Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit association may be subject to certain legal requirements, even though it hasn't filed for incorporation under its state's incorporation laws. For example, an unincorporated association will generally need to file tax returns, whether as a taxable or tax-exempt entity. Additionally, there may be state registration requirements.

Indiana Articles of Association of Unincorporated Church Association

Description

How to fill out Articles Of Association Of Unincorporated Church Association?

Are you presently in a circumstance where you require documents for either business or personal purposes almost constantly? There are numerous legal document templates accessible online, but finding reliable ones is not simple.

US Legal Forms offers thousands of document templates, including the Indiana Articles of Association of Unincorporated Church Association, which are tailored to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can acquire the Indiana Articles of Association of Unincorporated Church Association template.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Indiana Articles of Association of Unincorporated Church Association anytime, if necessary. Just select the required template to download or print the document.

Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid errors. This service provides professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life a bit simpler.

- Locate the template you need and verify that it is for the correct city/state.

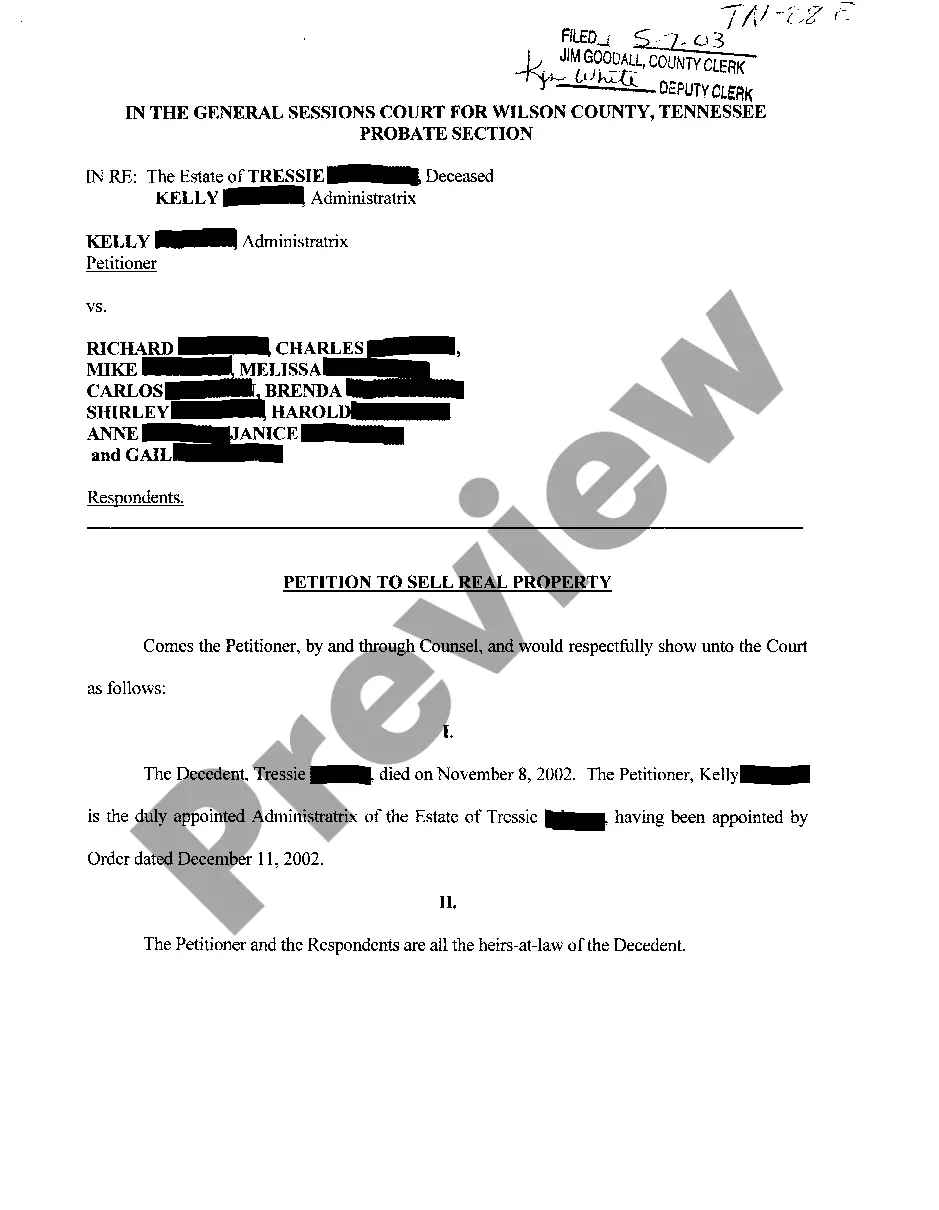

- Use the Review button to inspect the template.

- Read the description to ensure you have selected the right template.

- If the template does not meet your expectations, use the Search field to find the document that suits your requirements.

- Once you find the correct template, click Download now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and finalize your order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

A church can be either a corporation or an unincorporated association depending on its setup and governance. If formally registered, a church operates as a corporation, complete with Articles of Incorporation. However, many churches may function as unincorporated associations, requiring only the Indiana Articles of Association of Unincorporated Church Association. Knowing your church's status can impact its operations, tax benefits, and legal protections, which is why our platform offers guidance tailored to your specific situation.

Yes, a 501c3 organization requires Articles of Incorporation to gain tax-exempt status. These documents lay the foundation for your organization and outline its purpose and structure. Specifically for Indiana, understanding the Articles of Association of Unincorporated Church Association is essential, as this governs how your church operates. Utilizing our platform, you can easily prepare and file the necessary documents to comply with state regulations.

A church does not have ownership in the traditional sense, as it is typically owned by its congregation rather than individuals. This community-focused ownership aims to support shared goals and activities. In unincorporated churches, this concept can facilitate decision-making and governance. The Indiana Articles of Association of Unincorporated Church Association can help clarify ownership structures and responsibilities for congregations.

To file for a nonprofit organization in Indiana, you need to prepare several documents, including the articles of incorporation. It's essential to outline your mission, structure, and governance methods. Additionally, obtaining an Employer Identification Number (EIN) from the IRS is necessary for tax purposes. For unincorporated churches, reviewing the Indiana Articles of Association of Unincorporated Church Association can streamline the filing process and ensure compliance.

A church typically operates as a nonprofit organization. This structure allows it to focus on its mission and community service without prioritizing profit. Additionally, 501(c)(3) status can provide tax exemptions. If you are considering creating new policies or updating your governance structures, the Indiana Articles of Association of Unincorporated Church Association offer essential insights tailored to unincorporated churches.

Many churches choose to incorporate to gain specific legal benefits. Incorporation provides advantages like limited liability protection, which can safeguard personal assets from church liabilities. However, not all churches follow this route, as some prefer to remain unincorporated. The Indiana Articles of Association of Unincorporated Church Association may provide guidance and frameworks for those deciding to stay unincorporated.

Yes, a church can be unincorporated. An unincorporated church operates without formal state recognition as a legal entity. This means it does not have the same legal protections as incorporated organizations. Understanding the Indiana Articles of Association of Unincorporated Church Association can help unincorporated churches define their structure and operations.

The 33% rule refers to a guideline suggesting that nonprofits should not spend more than one-third of their total expenditures on fundraising activities. This helps ensure that most financial resources are directed towards the organization's mission. Understanding this rule can be beneficial for groups established under structures like the Indiana Articles of Association of Unincorporated Church Association.

The governing document of an organization specifies its rules, procedures, and operational guidelines. These documents are crucial for maintaining order and legality within the association. In the context of an unincorporated church association, this document is often informed by the Indiana Articles of Association of Unincorporated Church Association.

The organizing document for an unincorporated association is generally the founding document that outlines its purpose, rules, and membership structure. For a religious group, this might be the Indiana Articles of Association of Unincorporated Church Association. These articles provide legal clarity and guidance on how the group will function.