Indiana Time Sheet Instructions

Description

How to fill out Time Sheet Instructions?

You can spend hours online searching for the legal document template that meets the state and federal requirements you will need.

US Legal Forms provides thousands of legal documents that are assessed by experts.

It is easy to obtain or print the Indiana Time Sheet Instructions from your services.

If available, utilize the Review option to look at the document template as well.

- If you have a US Legal Forms account, you may Log In and select the Acquire option.

- Afterwards, you can complete, modify, print, or sign the Indiana Time Sheet Instructions.

- Each legal document template you purchase is yours to keep indefinitely.

- To obtain an additional copy of any acquired form, go to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have selected the correct document template for the region/town of your choice.

- Review the document details to make sure you have chosen the appropriate form.

Form popularity

FAQ

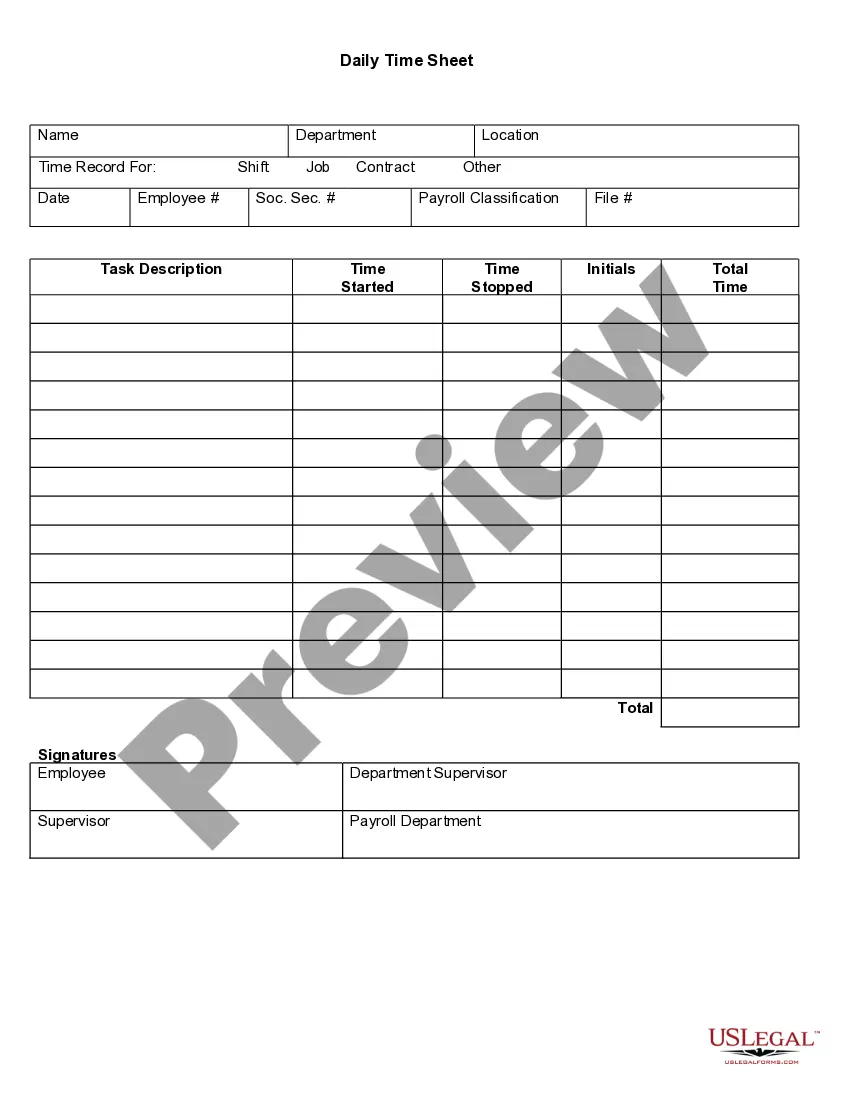

Timesheets or electric time clock systems must include the employee's name, any company assigned employee ID code, hours worked each day with date and times worked and other company specific information necessary to process payroll according to the pay schedule.

How to Fill Out a Timesheet (Step-by-Step Guide)Step 1: Enter the Employee Name.Step 2: Add the Date or Date Range.Step 3: Fill in the Project and Task Details.Step 4: Add Working Hours for Each Day of the Week.Step 5: Calculate the Total Hours.Step 6: Add Notes if Required.Step 7: Get Approval.

Within each day of the week, record the hours an employee worked. This view will help you see on which days an employee puts in the most or least hours. Once all days are filled in, calculate the total amount of hours worked within the time period, and fill in the total time in the total column.

Indiana labor laws require employers to pay employees overtime at a rate of 1½ time their regular rate when they work more than 40 hours in a workweek, unless otherwise exempt. IN Minimum Wage Notice; IN Statute 22-2-2-4(f).

The federal overtime provisions are contained in the Fair Labor Standards Act (FLSA). Unless exempt, employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay.

Indiana Law on Time Off Between Shifts Indiana does not have any laws pertaining to time off between shifts. Your employer may legally require you to work two shifts with only a short time in between. Like break rules, there are some industries that have safety rules requiring a set number of hours between shifts.

The Indiana Overtime law also referred to as the Indiana Minimum Wage Law, echoes the Federal Fair Labor Standards Act (FLSA) in multiple ways. The two require employees to receive 1½ times their regular hourly pay rate as overtime from their employers, for all hours they work above forty hours during a workweek.

Frequently Asked Questions About Overtime PayDivide the worker's daily rate by eight hours to get their hourly rate.Multiply the hourly rate by 110% (10% of the employee's hourly rate) for the night shift hourly rate.Take the worker's night shift hourly rate and multiply it by the number of hours worked.More items...?

How to Calculate Overtime Pay. Overtime is a 50% multiplier that is added to an employee's base wage for hours worked over 40 hours in a work week. This rule comes from the Department of Labor. The intent behind paying overtime is to compensate employees for excessive work hours.

A: Both the federal Fair Labor Standards Act (FLSA) and the Indiana Minimum Wage Law generally require employers to pay employees 1½ times their regular rate of pay (overtime compensation) when employees work more that forty (40) hours during a work week.