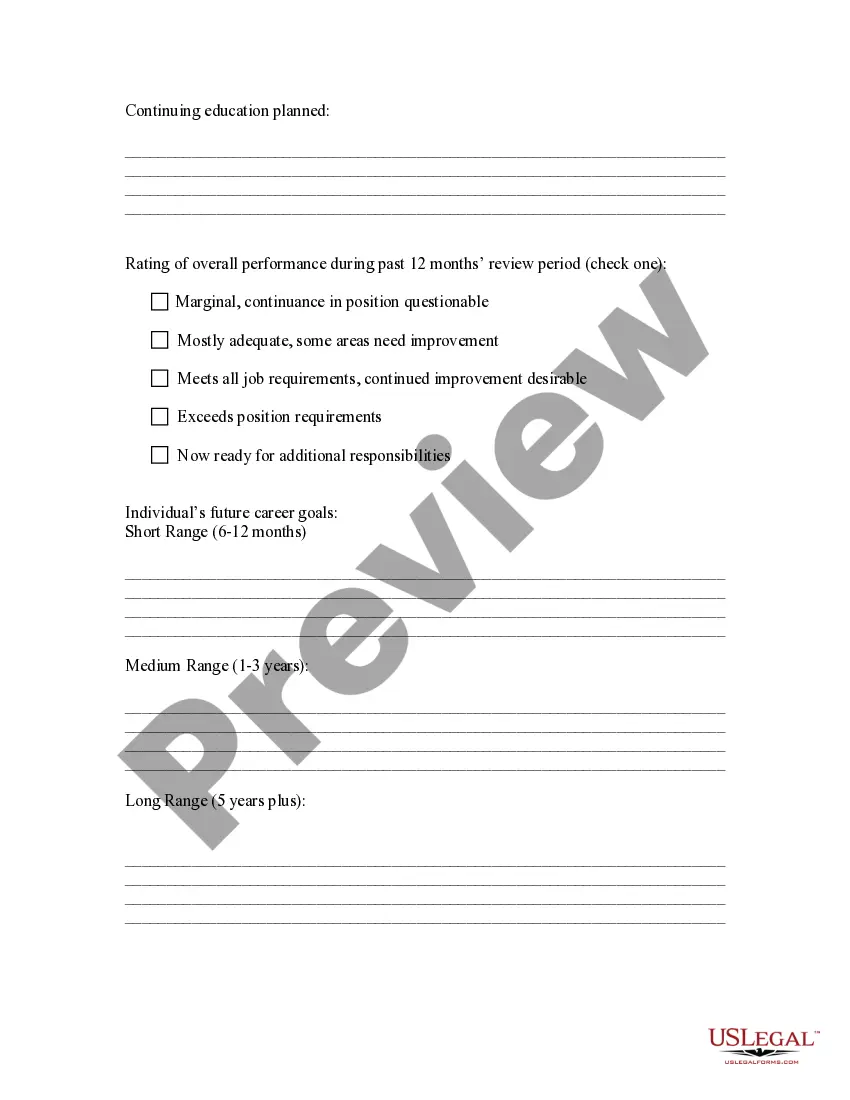

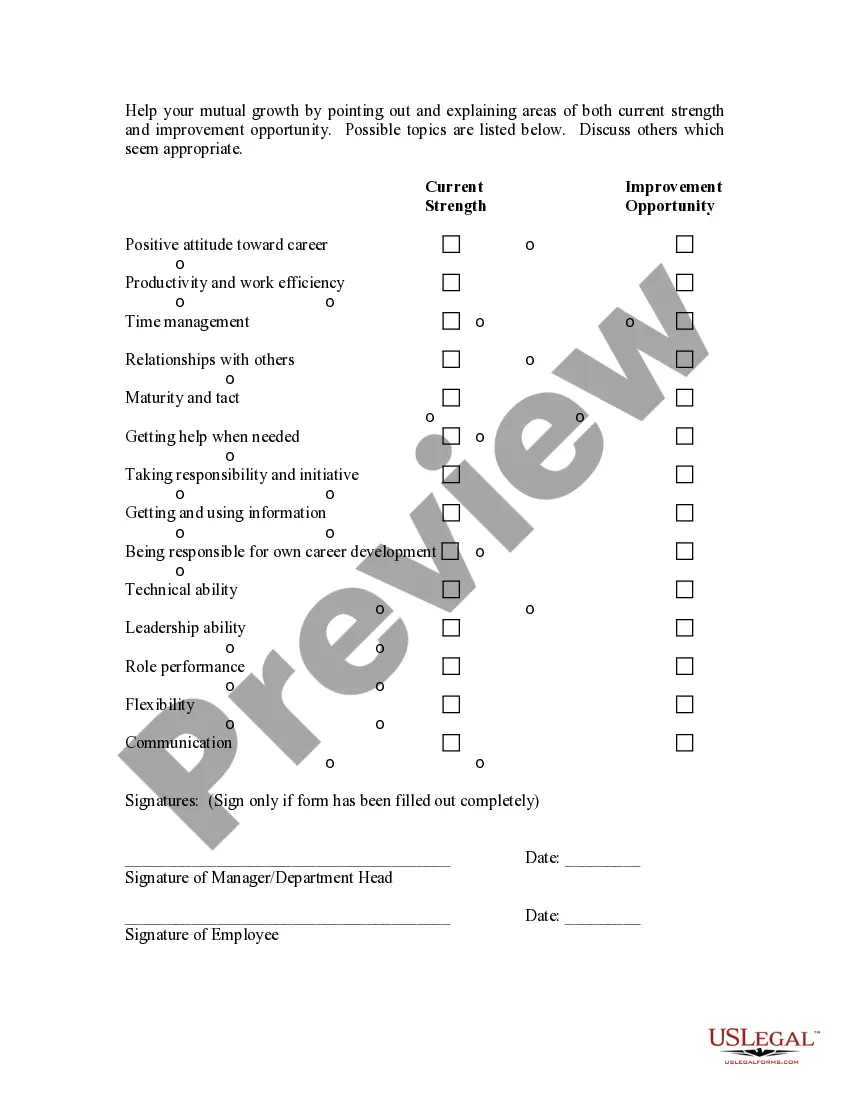

Indiana Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees

Description

How to fill out Model Performance Evaluation - Appraisal Form For Hourly, Exempt, Nonexempt, And Managerial Employees?

US Legal Forms - one of the largest compilations of legal documents in the United States - provides a broad selection of legal document templates you can acquire or create.

By using the website, you can discover thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of documents such as the Indiana Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees within moments.

If you are already registered, Log In and access the Indiana Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees from your US Legal Forms account. The Download option will be available on each form you view. You have access to all previously downloaded forms within the My documents section of your account.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you desire and provide your information to register for the account.

Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form onto your device. Edit. Fill out, revise and print, and sign the downloaded Indiana Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees.

- If you are using US Legal Forms for the first time, here are easy steps to get started.

- Ensure you have selected the appropriate form for your region/area.

- Click on the Review option to assess the form’s details.

- Check the form summary to ensure you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

Form popularity

FAQ

The FLSA, identifies two types of employees: non-exempt employees and exempt employees: Non-exempt employees are employees who, based on the duties performed and the manner of compensation, are required to account for time worked and sick leave, vacation, and other leave on an hourly and fractional hourly basis.

Even though there is no law that governs when performance reviews are to be conducted, if you never received one at all during your employment, and you were terminated for cause specifically for performance-related issues or during your probationary period, there may be grounds to fight your termination.

To be considered FLSA exempt, all of the below must be true for an employee: The employee receives pay on a salary basis (rather than hourly). The employee earns at least $35,568 per year, or $684 per week. The employee performs exempt job duties.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Employees whose jobs are governed by the FLSA are either "exempt" or "nonexempt." Nonexempt employees are entitled to overtime pay. Exempt employees are not. Most employees covered by the FLSA are nonexempt.

The most common types of appraisal are:straight ranking appraisals.grading.management by objective appraisals.trait-based appraisals.behaviour-based appraisals.360 reviews.

Here are some types of performance appraisals:Negotiated appraisal.Management by objective (MBO)Assessment center method.Self-appraisal.Peer reviews.Customer or client reviews.Behaviorally anchored rating scale (BARS)Human resource accounting method.

Performance appraisal allows you to provide positive feedback as well as identifying areas for improvement. An employee can discuss and even create a developmental (training) plan with the manager so he can improve his skills. It motivates employees if supported by a good merit-based compensation system.

To be considered FLSA exempt, all of the below must be true for an employee:The employee receives pay on a salary basis (rather than hourly).The employee earns at least $35,568 per year, or $684 per week.The employee performs exempt job duties.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.