Indiana Checklist - Health and Disability Insurance

Description

How to fill out Checklist - Health And Disability Insurance?

Are you currently in a situation where you require documents for either business or personal purposes almost all the time.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Indiana Checklist - Health and Disability Insurance, designed to comply with federal and state requirements.

Once you identify the right form, click Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Indiana Checklist - Health and Disability Insurance template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the necessary form and ensure it is for the correct city/state.

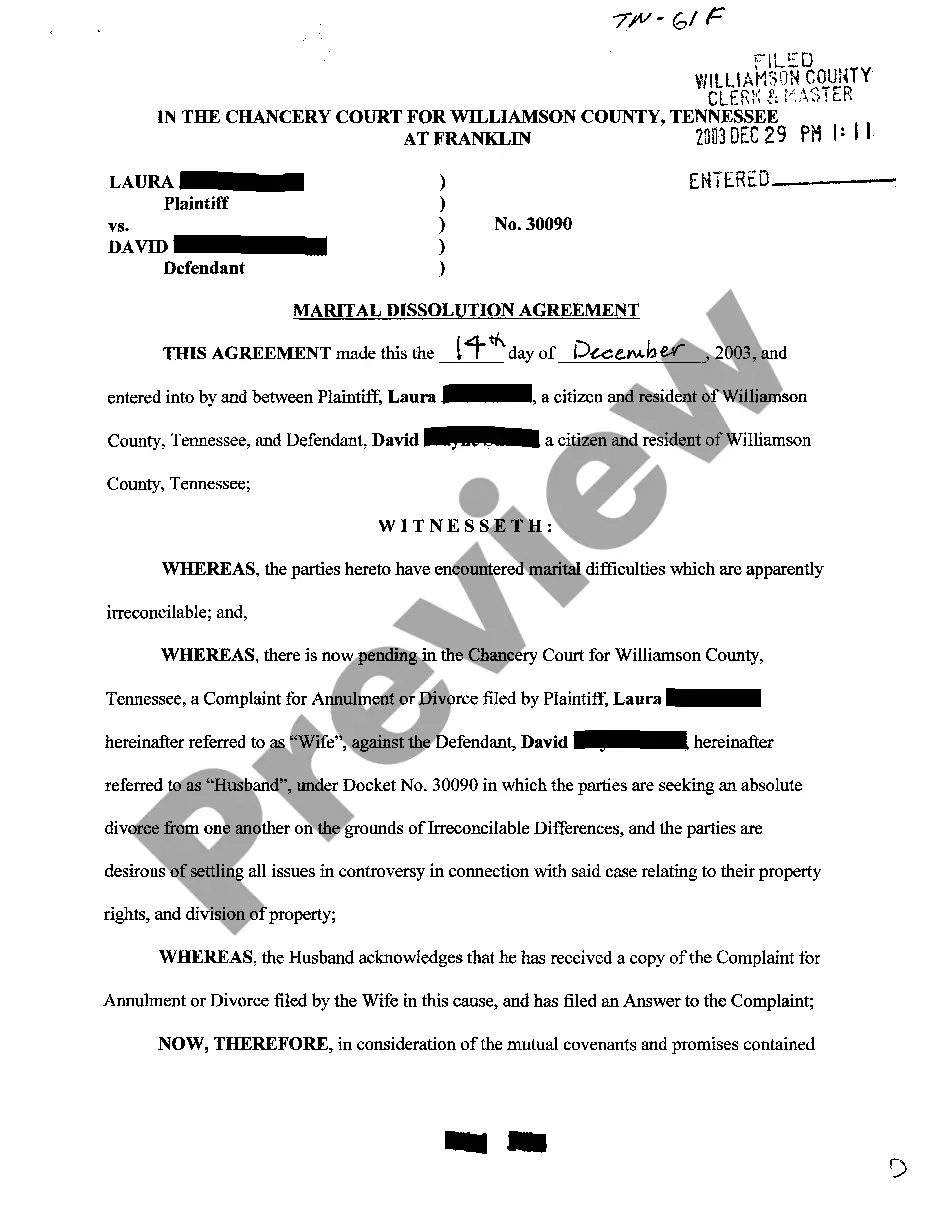

- Use the Preview button to review the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search box to find the form that suits your needs and requirements.

Form popularity

FAQ

In Indiana, several criteria determine eligibility for Disability benefits, including a severe medical condition that impairs your ability to work. Your condition must significantly impact your daily life and have been diagnosed by a qualified healthcare provider. Reviewing the Indiana Checklist - Health and Disability Insurance is essential for understanding these qualifications. Additionally, uslegalforms can assist you in gathering the necessary documentation to support your claim.

Yes, if you are approved for Disability benefits in Indiana, you may qualify for health insurance coverage through programs like Medicaid. This is vital for managing your healthcare needs while receiving Disability benefits. Familiarizing yourself with the Indiana Checklist - Health and Disability Insurance will help you understand your options. If you need assistance, uslegalforms offers valuable resources to help navigate this complex process.

The Indiana Life and Health Insurance exam typically contains 150 multiple-choice questions that assess your knowledge of insurance principles and regulations. It is crucial to prepare thoroughly to succeed in this exam. The Indiana Checklist - Health and Disability Insurance can help guide your study efforts, ensuring you cover all necessary topics. Platforms like uslegalforms often provide study resources that can enhance your preparation.

To determine if you qualify for Disability in Indiana, you should assess your medical condition against the criteria outlined in the Indiana Checklist - Health and Disability Insurance. Key factors include your ability to perform daily activities and the severity of your condition. Gathering thorough medical records and documentation is essential in this evaluation. Additionally, consulting with professionals or uslegalforms can provide you with valuable insights.

Getting Disability in Indiana can be challenging, as it requires meeting specific criteria set by state and federal regulations. Many applicants face initial denials due to insufficient medical evidence or lack of documentation. Understanding the Indiana Checklist - Health and Disability Insurance can help streamline the application process and improve your chances of approval. Utilizing resources, such as the forms provided by uslegalforms, can make the process easier.

Generally, you do not lose your health insurance when you go on disability unless you stop paying your premiums or your employer's policy changes. In fact, many find that their existing health insurance continues to cover them during this time. Familiarize yourself with this situation through your Indiana Checklist - Health and Disability Insurance to ensure you maintain essential coverage.

The Indiana health insurance exam consists of 150 questions that test your knowledge on various aspects of health insurance, including policies and regulations. Preparing effectively can boost your chances of passing. Utilize resources and knowledge from your Indiana Checklist - Health and Disability Insurance to excel.

Individuals typically choose disability insurance to ensure financial stability if they cannot work due to illness or injury. This coverage replaces a portion of their income, allowing them to cover living expenses without depleting savings. Consider this crucial aspect in your Indiana Checklist - Health and Disability Insurance.

In Indiana, employers with 50 or more full-time employees are required to offer health insurance under the Affordable Care Act. However, small businesses may not have this obligation. Be aware of these requirements as you navigate your Indiana Checklist - Health and Disability Insurance.

Health insurance covers medical expenses such as doctor visits and hospital stays, while disability insurance provides income replacement if you cannot work due to a disability. Both serve different financial protection purposes, but both are essential to consider in your Indiana Checklist - Health and Disability Insurance.