Indiana Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

Have you found yourself in a situation requiring documents for either organizational or personal reasons almost all the time.

There are numerous legal document templates accessible online, but discovering ones you can rely on can be challenging.

US Legal Forms offers a wide array of form templates, such as the Indiana Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, which can be completed to meet federal and state regulations.

Choose a convenient format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can retrieve an additional copy of the Indiana Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time whenever necessary. Click on the desired form to download or print the document template. Utilize US Legal Forms, which is one of the most extensive collections of legal forms, to save time and avoid mistakes. The service provides accurately crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life a bit.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Indiana Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

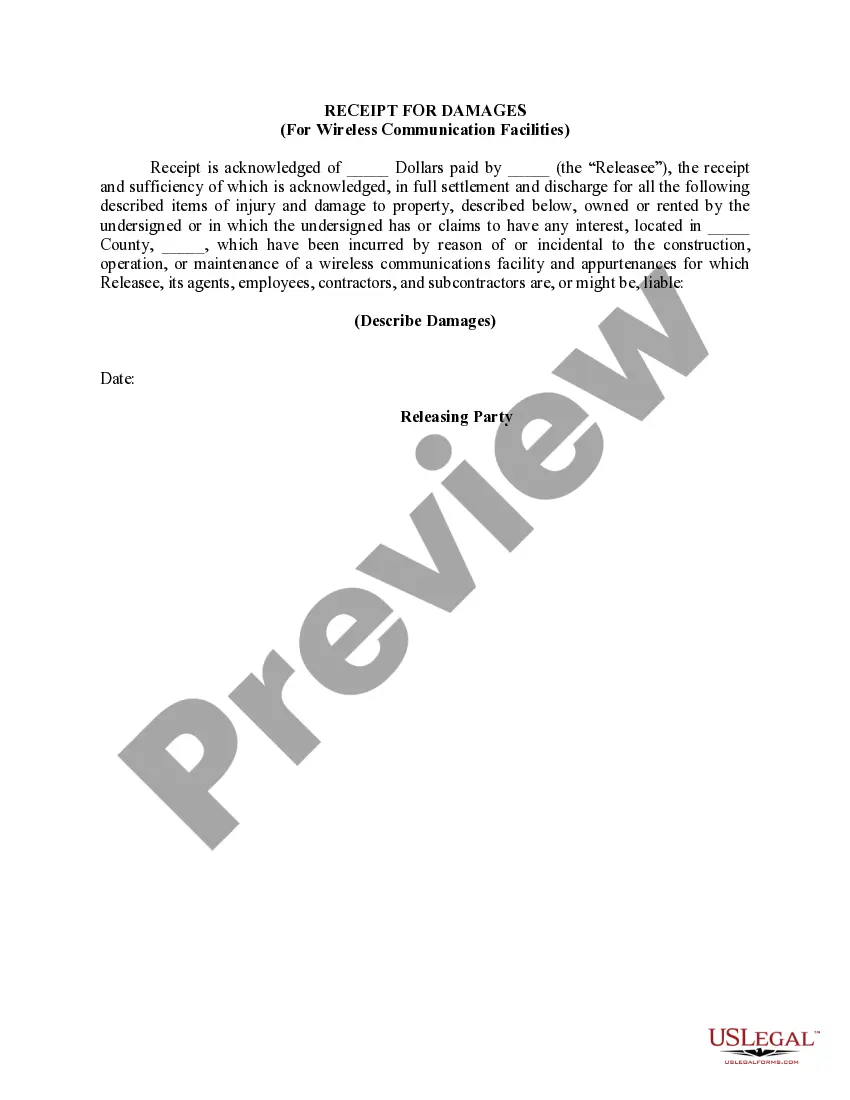

- Utilize the Preview feature to examine the form.

- Review the description to confirm that you have selected the correct form.

- If the form does not meet your needs, use the Search field to find the form that suits your requirements.

- Once you have the correct form, click Buy now.

- Select the pricing plan you want, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.

An irrevocable trust may automatically terminate on a specific date if the grantor specified a termination date in the trust document. If the grantor did not provide a termination date, an irrevocable trust may be terminated for other reasons.

A perpetual trust is irrevocable. Once the Trust has been set up, and assets have been transferred into the Trust, then the Trustor cannot change their mind. Therefore, an individual setting up a perpetual trust should be careful not to use any property they might need during their lifetime to fund the Trust.

Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

Under California's Rule Against Perpetuities, an interest in an irrevocable trust must vest or terminate either within 21 years after the death of the last potential beneficiary who was alive when the trust was created or within 90 years after the trust was created.

Planning Tip: If a trust permits accumulation of income and the trust does not distribute it, the trust pays tax on the income.

Some trusts require trustees to make mandatory distributions. These distributions might take place every month or every year. Often, a trust requires distribution of a percentage of the interest earned on trust assets during the year. Or the trust might list a specific amount of money or property to be distributed.

Year Trust, also known as a Legacy Trust or Medicaid Asset Protection Trust, can be established to protect assets from being spent down on long term care in a nursing home. The assets you place in the Legacy Trust will become exempt from the Medicaid spend down requirements after a 5 year look back period.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.