Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

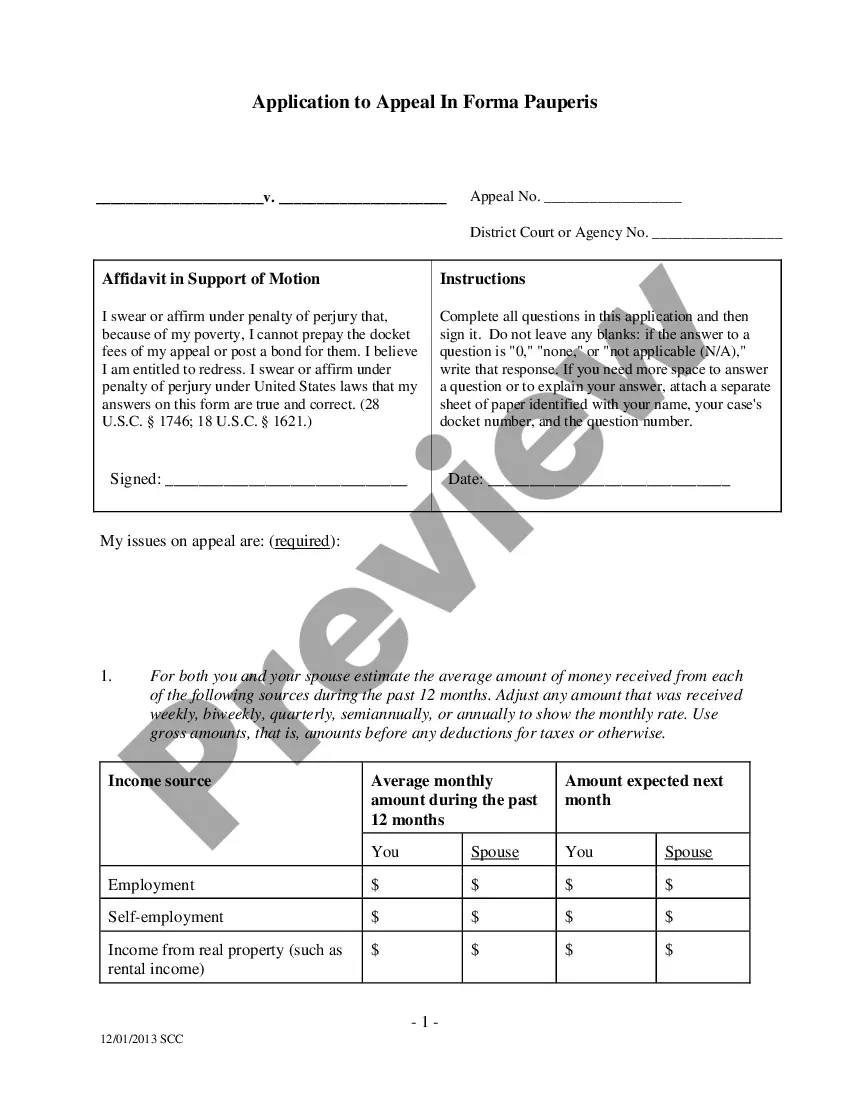

How to fill out Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

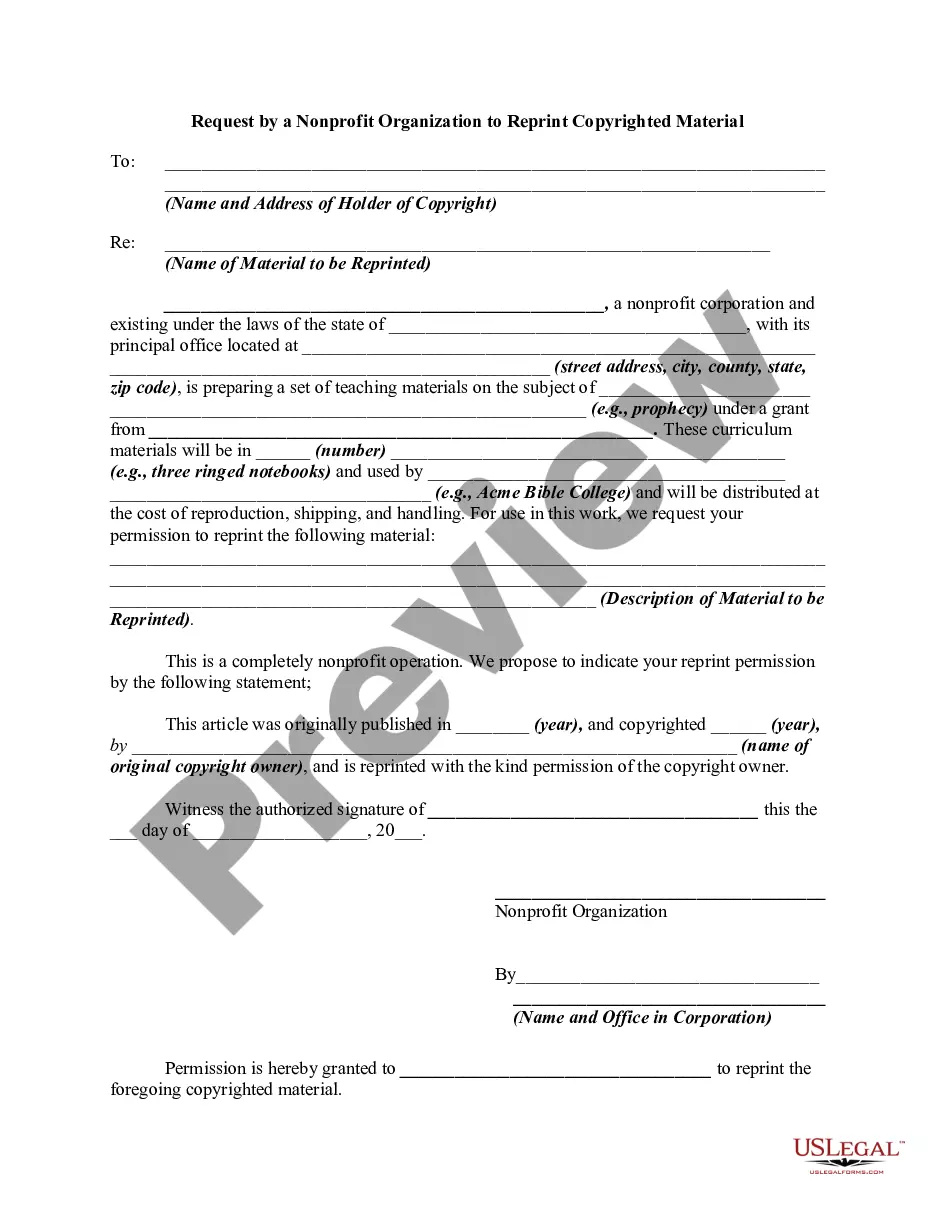

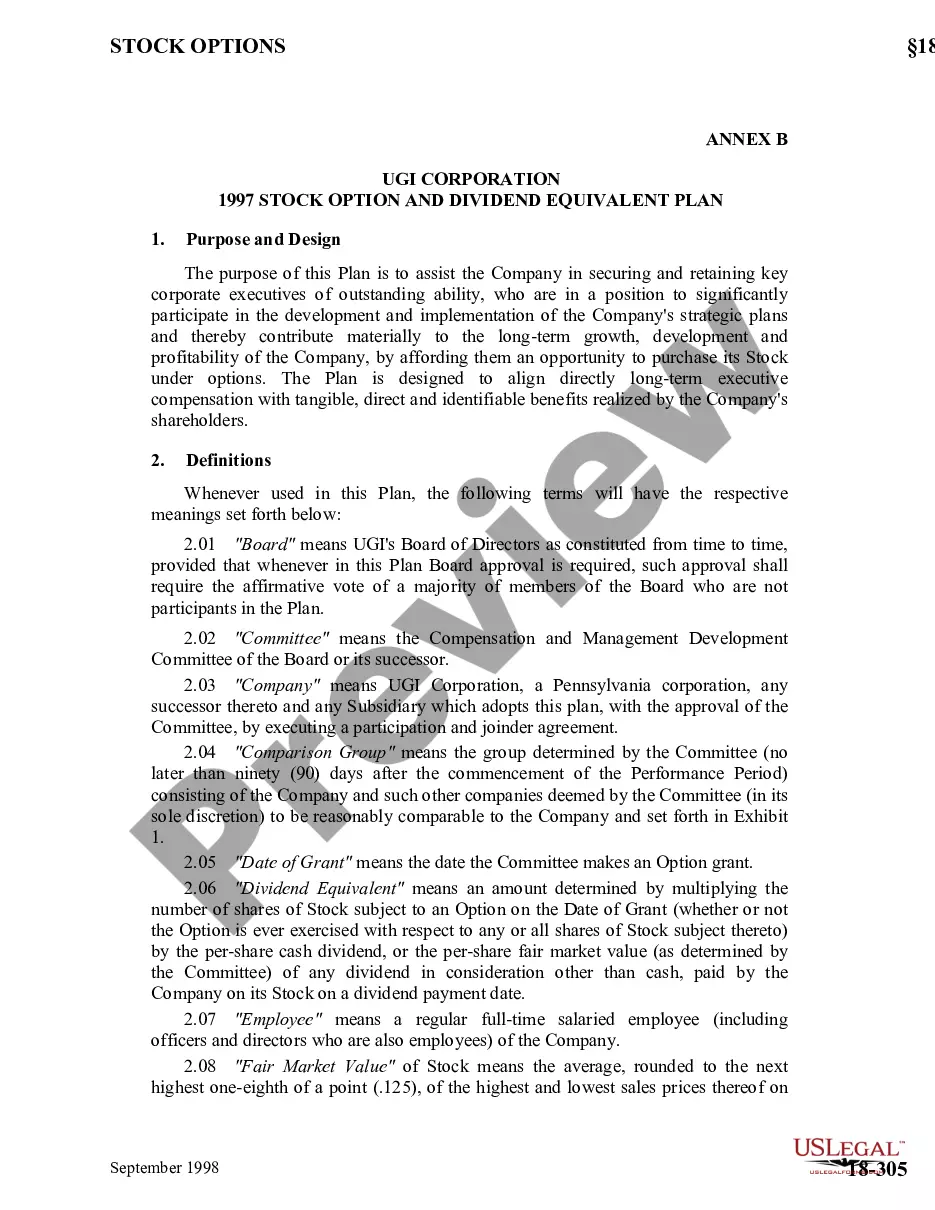

Finding the right lawful record template can be a struggle. Naturally, there are tons of web templates available online, but how will you discover the lawful kind you need? Utilize the US Legal Forms internet site. The support offers a large number of web templates, like the Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, which you can use for organization and personal demands. Each of the forms are inspected by pros and meet state and federal demands.

When you are presently registered, log in to the account and click on the Acquire key to have the Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse. Make use of your account to appear through the lawful forms you might have ordered previously. Proceed to the My Forms tab of your account and have one more copy of your record you need.

When you are a whole new consumer of US Legal Forms, allow me to share basic instructions for you to stick to:

- Initial, be sure you have chosen the right kind for your personal city/state. You are able to look over the form while using Review key and look at the form explanation to guarantee this is basically the right one for you.

- When the kind is not going to meet your expectations, make use of the Seach field to get the appropriate kind.

- When you are sure that the form would work, go through the Purchase now key to have the kind.

- Opt for the costs plan you would like and enter in the necessary details. Design your account and pay for the transaction making use of your PayPal account or credit card.

- Opt for the document structure and obtain the lawful record template to the system.

- Complete, revise and print and indication the obtained Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse.

US Legal Forms is the greatest local library of lawful forms that you can find different record web templates. Utilize the company to obtain skillfully-made documents that stick to status demands.

Form popularity

FAQ

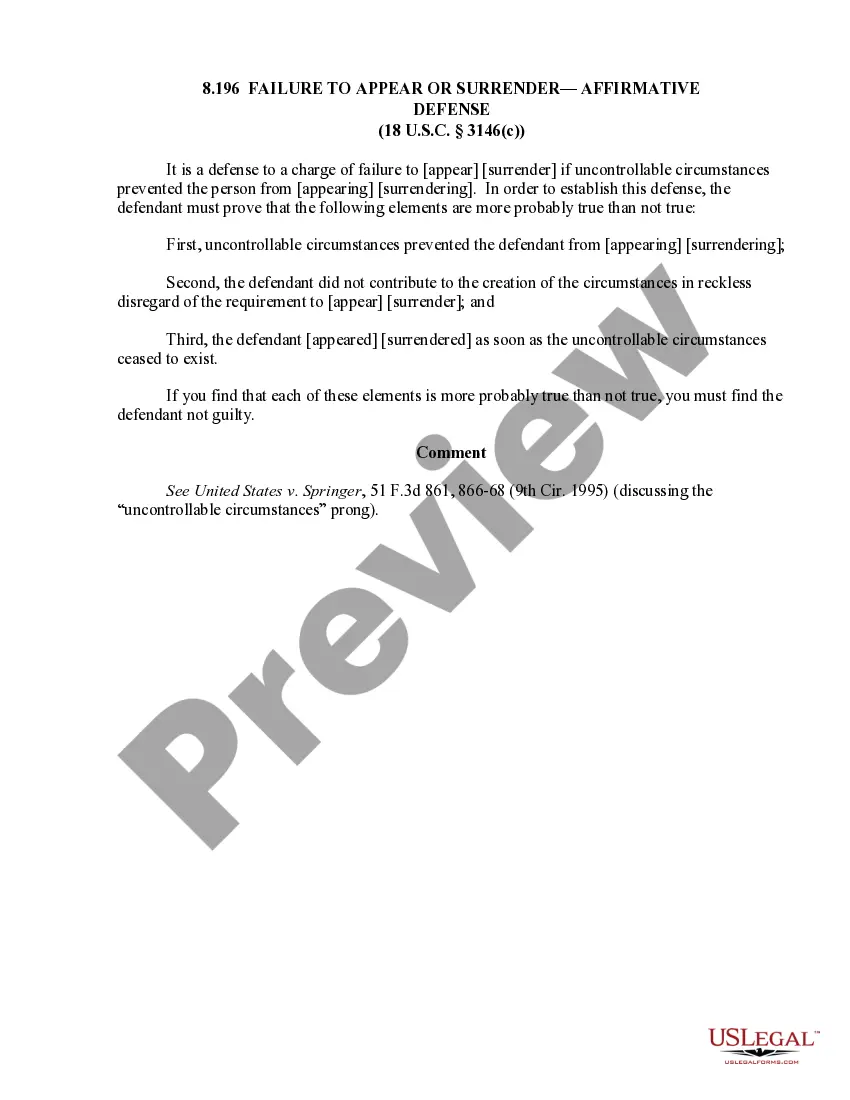

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner maintains the absolute and exclusive right to use the property during his or her lifetime. This can be a sole owner or joint Life Tenants.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

If you co-own real estate in joint tenancy (also called "joint tenancy with right of survivorship"), when one co-owner dies, that co-owner's share of the property will automatically go to the surviving co-owner(s).

The owner of a life estate cannot leave the property to anyone in their will as their interest in the property will terminate at their death. The holder has full rights to possess and use the property, and may also transfer their interest during their lifetime.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

Defining a California Life Estate A life estate is a form of ownership that allows one person to live in or on a piece of real property until they pass away. At their death, the real property passes to the intended beneficiary of the original owner.

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

Dower & Curtesy Defined At common law, the estate of dower is held by a widow upon her husband's death and consists of a life estate of one-third to one-half of the land owned by her husband if he held a freehold interest in the land (e.g., a fee simple) and the land is inheritable by the issue of the marriage.