifications.

- Whenever you discover the correct form, just click Buy now.

- Opt for the costs prepare you desire, fill out the specified information and facts to create your account, and buy the transaction using your PayPal or credit card.

- Decide on a convenient file file format and obtain your version.

Get each of the record web templates you have bought in the My Forms menu. You can aquire a additional version of Indiana Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5 whenever, if needed. Just select the essential form to obtain or print out the record design.

Use US Legal Forms, the most considerable assortment of authorized forms, to save time and steer clear of mistakes. The service gives appropriately created authorized record web templates that you can use for a range of purposes. Create a merchant account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

§ 1.468B?1 Qualified settlement funds. If a fund, account, or trust that is a qualified settlement fund could be classified as a trust within the meaning of §301.7701?4 of this chapter, it is classified as a qualified settlement fund for all purposes of the Internal Revenue Code (Code).

§ 1.468B-1 Qualified settlement funds. (a) In general. A qualified settlement fund is a fund, account, or trust that satisfies the requirements of paragraph (c) of this section. (b) Coordination with other entity classifications.

There are only three requirements for establishing a QSF. It must be created by a court order with continuing jurisdiction over the QSF. [i] The trust is set up to resolve tort or other legal claims prescribed by the Treasury regulations. [ii] Finally, it must be a trust under applicable state law.

The designated settlement fund concept was created in 1986 under Section 468B of the IRC to enable defendants to deduct amounts paid to settle multi-plaintiff lawsuits before it was agreed how these amounts would be allocated.

A qualified settlement fund is a United States person and is subject to tax on its modified gross income for any taxable year at a rate equal to the maximum rate in effect for that taxable year under section 1(e).

A qualified settlement fund (QSF), commonly referred to as a 468B Trust, is a legal mechanism used in mass tort lawsuits to expedite the administration and distribution of settlement payments. A QSF is essentially a temporary ?holding tank? for the proceeds of a settlement.

Qualified Settlement Fund Services Generating client closing statements and providing accounting for the fund. Disbursement of all claimant payments, including directing funding of Special Needs Trusts and/or structured settlements.

The benefits of a QSF for an attorney include: More time to plan for contingency fees using attorney fee deferral. Affording clients extra time to implement settlement planning strategies and comply with government benefits income thresholds.