Indiana Sample Letter of Intent - Franchise Purchase via Stock Purchase

Description

How to fill out Sample Letter Of Intent - Franchise Purchase Via Stock Purchase?

Have you been inside a position that you need to have paperwork for both enterprise or personal reasons almost every day time? There are plenty of authorized record templates available on the net, but getting kinds you can depend on isn`t effortless. US Legal Forms delivers thousands of develop templates, like the Indiana Sample Letter of Intent - Franchise Purchase via Stock Purchase, which can be composed to fulfill state and federal needs.

Should you be presently familiar with US Legal Forms internet site and also have a free account, merely log in. Following that, it is possible to obtain the Indiana Sample Letter of Intent - Franchise Purchase via Stock Purchase template.

Should you not offer an accounts and want to start using US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is for the appropriate town/region.

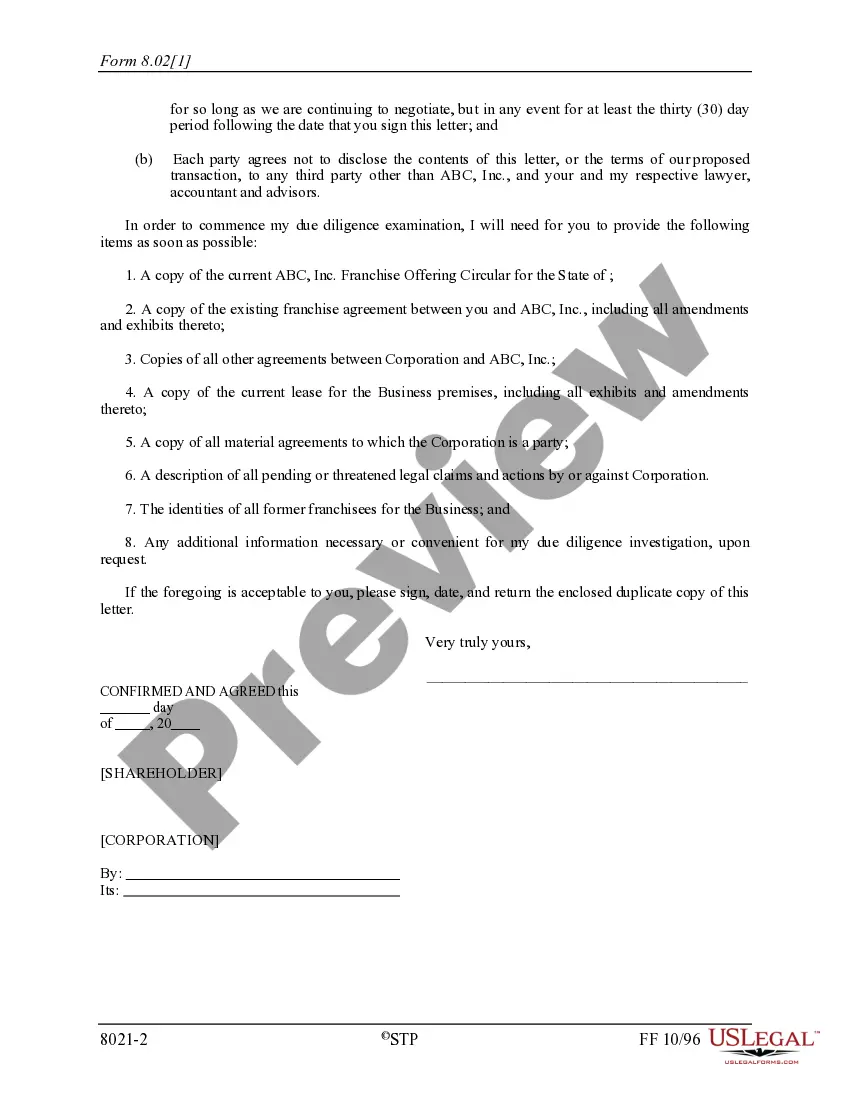

- Take advantage of the Preview button to examine the shape.

- Read the information to ensure that you have chosen the correct develop.

- If the develop isn`t what you are looking for, take advantage of the Search field to obtain the develop that meets your needs and needs.

- Whenever you obtain the appropriate develop, click on Acquire now.

- Pick the costs program you need, fill out the required information to produce your account, and pay money for the order with your PayPal or charge card.

- Choose a convenient document file format and obtain your copy.

Discover each of the record templates you have purchased in the My Forms food list. You may get a further copy of Indiana Sample Letter of Intent - Franchise Purchase via Stock Purchase any time, if required. Just click the essential develop to obtain or print out the record template.

Use US Legal Forms, probably the most comprehensive collection of authorized varieties, to save time as well as steer clear of mistakes. The assistance delivers skillfully made authorized record templates that can be used for a selection of reasons. Create a free account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

A stock purchase letter of intent is used for the purchase of a limited number of stocks in a company or corporation from an individual or entity that owns the desired shares. A letter of intent is often non-binding and is instead a preliminary offer prior to the signing of a purchase agreement.

What is a Stock Purchase LOI? A stock purchase letter of intent is used for the purchase of a limited number of stocks in a company or corporation from an individual or entity that owns the desired shares.

An investment letter of intent (LOI) is used to express interest in purchasing partial ownership in a company or real estate. The letter presents the basic terms of the investor's proposal and acts as a mark of their commitment to proceed through negotiations to reach a formal agreement.

A letter of intent (LOI) is a document written in business letter format that declares your intent to do a specific thing. It's usually, but not always, nonbinding, and it states a preliminary commitment by one party to do business with another party.

What to include in letters of intent to purchase. Name and contact information of the buyer. Name and contact information of the seller. Detailed description of the items or property being sold. Any relevant disclaimers or liabilities. The total purchase price. Method of payment and other payment terms, including dates.

Identify your letter as a letter of intent to sell shares. Define the company and who is meant by "seller" and "buyer." Include contact information for all the parties. Include the postal and registered address of the company, if they're different. Name every shareholder involved in the sale.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

How to Structure the Letter Name the Parties. Provide the full names and mailing addresses of the buyer and seller. ... Identify the Business. The parties must identify the name of the business being considered for purchase. Establish the Payment Terms. ... Detail the Terms and Conditions. ... Sign the Letter.