Indiana Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump Sum Payment?

Locating the appropriate legal document template can be challenging.

Clearly, there are numerous designs accessible online, but how do you find the legal template you need.

Make use of the US Legal Forms website.

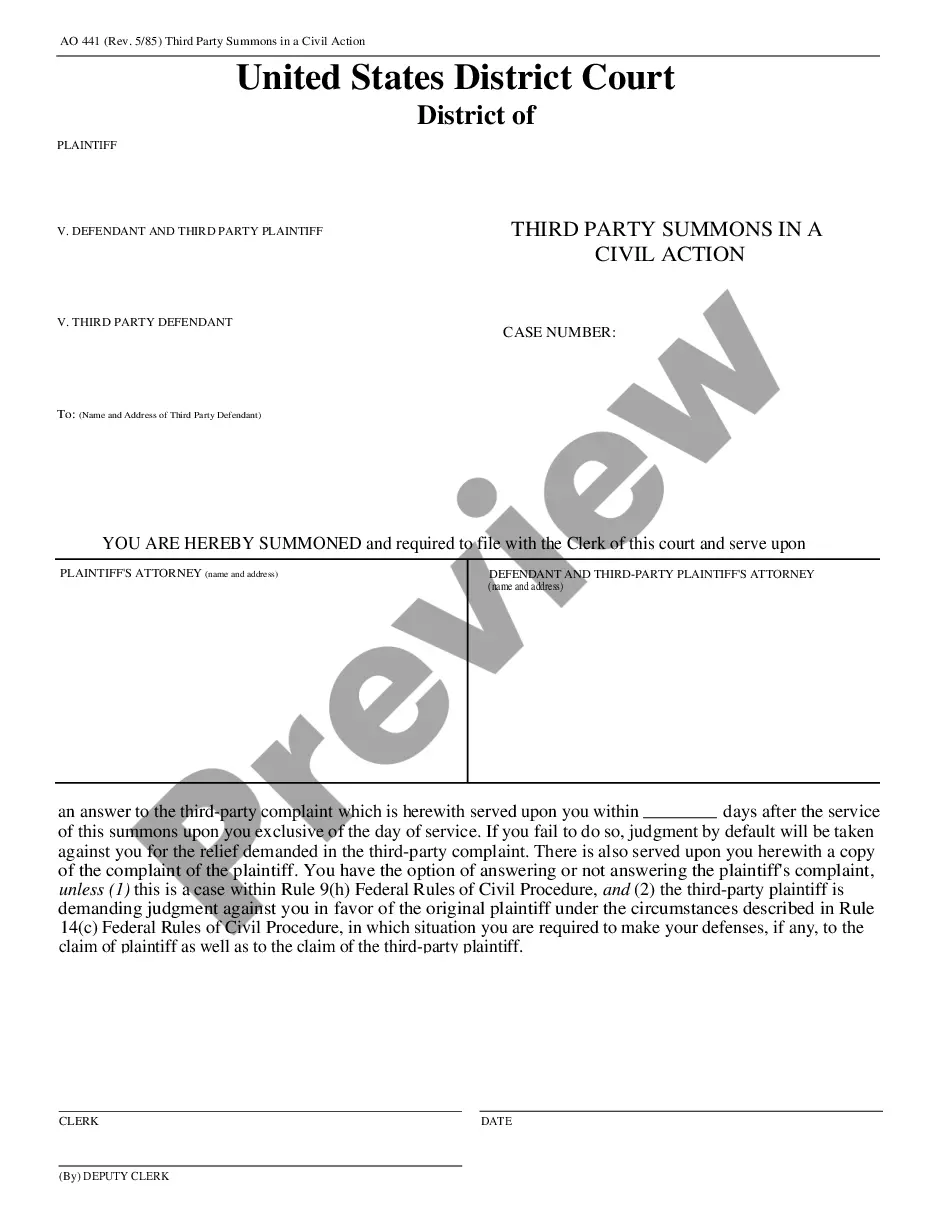

If you are a new user of US Legal Forms, here are simple instructions to follow: First, ensure that you have selected the correct template for your state/region. You can preview the form using the Review button and check the form description to confirm it is suitable for you.

- This service offers thousands of templates, including the Indiana Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment, usable for both corporate and personal needs.

- All forms are reviewed by experts and comply with federal and state requirements.

- If you are already registered, Log Into your account and click on the Acquire button to locate the Indiana Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment.

- Use your account to look through the legal forms you have previously purchased.

- Visit the My documents tab in your account to obtain another copy of the document you need.

Form popularity

FAQ

Settlement of accounts on dissolutionPayment of the debts of the firm to the third parties.Payment of advances and loans given by the partners.Payment of capital contributed by the partners.The surplus, if any, will be divided among the partners in their profit-sharing ratio.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Vote or Take Action to Dissolve Most often, the dissolution provisions outlined in a legal agreement express a requirement for a majority of (if not all) partners to consent to such a major change to the business. This can be accomplished through an official vote by the remaining partners.

To terminate a partnership, a partner must sell or exchange a 50% or greater interest in both the capital and profits of the partnership. Thus, if a partner sells a 60% capital interest but only a 30% profits interest, the partnership will not terminate.

Dissolution occurs when any partner discontinues his or her involvement in the partnership business or when there is any change in the partnership relationship. The second step is known as winding up. This is when partnership accounts are settled and assets are liquidated.

To dissolve your Indiana Corporation, file Indiana Form 34471, Articles of Dissolution with the Secretary of State, Corporations Division. You can also file for dissolution online if you set up an IN.gov payment account or pay by MasterCard, Discover or Visa credit card.

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

Winding up ends all outstanding legal and financial obligations of the partnership so that the business can be terminated. Winding up is a process and will be conducted according to the partnership agreement and according to applicable state laws. Once winding up is complete, the partnership is terminated.

Officially dissolving a corporation in AlbertaFile the Articles of Dissolution with Alberta registries and pay the fee (Owner) Close your GST account and payroll account (Owner or accountant) File final corporate tax return and GST return (Accountant) Pay any final balances owing (if any) (Owner)