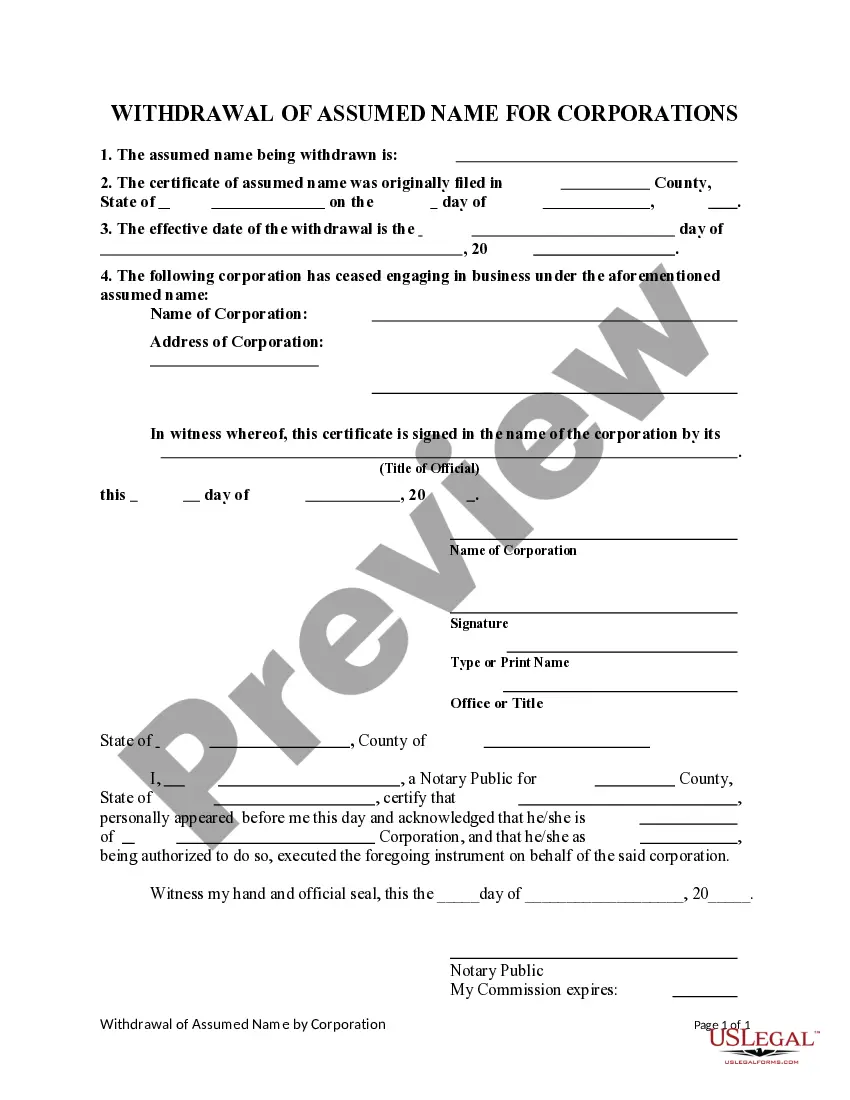

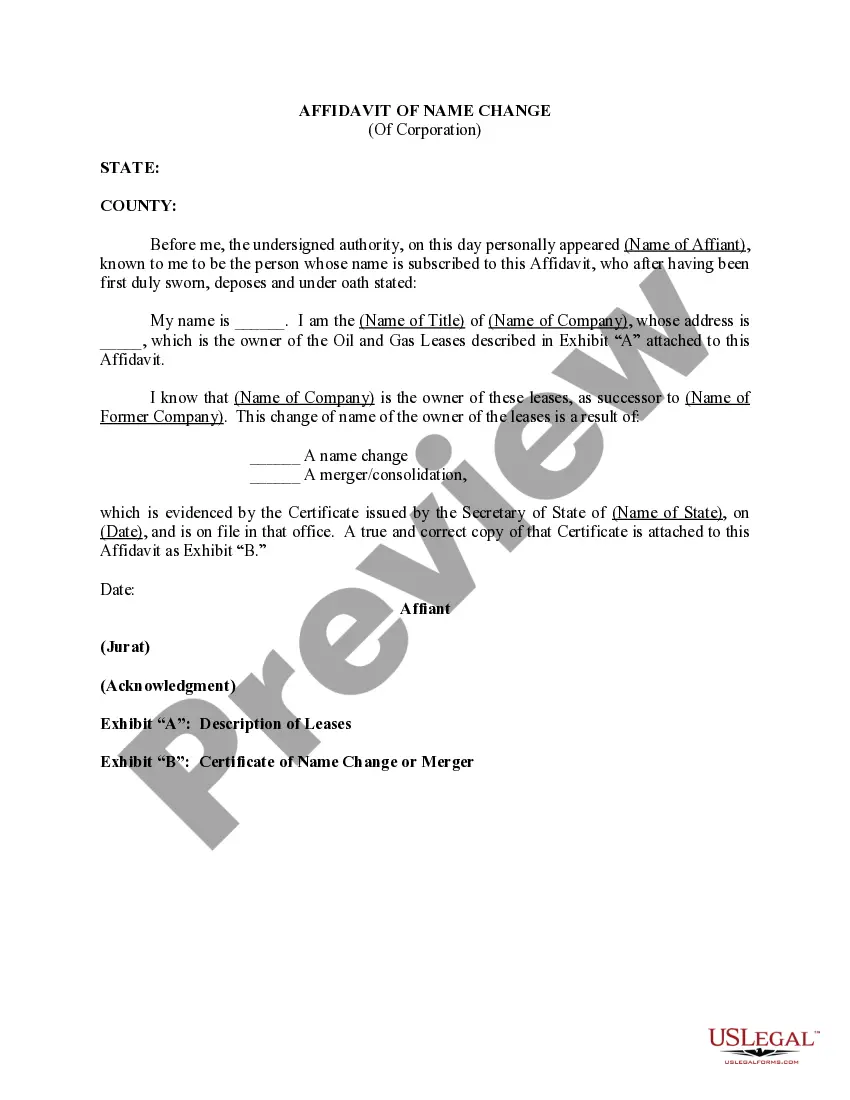

Indiana Withdrawal of Assumed Name for Corporation

Description

How to fill out Withdrawal Of Assumed Name For Corporation?

Discovering the right lawful record design can be quite a have difficulties. Of course, there are tons of templates available on the Internet, but how will you find the lawful type you will need? Take advantage of the US Legal Forms site. The services provides 1000s of templates, including the Indiana Withdrawal of Assumed Name for Corporation, that can be used for organization and private needs. All the varieties are inspected by experts and fulfill federal and state needs.

In case you are already listed, log in to the profile and click on the Down load switch to find the Indiana Withdrawal of Assumed Name for Corporation. Use your profile to search from the lawful varieties you have purchased earlier. Visit the My Forms tab of the profile and obtain yet another version of the record you will need.

In case you are a whole new user of US Legal Forms, listed here are basic recommendations so that you can comply with:

- First, ensure you have selected the appropriate type for your personal metropolis/county. It is possible to examine the shape using the Preview switch and read the shape description to ensure it is the right one for you.

- If the type fails to fulfill your requirements, make use of the Seach field to obtain the appropriate type.

- Once you are certain the shape is proper, go through the Buy now switch to find the type.

- Pick the pricing program you desire and enter in the needed details. Make your profile and buy an order making use of your PayPal profile or charge card.

- Opt for the data file structure and down load the lawful record design to the product.

- Full, change and print out and sign the obtained Indiana Withdrawal of Assumed Name for Corporation.

US Legal Forms may be the largest catalogue of lawful varieties that you will find numerous record templates. Take advantage of the company to down load skillfully-produced files that comply with state needs.

Form popularity

FAQ

In addition, sole proprietorships are required to obtain all permits and licenses needed to operate legally on a state and local level, just like formally registered companies. General Partnerships: Business registration is not required for general partnerships in Indiana.

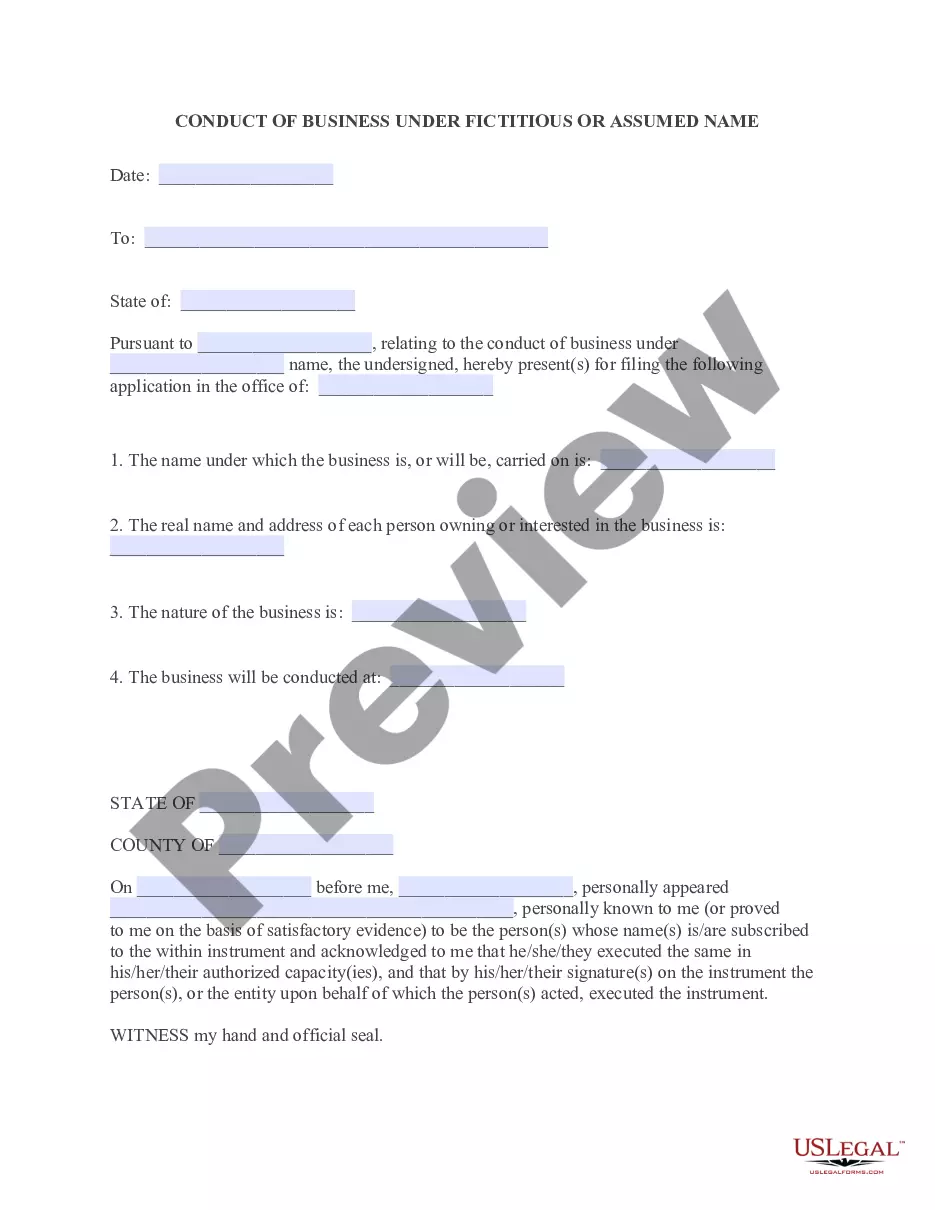

Filling out the dba forms This form must be filled out and filed with the Indiana Secretary of State, as well as with the county recorder in each county where a place of business is located.

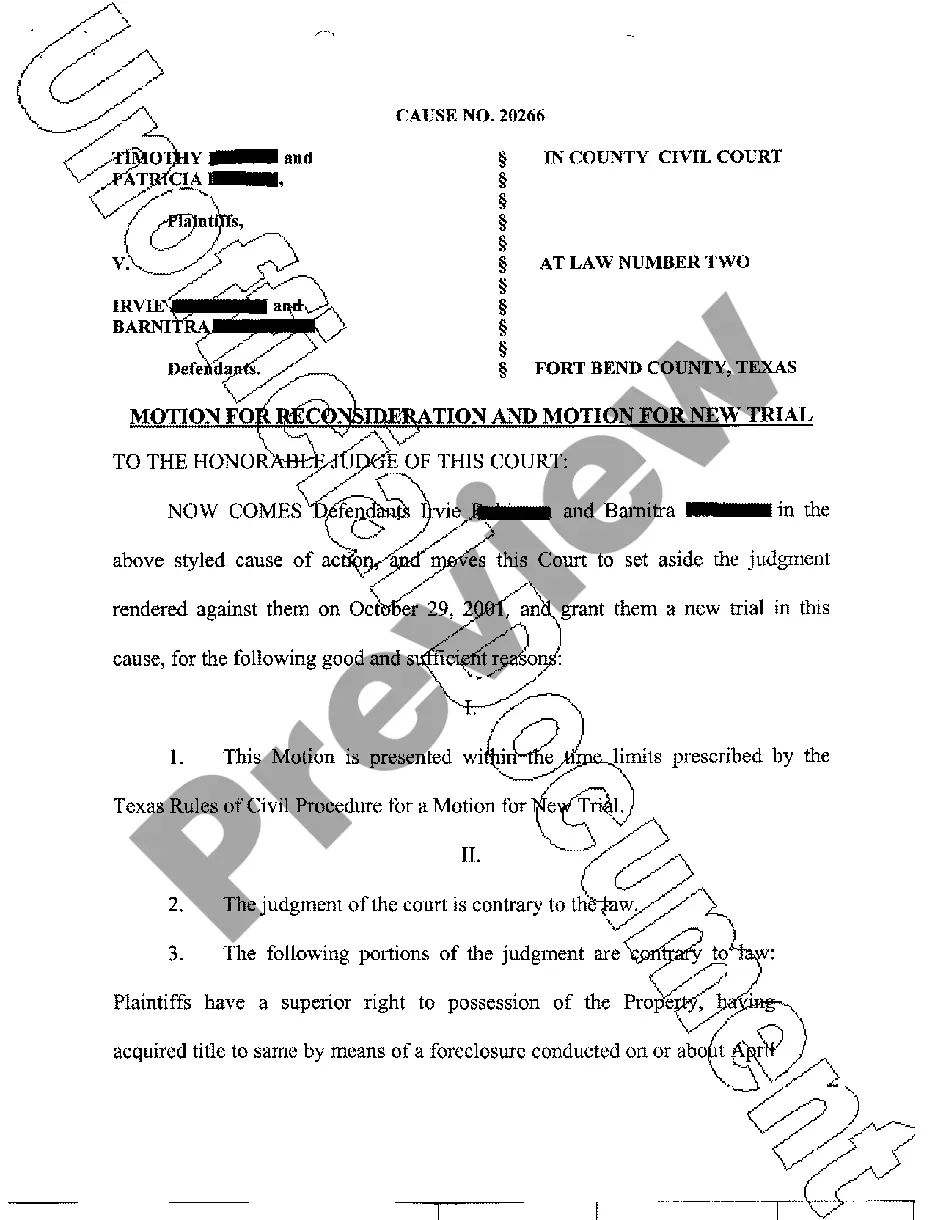

To dissolve your LLC in Indiana, submit one original and one copy of the Indiana Articles of Dissolution (Form 49465) to the Indiana Secretary of State (SOS) by mail or in person. Articles of Dissolution can be filed online if you pay using an IN.gov payment account or a MasterCard, Discover or Visa credit card.

To withdraw or cancel your foreign corporation in Indiana, provide one original and one copy of Form 39077, Application for Certificate of Withdrawal of a Foreign Corporation, along with the filing fee, to the Indiana Secretary of State. The Application for Withdrawal can't be filed online.

All businesses in Indiana, even home-based businesses and sole proprietors, will need some type of state or local licensing in order to legally operate.

How much does a DBA filing cost in Indiana? The DBA one-time filing fee for sole proprietors is $35. The Indiana DBA one-time filing fee for LLCs, for-profit corporations, LPs, and LLPs is $30 by mail or in person, or $20 online. The one-time DBA filing fees for non-profits are $26 by mail or in person or $10 online.

Ing to Indiana state law, a business must register a DBA or assumed name before conducting business under that name (IC 23-0.5-3-4).

The DBA filing fees for incorporated businesses are a one-time fee because DBAs in Indiana do not expire.