Indiana Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Declaration Of Gift With Signed Acceptance By Donee?

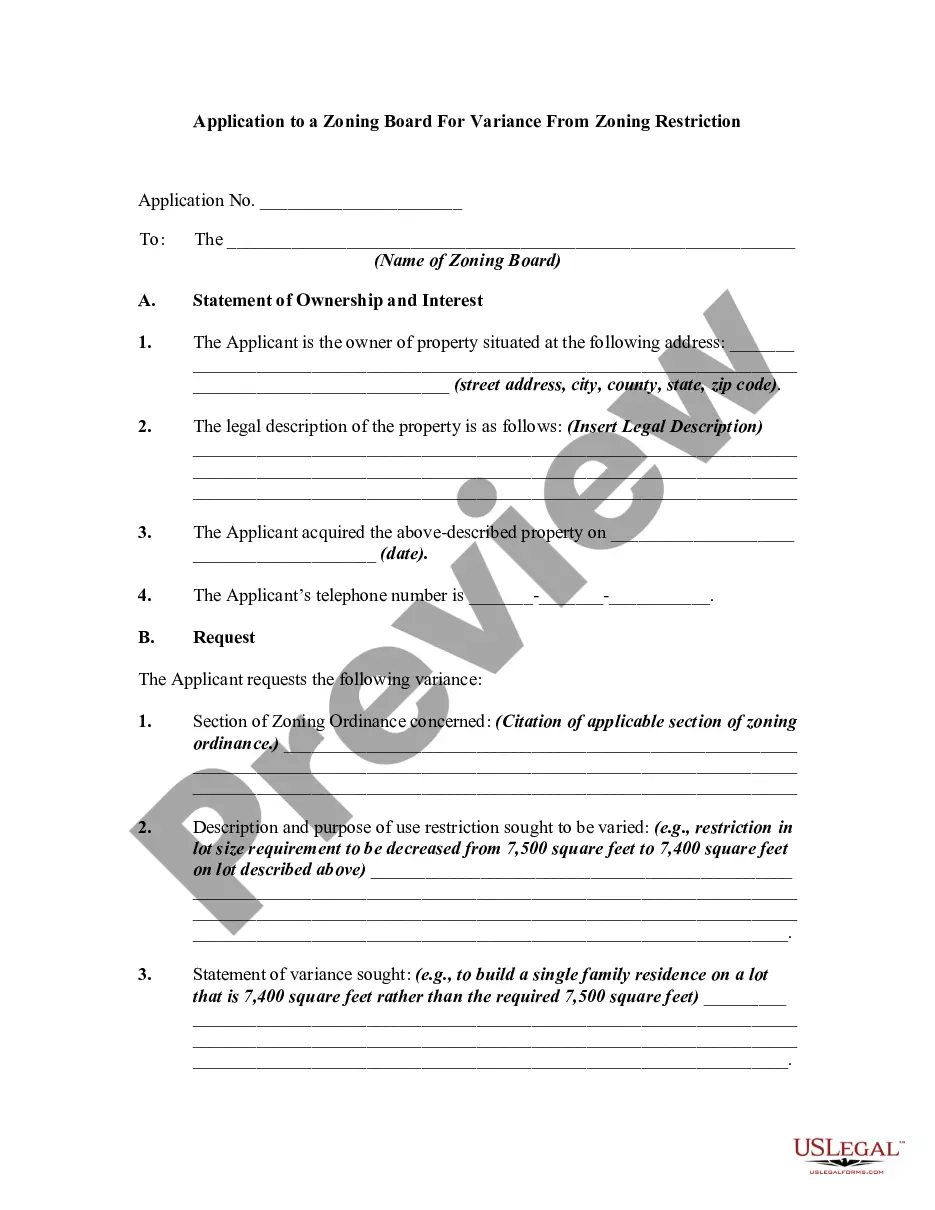

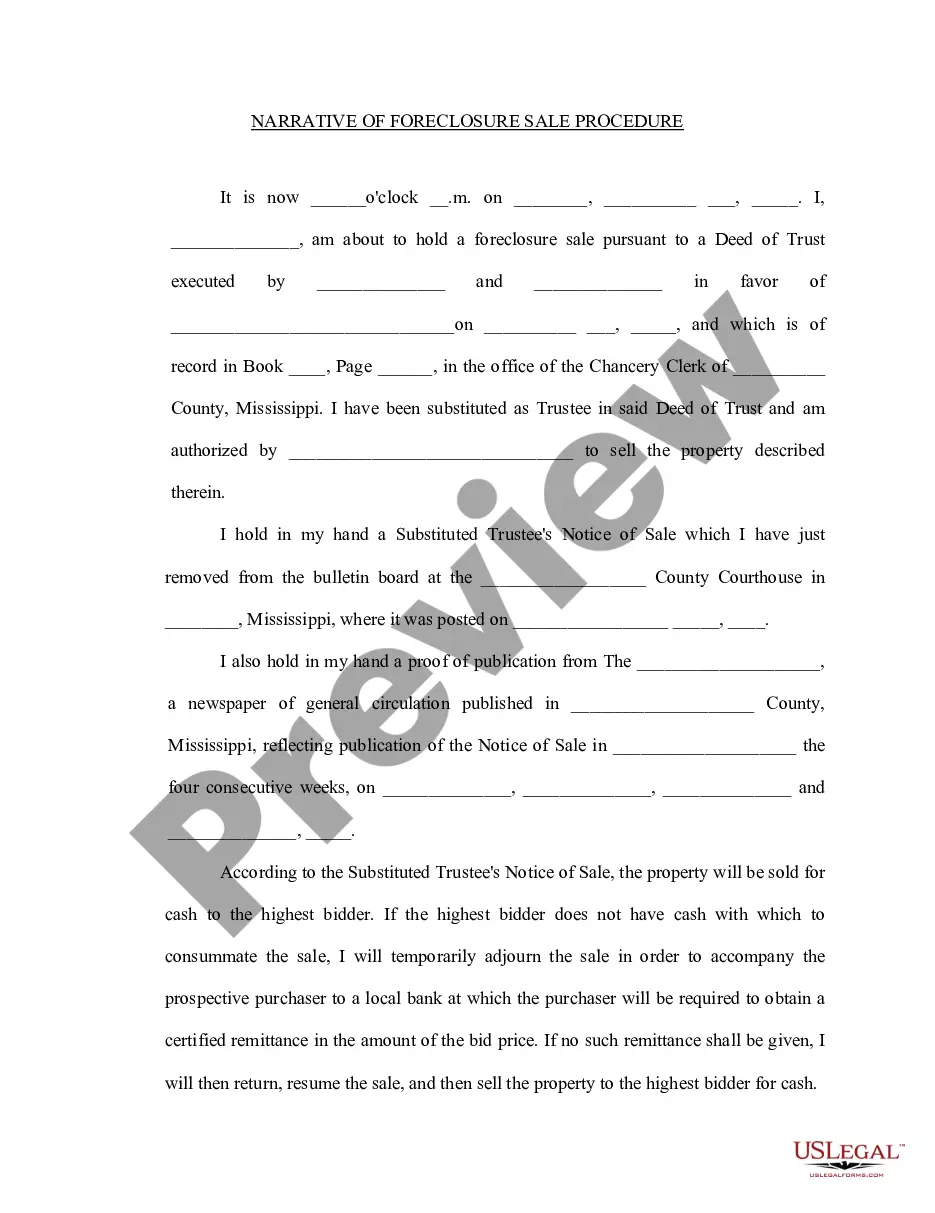

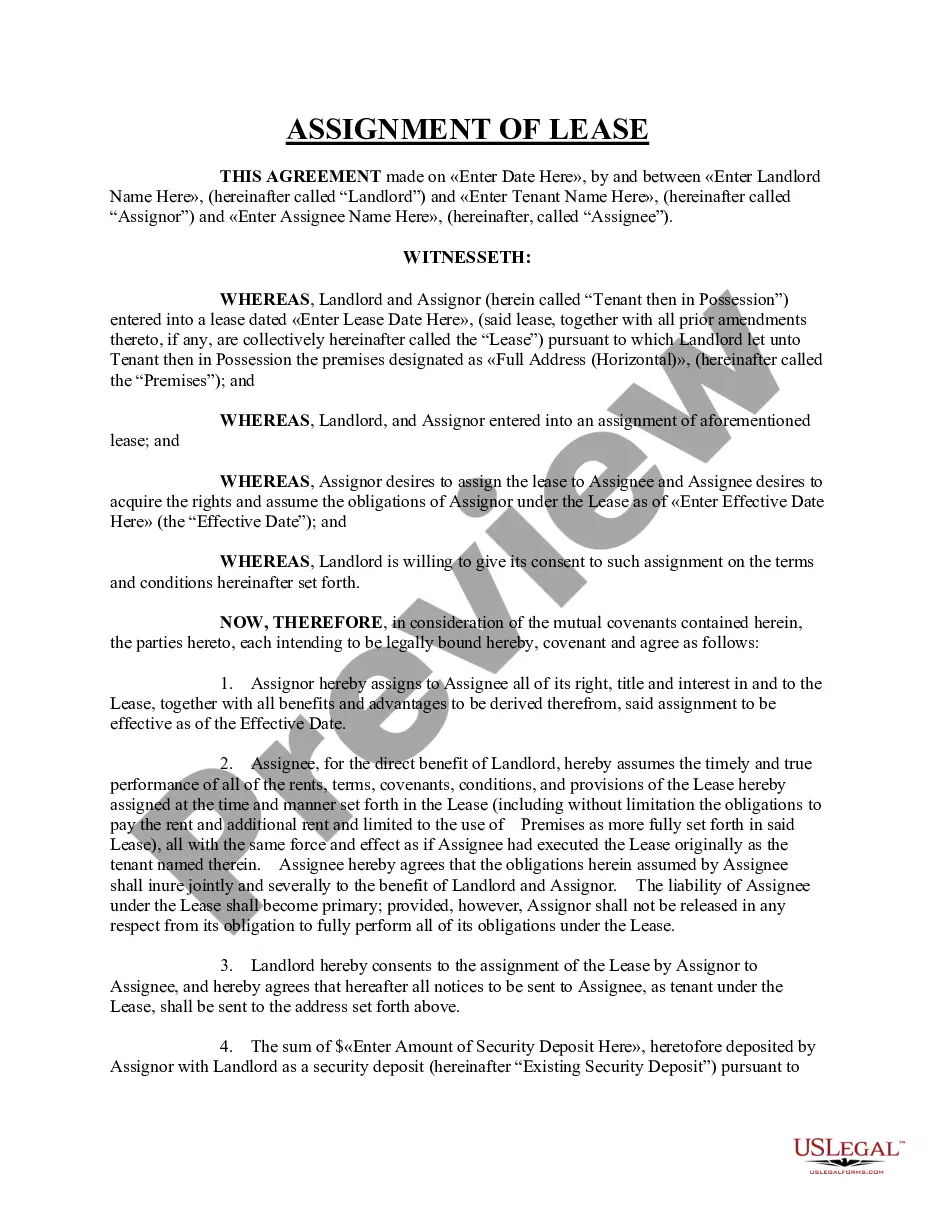

If you wish to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Utilize the site's simple and effective search to find the documents you require. Numerous templates for business and personal purposes are categorized by type, state, or keywords.

Employ US Legal Forms to acquire the Indiana Declaration of Gift with Signed Acceptance by Donee in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you've downloaded in your account. Visit the My documents section to select a template to print or download again.

Complete, acquire, and print the Indiana Declaration of Gift with Signed Acceptance by Donee using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Indiana Declaration of Gift with Signed Acceptance by Donee.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

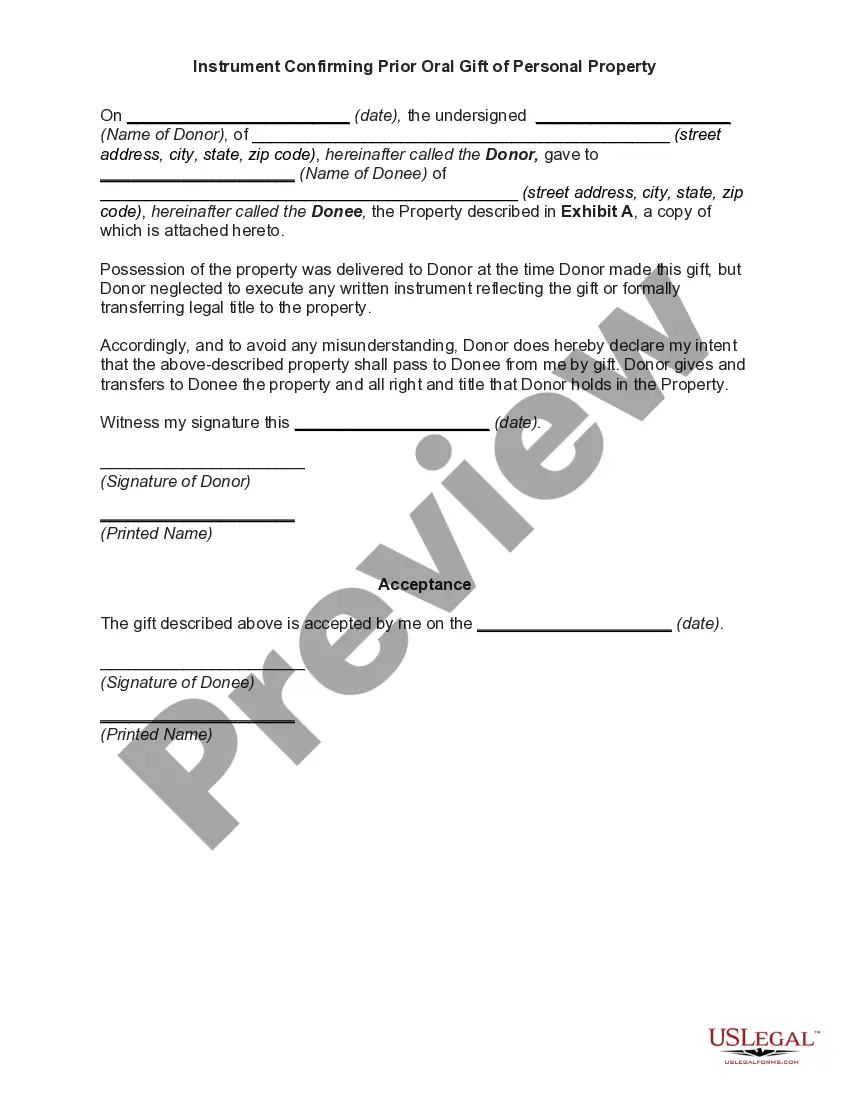

- Step 2. Utilize the Preview feature to review the form's content. Don't forget to check the outline.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions in the legal form catalog.

- Step 4. After locating the form you need, click the Get now button. Choose the pricing plan you prefer and input your information to register for the account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Indiana Declaration of Gift with Signed Acceptance by Donee.

Form popularity

FAQ

If the recipient wants to give the gift away or donate it to charity, the law says that this is just fine. The only time someone can ask for a gift back is if the gift was given in exchange for a promise. This is known as a conditional gift. An example of a conditional gift is an engagement ring.

A gift, if valid, is a legally enforceable transfer under general contract law. That means, if a gift meets all of the legal elements of a valid gift, then the gift is enforceable and cannot generally be rescinded and revoked.

You may accept a gift given under circumstances that make it clear that the gift is motivated by a family relationship or personal friendship rather than your official position.

Section 122 of Transfer of Property Act defines a gift as the transfer of an existing moveable or immovable property. Such transfers must be made voluntarily and without consideration. The transferor is known as the donor and the transferee is called the donee. The gift must be accepted by the donee.

According to The Transfer of Property Act, 1882, acceptance of gift must be made by the donee during the lifetime of the donor and while the donor is still capable of giving the gift. If the donee dies before accepting the gift, then it is void.

Guidelines say no gifts can be solicited, and only gifts of minimal value, such as inexpensive cups or pens, can be accepted. Gifts such as fruit baskets are to be shared with a work group or donated.

Acceptance The final requirement for a valid gift is acceptance, which means that the donee unconditionally agrees to take the gift. It is necessary for the donee to agree at the same time the delivery is made. The gift can, however, be revoked at any time prior to acceptance.

Both types of gifts share three elements which must be met in order for the gift to be legally effective: donative intent (the intention of the donor to give the gift to the donee), the delivery of the gift to the donee, and the acceptance of the gift.

Incorporate guidelines for all types, forms, and purposes of gifts. As pertinent, include language about charitable bequests, specific endowments, naming opportunities, and any dollar limits and pledge restrictions. If you'll accept trusts, indicate whether your organization is willing to serve as a trustee.

The three elements which are essential to the making of a valid gift are delivery, donative intent, and acceptance by the donee. The delivery of a gift is complete when it is made directly to the donee.