This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage

Description

How to fill out Complaint To Compel Mortgagee To Execute And Record Satisfaction And Discharge Of Mortgage?

You may devote hours on-line trying to find the authorized document web template that fits the federal and state needs you will need. US Legal Forms supplies thousands of authorized varieties that are analyzed by professionals. It is possible to acquire or produce the Indiana Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage from the support.

If you currently have a US Legal Forms profile, it is possible to log in and click the Obtain key. After that, it is possible to full, edit, produce, or indication the Indiana Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. Each and every authorized document web template you purchase is yours forever. To acquire one more copy for any purchased type, visit the My Forms tab and click the related key.

Should you use the US Legal Forms internet site initially, keep to the basic directions under:

- First, make sure that you have selected the best document web template for that state/metropolis that you pick. See the type information to ensure you have picked out the correct type. If offered, take advantage of the Preview key to search with the document web template also.

- If you want to get one more edition in the type, take advantage of the Research discipline to discover the web template that suits you and needs.

- When you have located the web template you need, just click Get now to move forward.

- Pick the pricing plan you need, type in your references, and register for an account on US Legal Forms.

- Complete the purchase. You can use your charge card or PayPal profile to cover the authorized type.

- Pick the format in the document and acquire it for your product.

- Make changes for your document if necessary. You may full, edit and indication and produce Indiana Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage.

Obtain and produce thousands of document themes making use of the US Legal Forms website, which provides the most important collection of authorized varieties. Use skilled and status-distinct themes to take on your organization or personal requirements.

Form popularity

FAQ

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.

Section 32-17-14-12 - Transfer on death transfers of tangible personal property (a) A deed of gift, bill of sale, or other writing intended to transfer an interest in tangible personal property is effective on the death of the owner and transfers ownership to the designated transferee beneficiary if the document: (1) ...

(3) If the mortgage lender does not satisfy the net worth requirements within 120 days, the license of the mortgage lender shall be deemed to be relinquished and canceled and all servicing contracts shall be disposed of in a timely manner by the mortgage lender.

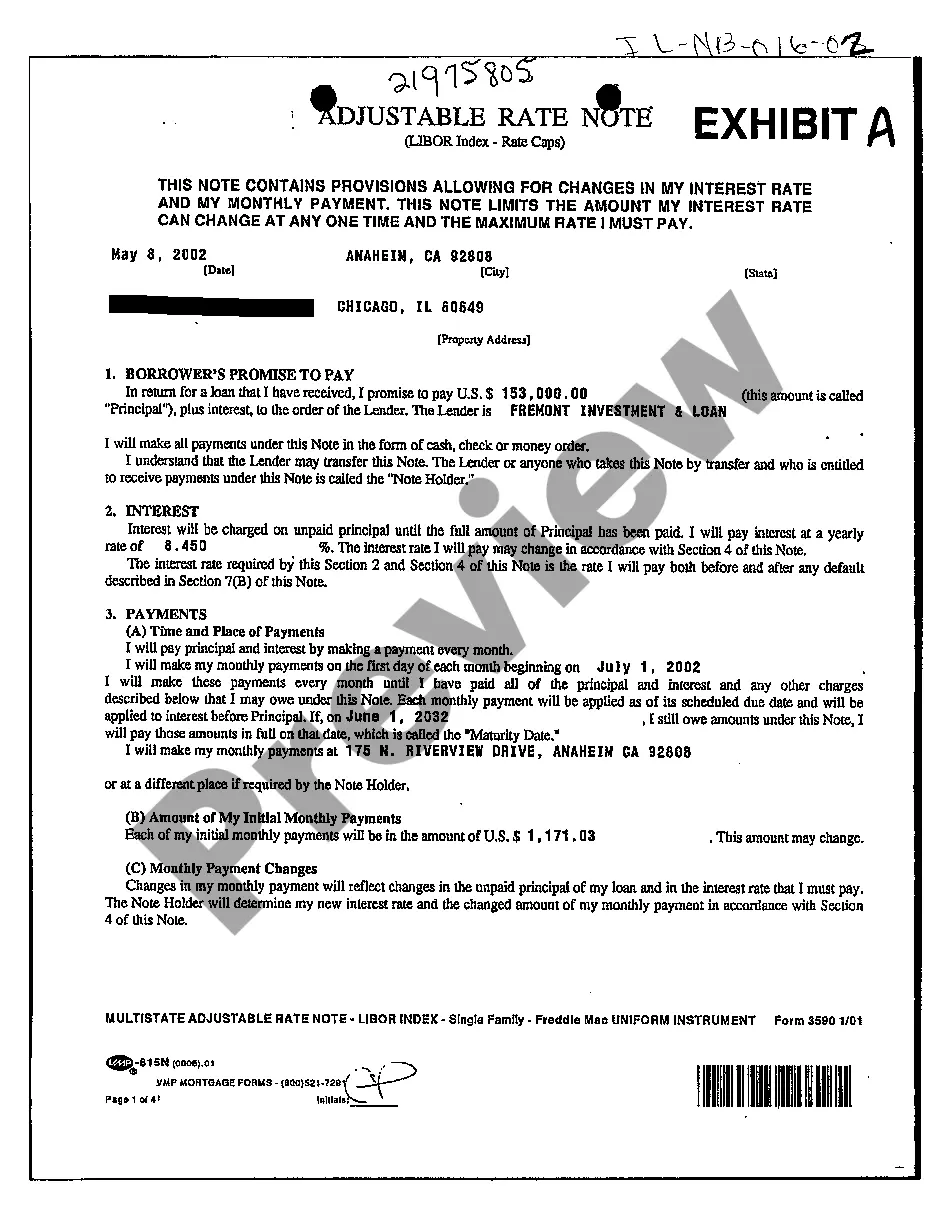

A satisfaction of mortgage, also known as release, cancellation or discharge of mortgage, is a type of legal document that proves you paid your mortgage in full. As a result, it also certifies that the property's title is clear of any liens.

Any defendant may appeal the interlocutory order overruling the objections and appointing appraisers in the manner that appeals are taken from final judgments in civil actions. (f) All the parties shall take notice of and be bound by the judgment in the appeal.

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.

If Mortgagee fails to satisfy of record, he is liable for damages, including attorney fees, if 20 days written notice is given by Mortgagor prior to suit. Acknowledgment: An assignment or satisfaction must contain a proper New Jersey acknowledgment, or other acknowledgment approved by Statute.

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.