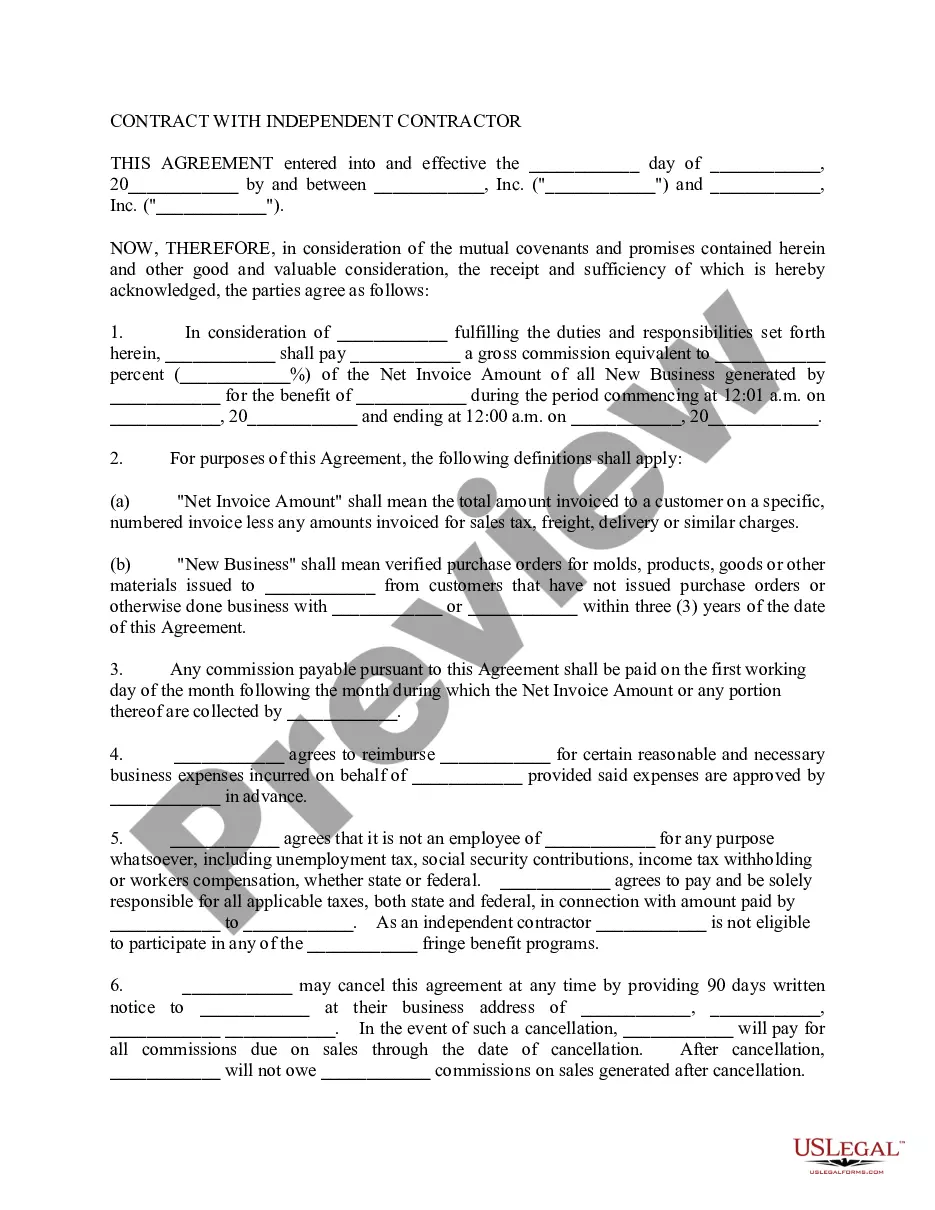

Indiana Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

Choosing the best legal papers design could be a have a problem. Of course, there are a lot of layouts available on the Internet, but how can you find the legal kind you want? Make use of the US Legal Forms web site. The service gives a large number of layouts, for example the Indiana Self-Employed Independent Contractor Employment Agreement - commission for new business, that can be used for company and personal demands. All of the kinds are checked by professionals and meet federal and state demands.

When you are previously registered, log in to your profile and click on the Acquire switch to have the Indiana Self-Employed Independent Contractor Employment Agreement - commission for new business. Utilize your profile to appear from the legal kinds you have bought formerly. Go to the My Forms tab of your own profile and have an additional version from the papers you want.

When you are a brand new user of US Legal Forms, listed below are basic recommendations for you to comply with:

- Initially, ensure you have chosen the proper kind for your town/county. You can look through the form making use of the Preview switch and look at the form outline to make sure it will be the right one for you.

- When the kind fails to meet your requirements, take advantage of the Seach discipline to discover the right kind.

- Once you are certain that the form would work, click the Get now switch to have the kind.

- Choose the rates program you need and enter in the required information. Create your profile and purchase the transaction using your PayPal profile or bank card.

- Opt for the data file format and download the legal papers design to your product.

- Comprehensive, change and produce and indicator the obtained Indiana Self-Employed Independent Contractor Employment Agreement - commission for new business.

US Legal Forms may be the biggest local library of legal kinds that you can discover a variety of papers layouts. Make use of the service to download expertly-produced files that comply with status demands.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors doing business in the State of Indiana are required to file a statement and documentation with the Indiana Department of Revenue (DOR) stating independent contractor status. There is a five dollar filing fee and the certificate is valid for one year.

A person is required to come into an agreement (known as Independent Contractor Agreement and/or ICA) if he is appointed as an independent contractor with the company, being the other party. This ICA recognises the rights, duties, obligations, services of the contractor, etc.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.07-Mar-2018