Indiana Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory

Description

How to fill out Sales Consultant Agreement With Consultant Operating As Independent Contractor In A Defined Territory?

US Legal Forms - one of the foremost collections of legal documents in the United States - provides an extensive selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Indiana Sales Consultant Agreement with Consultant Acting as Independent Contractor in a Designated Territory in moments.

If you already possess a subscription, Log In and download the Indiana Sales Consultant Agreement with Consultant Acting as Independent Contractor in a Designated Territory from your US Legal Forms library. The Acquire button will be visible on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Indiana Sales Consultant Agreement with Consultant Acting as Independent Contractor in a Designated Territory. Each document you save to your account does not expire and is yours permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Access the Indiana Sales Consultant Agreement with Consultant Acting as Independent Contractor in a Designated Territory with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Before using US Legal Forms for the first time, here are some basic instructions to get started.

- Ensure that you have selected the correct form for your area/county.

- Click on the Preview button to review the form's details.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred payment plan and provide your credentials to create an account.

Form popularity

FAQ

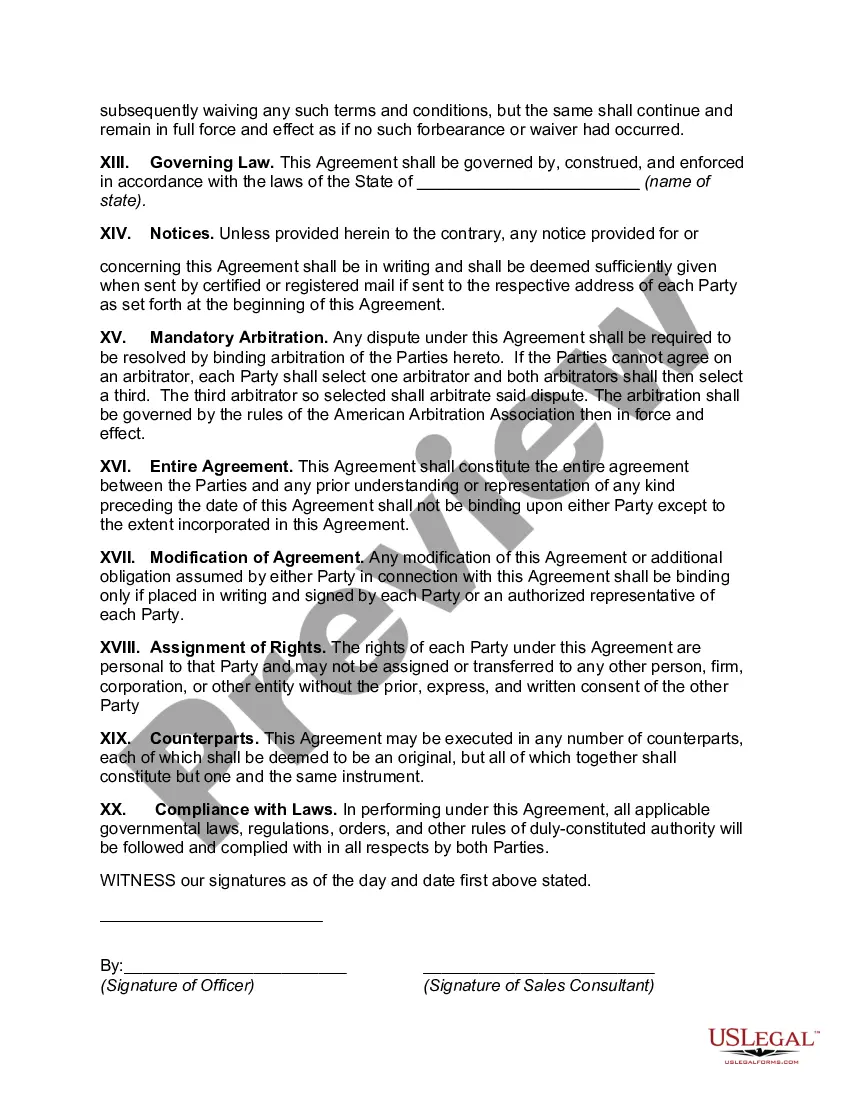

The contractor isn't an employee of the company but works independently. The contractor provides services to the client under an Independent Contractor Agreement.

A consulting agreement is a legally binding document that affirms a client's request for assistance from a consultant. It's a contract detailing the terms of service between a consultant operating as an independent contractor and a client.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.

The consulting agreement is an agreement between a consultant and a client who wishes to retain certain specified services of the consultant for a specified time at a specified rate of compensation. As indicated previously, the terms of the agreement can be quite simple or very complex.

A consulting contract should offer a detailed description of the duties you will perform and the deliverables you promise the client. The agreement may also explain how much work you will perform at the client's office and how often you will work remotely.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

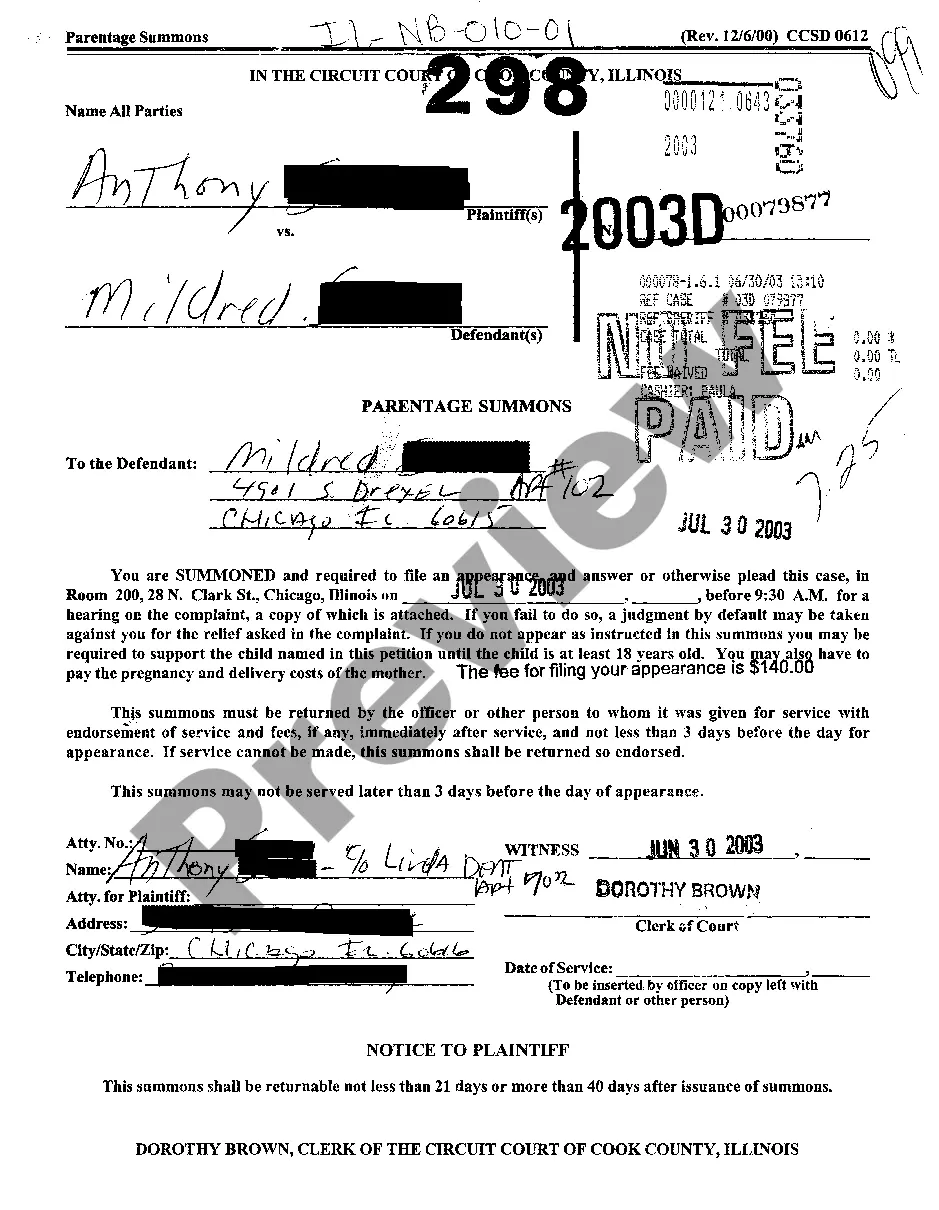

Binding agreements between parties can be written or verbal and can take many forms including bills of sale, purchase orders, real estate leases, and offers for employment.