Indiana Sample Letter of Credit

Description

How to fill out Sample Letter Of Credit?

Discovering the right lawful document template can be quite a have difficulties. Of course, there are tons of templates available on the net, but how will you discover the lawful form you want? Take advantage of the US Legal Forms website. The service offers 1000s of templates, for example the Indiana Sample Letter of Credit, that can be used for company and private requirements. All the types are inspected by professionals and meet up with federal and state needs.

When you are already listed, log in for your account and then click the Down load key to obtain the Indiana Sample Letter of Credit. Utilize your account to appear with the lawful types you may have purchased previously. Visit the My Forms tab of your account and have an additional copy of the document you want.

When you are a brand new user of US Legal Forms, allow me to share easy directions that you can adhere to:

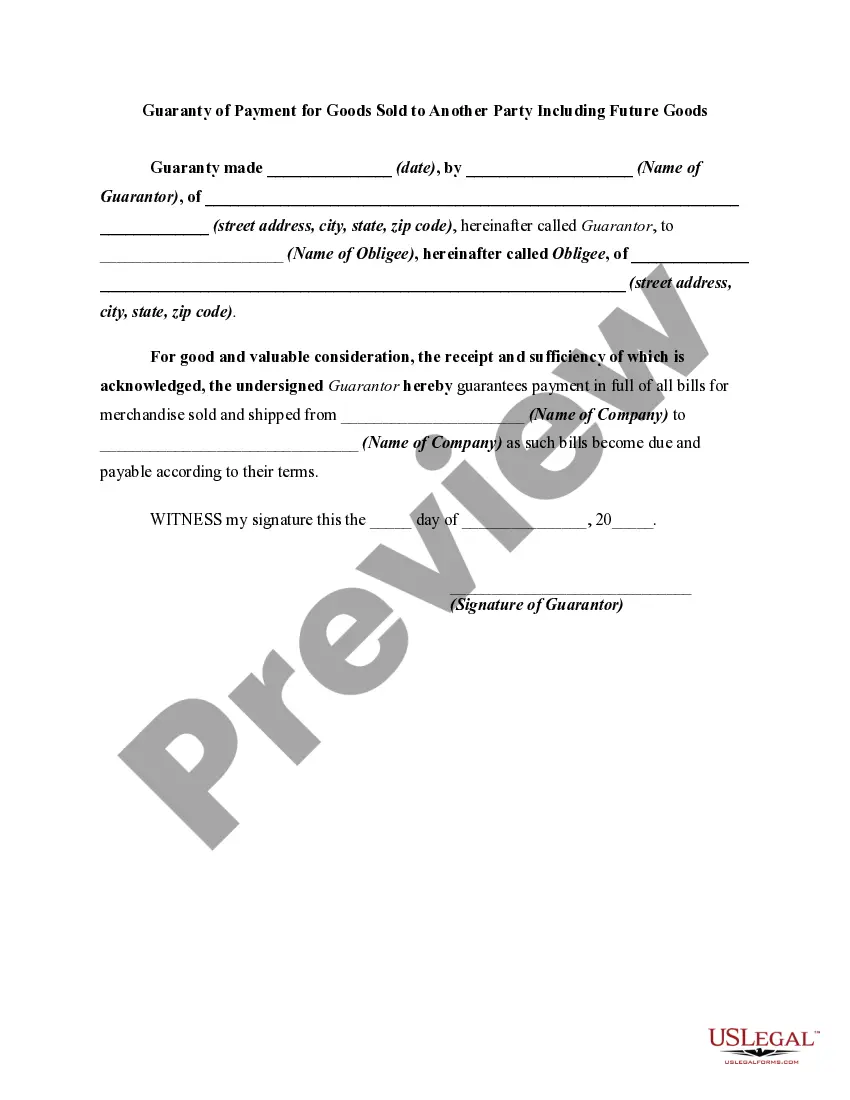

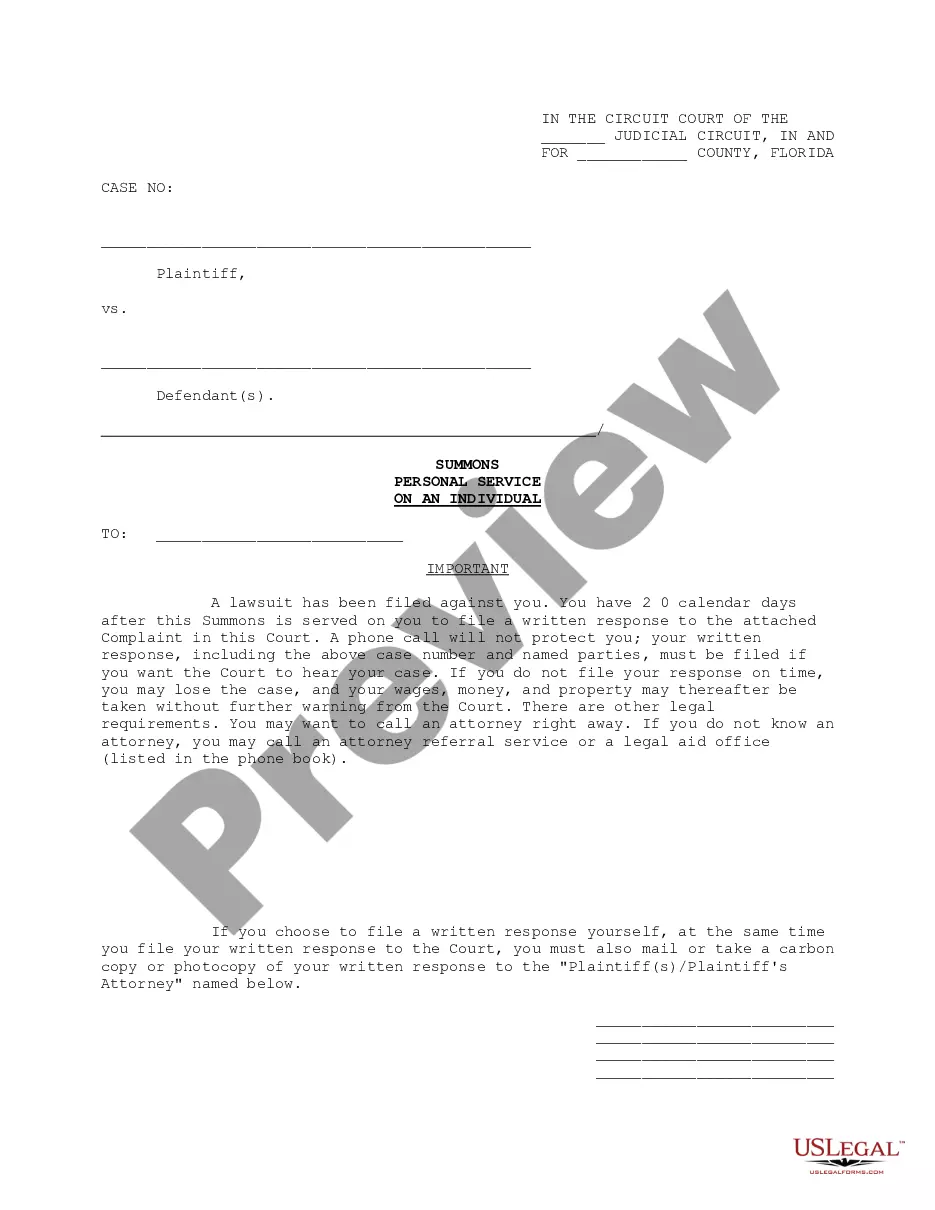

- First, be sure you have chosen the right form for the area/county. You may look through the form making use of the Review key and look at the form description to ensure this is basically the right one for you.

- In case the form will not meet up with your needs, utilize the Seach discipline to find the appropriate form.

- Once you are certain that the form is proper, go through the Get now key to obtain the form.

- Choose the prices prepare you want and enter in the necessary details. Create your account and purchase an order making use of your PayPal account or charge card.

- Opt for the file format and acquire the lawful document template for your gadget.

- Total, change and print out and indication the obtained Indiana Sample Letter of Credit.

US Legal Forms is the largest collection of lawful types that you will find different document templates. Take advantage of the company to acquire appropriately-made papers that adhere to condition needs.

Form popularity

FAQ

A Letter of Credit (LC) is a document that guarantees the buyer's payment to the sellers. It is issued by a bank and ensures timely and full payment to the seller. If the buyer is unable to make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

A bank guarantee is a promise from a lending institution that ensures the bank will step up if a debtor can't cover a debt. Letters of credit are also financial promises on behalf of one party in a transaction and are especially significant in international trade.

Example of an LC at Sight: The importer does not, however, want to take the chance of making an advance payment and later, not receiving goods. In this case, both parties agree to use the 'LC at Sight' payment technique to avoid risk. All terms and conditions governing the trade agreement are accepted by the parties.

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

Example: An Indian exporter receives an export LC from his overseas client in the Netherlands. The Indian exporter approaches his banker with a request to issue an LC in favour of his local supplier of raw materials. The bank issues an LC backed by the export LC.

Main types of LC Irrevocable LC. This LC cannot be cancelled or modified without consent of the beneficiary (Seller). ... Revocable LC. ... Stand-by LC. ... Confirmed LC. ... Unconfirmed LC. ... Transferable LC. ... Back-to-Back LC. ... Payment at Sight LC.