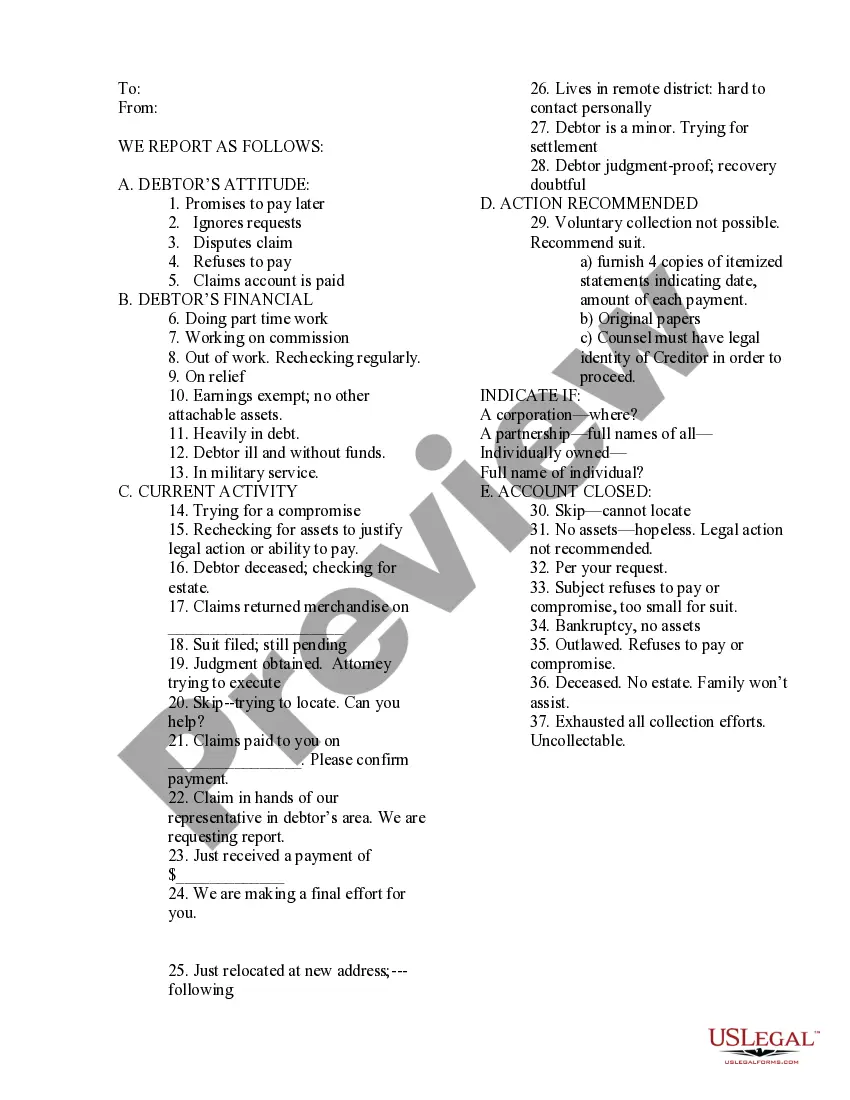

Indiana Collection Report

Description

How to fill out Collection Report?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a range of legal document templates that you can obtain or print. By utilizing the website, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Indiana Collection Report within seconds.

If you already have an account, Log In and obtain the Indiana Collection Report from the US Legal Forms library. The Obtain button will appear on every form you view. You can access all previously saved forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

Process the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make changes. Fill out, edit, print, and sign the saved Indiana Collection Report. Every template saved in your account does not have an expiration date and is yours permanently. Therefore, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the Indiana Collection Report with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Be sure to have selected the appropriate form for your area/state.

- Click the Review button to examine the form's content.

- Read the form details to ensure that you have selected the correct form.

- If the form doesn't fit your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your details to sign up for the account.

Form popularity

FAQ

A lien is placed by the Indiana Department of Revenue when taxes owed remain unpaid. This can extend to your vehicle if the debt goes unresolved, affecting your ownership rights. To clear a lien, refer to your Indiana Collection Report and understand the steps necessary to settle your tax obligations promptly.

How long can the IRS collect back taxes? In general, the Internal Revenue Service (IRS) has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations.

For current balance due on any individual or business tax liability, you may call the automated information line at 317-233-4018, Monday through Saturday, 7 a.m. to 10 p.m. EST. You will need to have your taxpayer identification number or Social Security number and Letter ID.

We now have tax warrant data for the entire state of Indiana and this information can be searched from the Welcome Page or by clicking on the tax warrants tab. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income, sales tax, withholding or corporation liability.

The Indiana Department of Revenue (DOR) contracts with United Collection Bureau, Inc. (UCB) as a legal collection agent who are authorized to collect delinquent tax liabilities, including applying levies, wage garnishments, etc.

DOR frequently sends letters to customers to request needed information to process a tax return. Not responding to an information request can cause a tax return to remain unprocessed, generating an overdue payment with penalties and interest owed. Additionally, any potential refund could be delayed.

Collection Allowance: The collection allowance is available when the payment is remitted timely. The deduction allows a retail merchant to retain a percentage of the amount due on sales tax and the tire fee. This is 0.83 percent of the sales tax due (it was reduced from 1 percent in 2002).

The statute of limitations for assessing tax in Indiana is three years from the later to occur of the due date of the tax return or the end of the calendar year which contains the taxable period for which the return is filed for certain taxes, such as the use tax, special fuel tax or oil inspection fee.

There are three stages of collection of back Indiana taxes. Depending on the amount of tax you owe, you might have up to 36 months to pay off your tax debt. If not paid at this point, your Indiana tax debt becomes an Indiana tax lien.

A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed.