Indiana Annuity as Consideration for Transfer of Securities

Description

How to fill out Annuity As Consideration For Transfer Of Securities?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast array of legal template forms that you can download or print. By utilizing the website, you can access a wide selection of forms for both business and personal purposes, categorized by classes, states, or keywords.

You can quickly obtain the most recent forms such as the Indiana Annuity as Consideration for Transfer of Securities in just seconds.

If you have a subscription, Log In to acquire the Indiana Annuity as Consideration for Transfer of Securities from the US Legal Forms library. The Download option will appear on every form you view. You can find all your previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Select the format and download the form to your device. Make adjustments. Complete, modify, print, and sign the downloaded Indiana Annuity as Consideration for Transfer of Securities. Every design you add to your account does not expire and is yours for an indefinite time. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you require. Access the Indiana Annuity as Consideration for Transfer of Securities with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize a large number of professional and state-specific templates that fulfill your business or personal demands and specifications.

- Ensure you have chosen the appropriate form for your city/region.

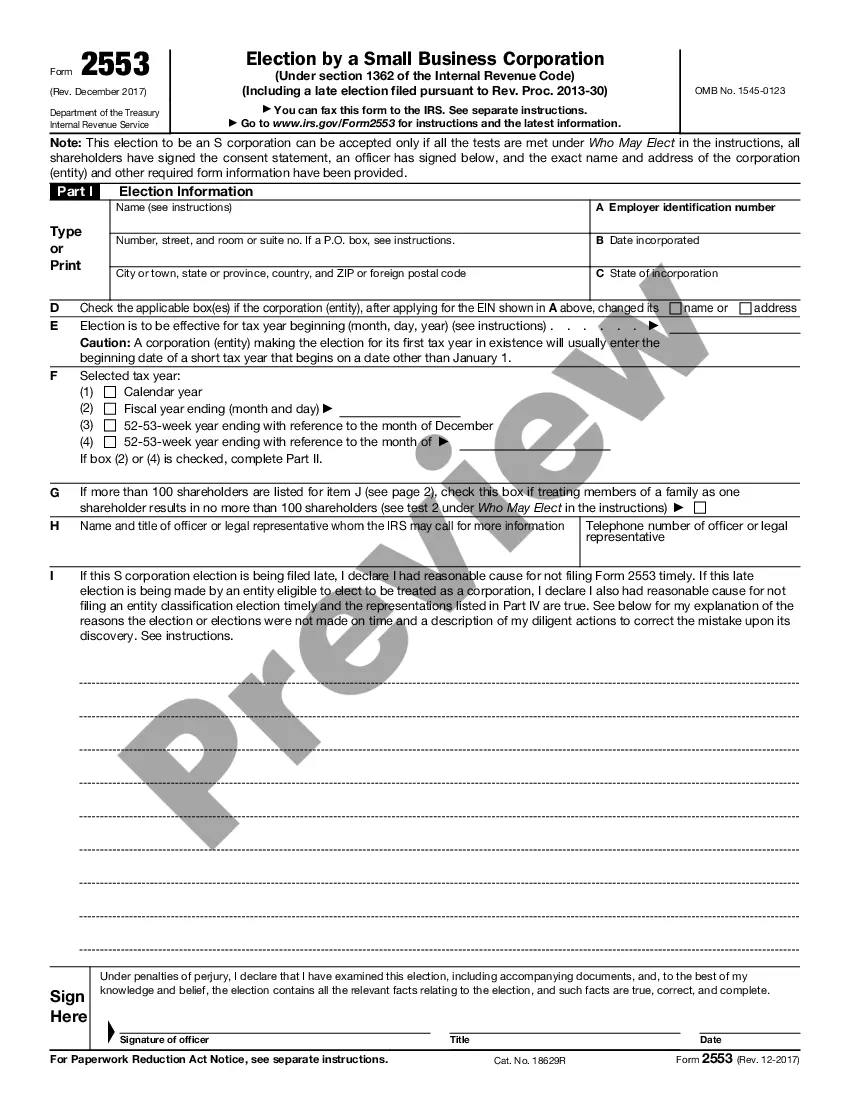

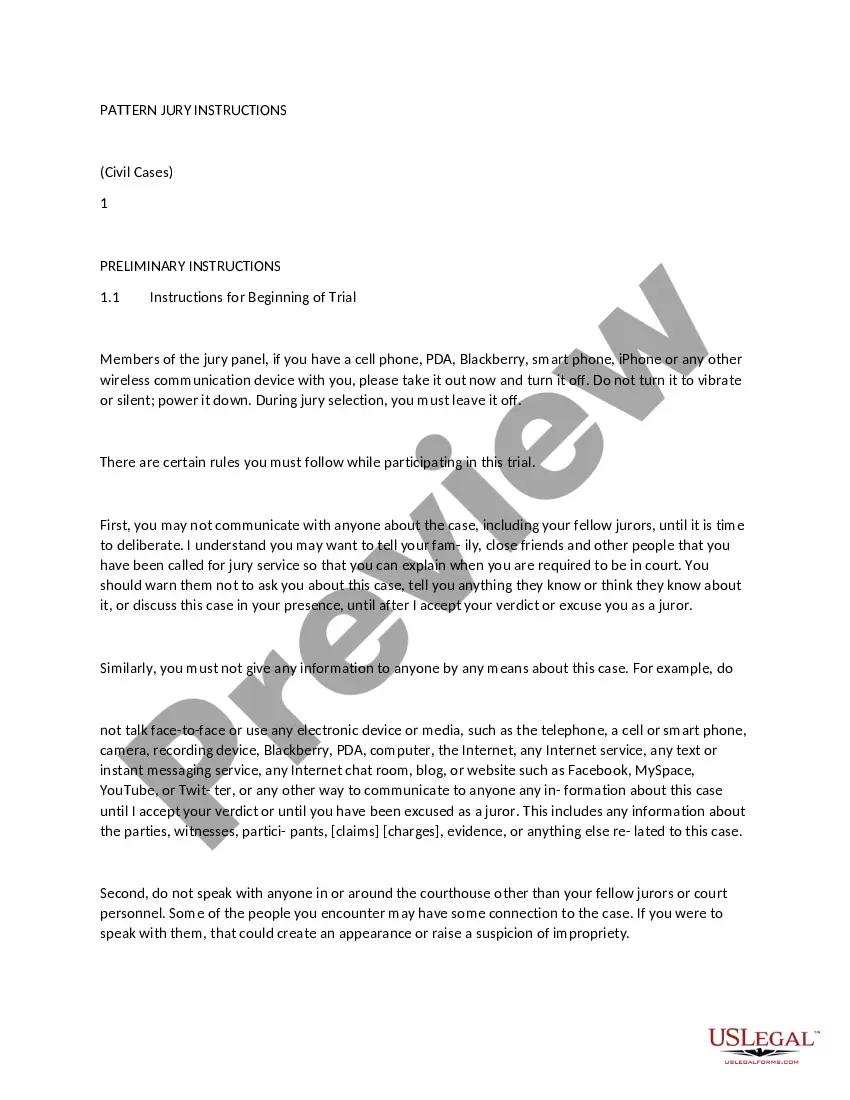

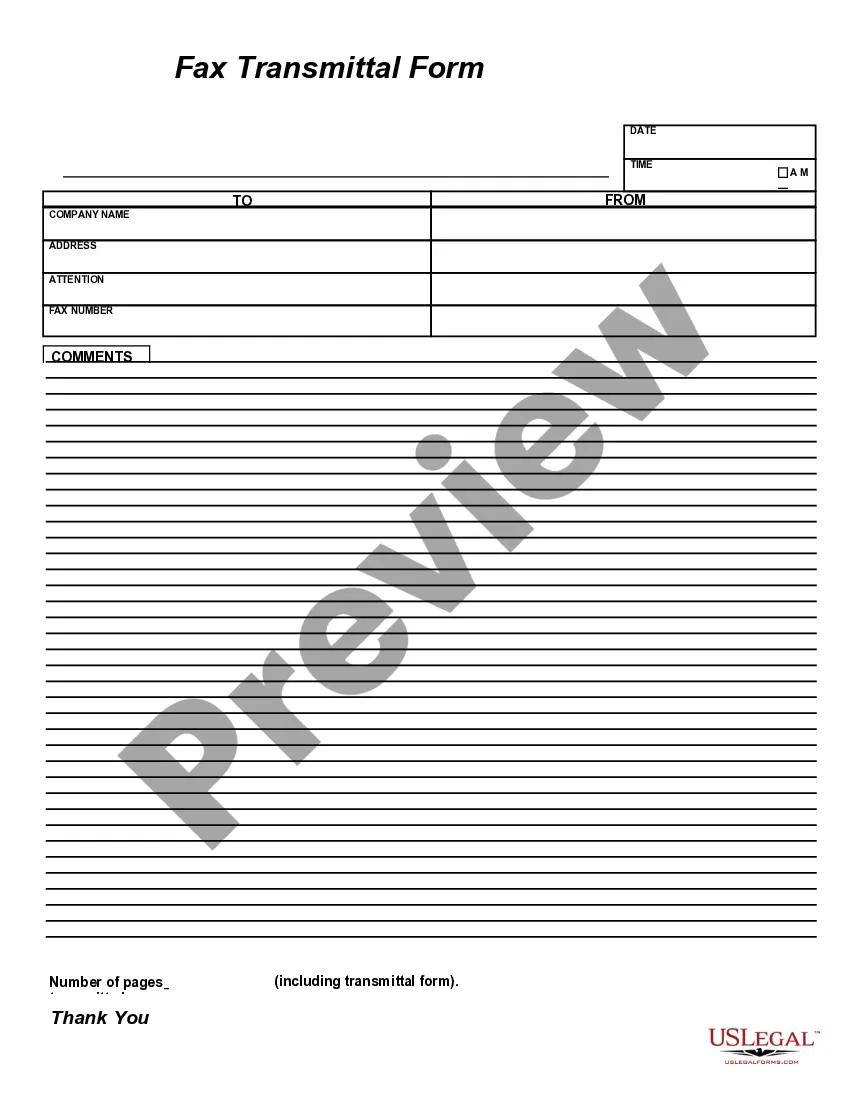

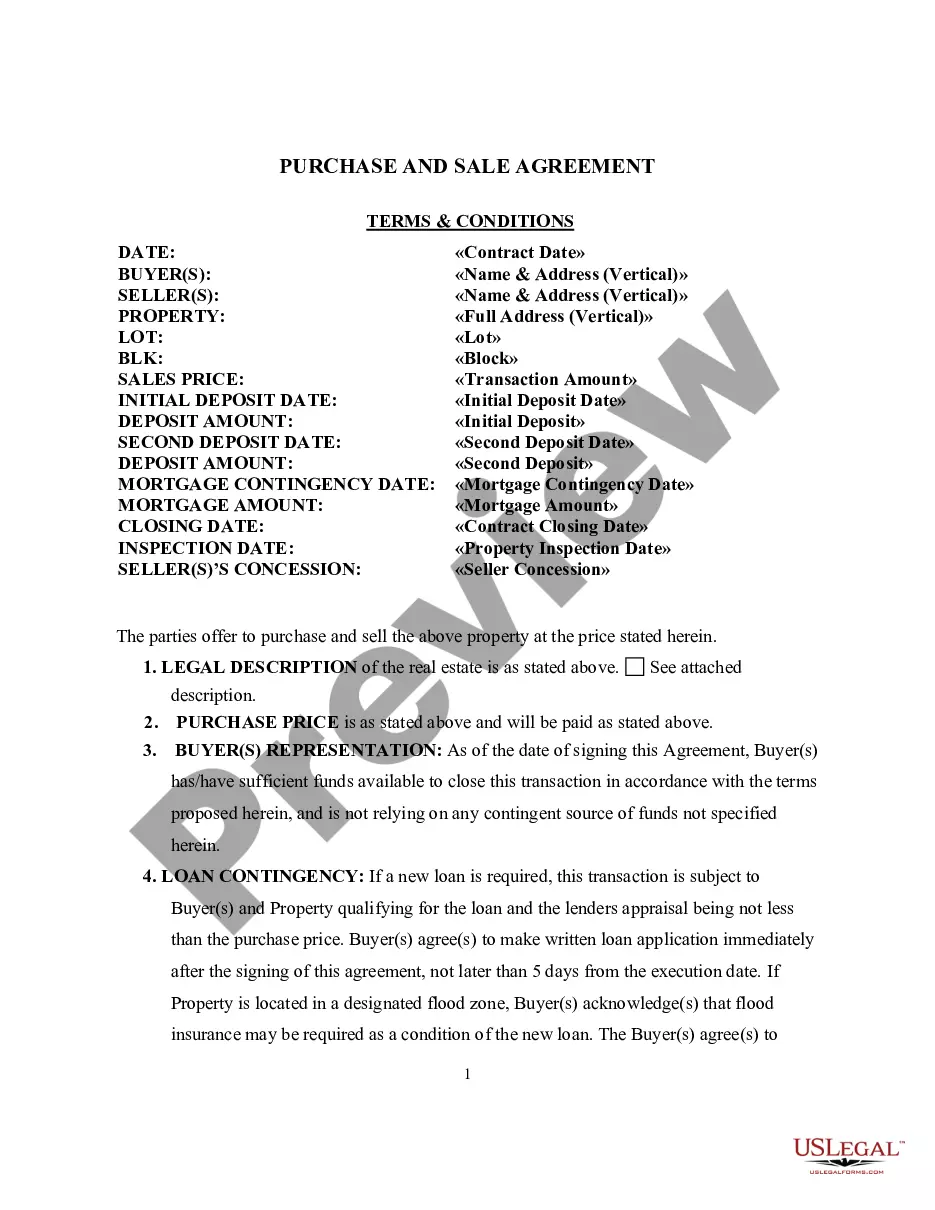

- Select the Preview option to examine the form's content.

- Review the form details to confirm that you have selected the correct one.

- If the form doesn’t meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, affirm your choice by clicking the Purchase Now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

You can change annuity brokers, but changing annuities can be costly.

Most annuities allow the contract owner to change the annuitant at any time. The annuitant is the individual named under the annuity contract whose life will serve as the measuring life to determine benefits to be paid out under the contract.

When you give an annuity away, you're changing the owner of the contract, but you're not changing the annuitant. Your life is still the life that will trigger benefits and determine the amount. The new owner of the annuity can start receiving payments, change beneficiaries, and cash out the policy whenever they want.

When an annuity contract transfers from one individual to another, the transferred amount is treated as a distribution. The original owner is taxed on any tax-deferred gain and possibly subject to a 10% penalty.

In the case of annuities, you can surrender your existing contract for another annuity with a different insurance company without fear of IRS penalties or restrictions.

Annuities outside of an IRA structure can be transferred as a nontaxable event by using the IRS approved 1035 transfer rule. Annuities within an IRA can transfer directly to another IRA with an annuity carrier, and not create any tax consequences as well.

The new owner of the annuity can start receiving payments, change beneficiaries, and cash out the policy whenever they want. To give the annuity away, you simply contact the insurance company and state that you want to gift the ownership of the annuity policy to someone else or a trust.

An annuity consideration or premium is the money an individual pays to an insurance company to fund an annuity or receive a stream of annuity payments. An annuity consideration may be made as a lump sum or as a series of payments, often referred to as contributions.

So long as you transferred ownership more than three years before dying, the value of the annuity won't go into your taxable estate. But if you give the annuity as a gift, you have to pay tax on any gain at the time of the transfer. Additionally, you might be liable for gift taxes depending on the value of the annuity.

Contact your annuity company and let your account manager know you want to change the owner of your contract. The annuity company will send you a change of ownership form. Fill out the change of ownership form for your annuity.