Indiana LLC Operating Agreement for Rental Property

Description

How to fill out LLC Operating Agreement For Rental Property?

Are you currently in a situation where you require documents for either business or personal activities almost daily.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

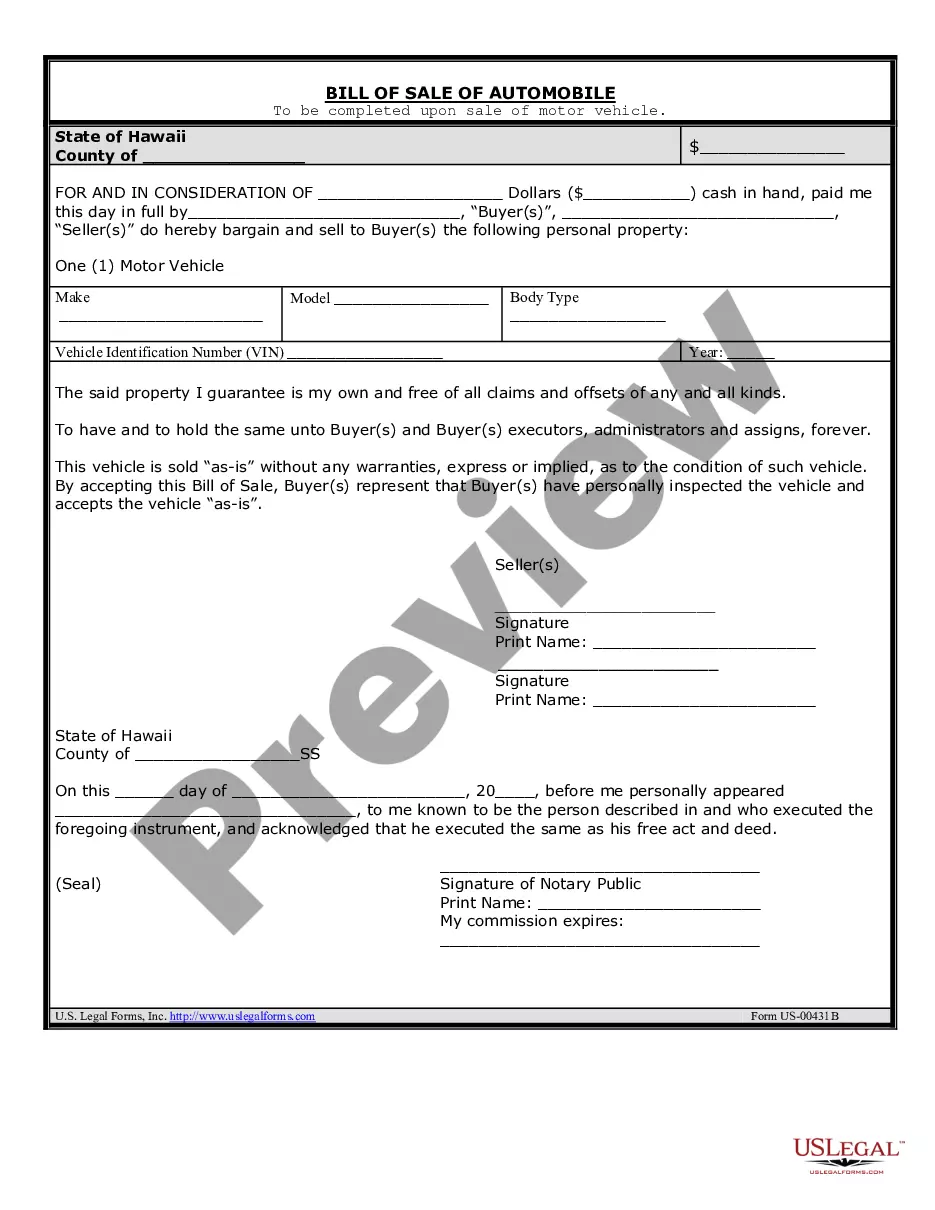

US Legal Forms offers a wide range of template forms, including the Indiana LLC Operating Agreement for Rental Property, designed to meet federal and state requirements.

Once you find the right form, click Purchase now.

Select the payment plan you want, fill in the necessary details to create your account, and finalize your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just sign in.

- Then, you can download the Indiana LLC Operating Agreement for Rental Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

- Utilize the Review button to evaluate the form.

- Read the description to confirm you have chosen the appropriate form.

- If the form isn’t what you are looking for, use the Search area to find the form that meets your needs and requirements.

Form popularity

FAQ

Yes, Indiana allows the formation of single member LLCs. This option can offer greater flexibility and simplicity for individuals looking to operate a rental property. Establishing an Indiana LLC Operating Agreement for Rental Property can help you outline your responsibilities and protect your personal assets.

LLC Indiana - To form an Indiana LLC, you'll need to file the Articles of Organization with the Indiana Secretary of State Business Services Division, which costs $95-$100. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Indiana Limited Liability Company.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Indiana LLC net income must be paid just as you would with any self-employment business.

Is an LLC Operating Agreement required in Indiana? No, Indiana does not require LLCs to create an Operating Agreement as a legal document to operate. However, the state does recommend having an Operating Agreement on file in case of disputes or issues.

An Indiana LLC operating agreement is a legal document that will provide assistance to the member(s) of businesses, in any size, to provide an outline of the company's organization of members, operational procedures, and many various aspects of the business that will be agreed upon by all members prior to

Is an LLC Operating Agreement required in Indiana? No, Indiana does not require LLCs to create an Operating Agreement as a legal document to operate.

An Indiana LLC operating agreement is a legal document that will provide assistance to the member(s) of businesses, in any size, to provide an outline of the company's organization of members, operational procedures, and many various aspects of the business that will be agreed upon by all members prior to