Indiana Resolution of Meeting of LLC Members to Purchase

Description

How to fill out Resolution Of Meeting Of LLC Members To Purchase?

You might spend hours on the web trying to locate the valid document template that fulfills the local and federal requirements you need.

US Legal Forms offers a vast selection of valid forms that are vetted by professionals.

You can easily download or print the Indiana Resolution of Meeting of LLC Members to Purchase from your account.

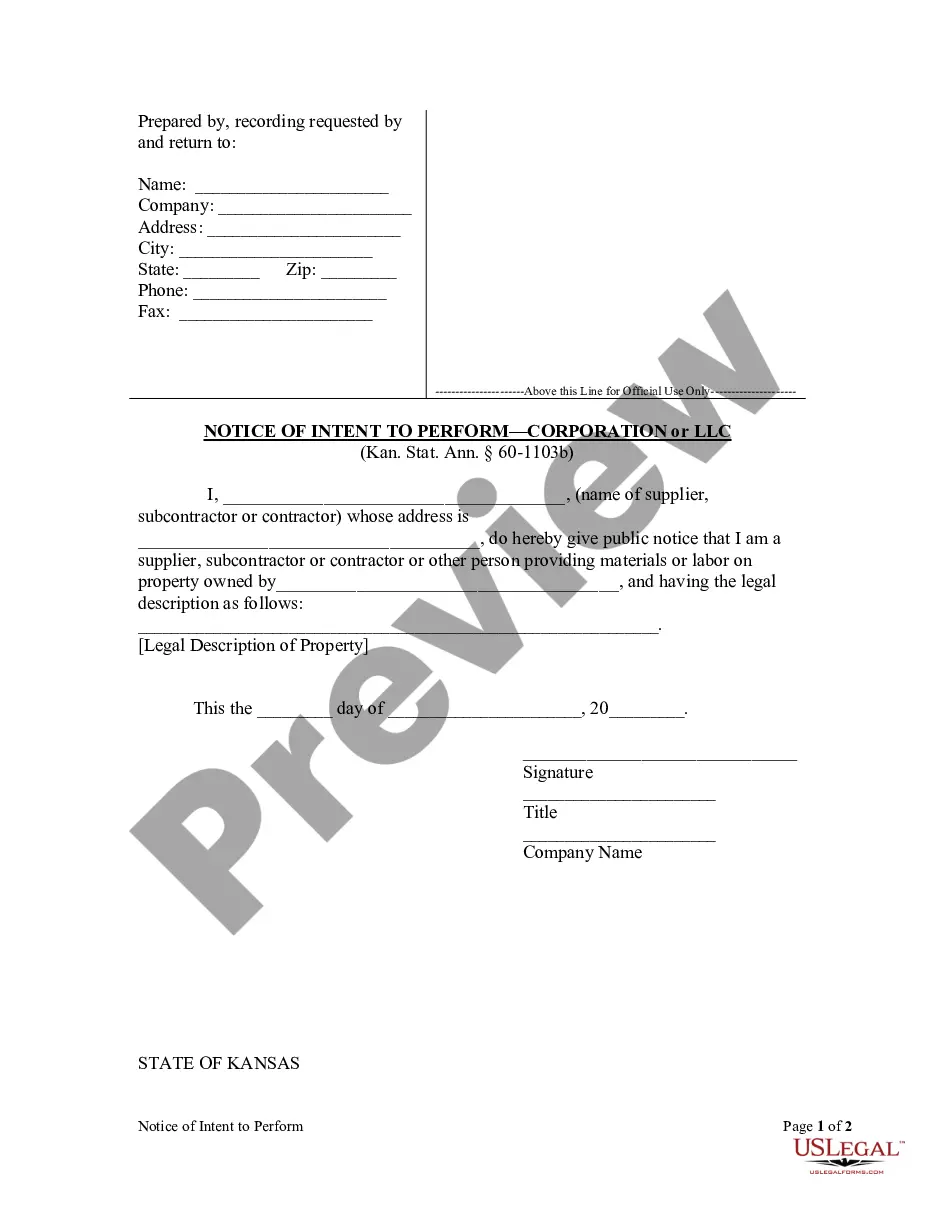

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the Indiana Resolution of Meeting of LLC Members to Purchase.

- Every valid document template you purchase is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the respective button.

- If you are using US Legal Forms for the first time, follow these simple steps.

- First, ensure you have selected the correct document template for the state/region of your choosing.

- Review the form description to make certain you have picked the right one.

Form popularity

FAQ

To write a resolution letter regarding the Indiana Resolution of Meeting of LLC Members to Purchase, begin by clearly stating the purpose of the letter. Include the details of the meeting where the resolution was made, such as the date, participants, and the exact language of the resolution. Ensure the letter reflects the intention of the LLC members, specifying the decisions taken during the meeting. You can utilize the resources available on uslegalforms to create a professional and compliant resolution letter.

To write the Indiana Resolution of Meeting of LLC Members to Purchase, begin by outlining the key details such as the meeting date, purpose, and attendees. Clearly state the resolution's intent, ensuring it reflects the agreement made among the members regarding the purchase. Utilize a simple and direct format to prevent ambiguity, and make sure all members sign the document to affirm their commitment. For further assistance, consider using the UsLegalForms platform to access templates and resources tailored for your LLC's needs.

Writing a corporate resolution involves outlining the specific decision being made, identifying the individuals involved, and including the date of the meeting. In cases like the Indiana Resolution of Meeting of LLC Members to Purchase, it should clearly state the purpose and any actions that are agreed upon. Always ensure to sign and date the resolution to validate it legally.

An operating agreement outlines the governance structure and operational guidelines of an LLC, whereas a resolution records specific decisions made by members or managers. In the context of the Indiana Resolution of Meeting of LLC Members to Purchase, a resolution may be created to document the members' agreement, while the operating agreement covers the overall framework for how decisions are made. Both documents are essential for proper LLC management.

The primary purpose of a company resolution is to document important decisions made within the company. In the context of the Indiana Resolution of Meeting of LLC Members to Purchase, company resolutions record member agreements for transactions or ownership changes. These documents provide clarity and serve as an official record, which is critical for legal and operational reasons.

A member resolution is a formal document that reflects the agreement or decision made by one or more members of an LLC. It is an essential component of the Indiana Resolution of Meeting of LLC Members to Purchase, particularly when members agree on buying interests or making significant changes to the organization. Member resolutions are important for documenting the members' authority and intentions.

A resolution for an LLC manager serves as an official record of decisions made by an LLC manager on behalf of the company. This type of resolution often accompanies the Indiana Resolution of Meeting of LLC Members to Purchase when managerial changes or financial decisions are involved. Proper documentation through resolutions helps ensure compliance with state laws and maintains organizational integrity.

The resolution of members of an LLC is a formal document that records decisions made by the LLC members during a meeting. This document is significant during the Indiana Resolution of Meeting of LLC Members to Purchase, as it outlines the agreement reached by members on important matters. These resolutions help maintain clear communication and provide legal documentation for future reference.

A single member LLC resolution is a formal document that outlines decisions made by the sole member of a Limited Liability Company. This resolution is essential for recording actions, such as the Indiana Resolution of Meeting of LLC Members to Purchase. It provides legal documentation of the member's approval for specific actions, helping to maintain clarity and compliance within the LLC. Using this resolution can enhance your company’s legal standing and simplify decision-making processes.