Indiana Community Property Agreement

Description

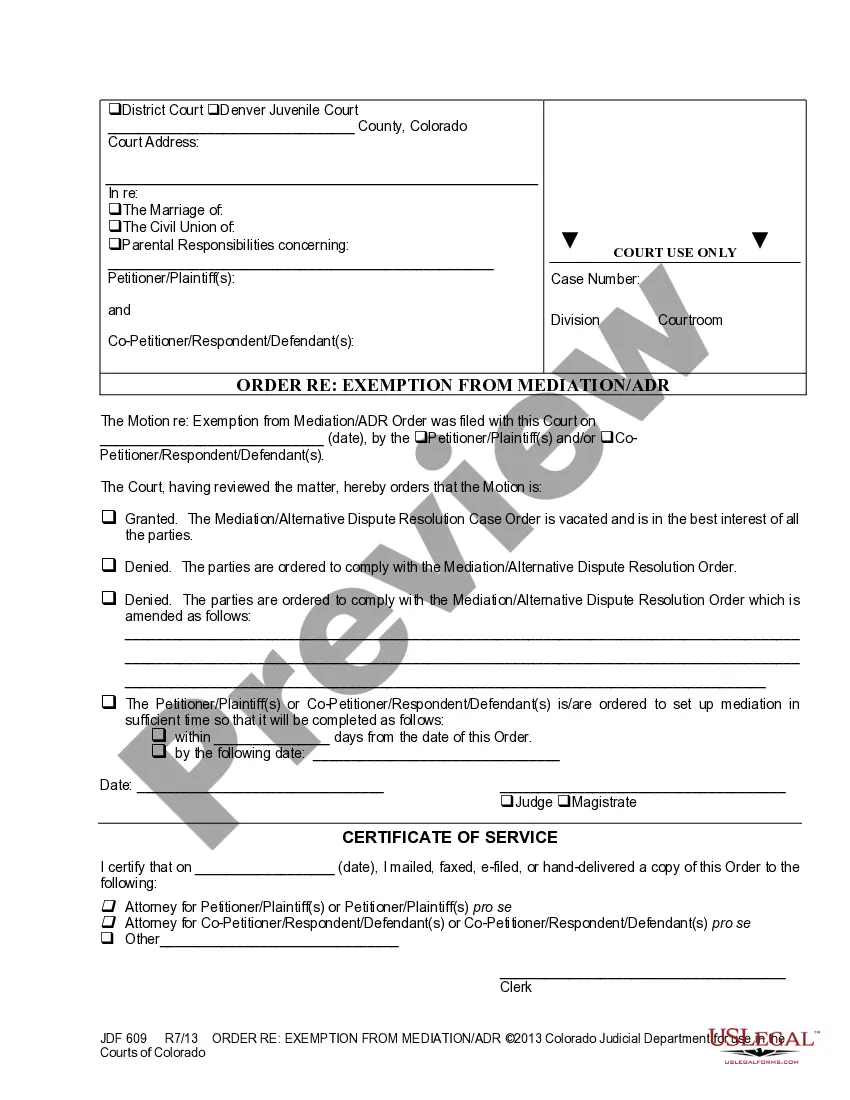

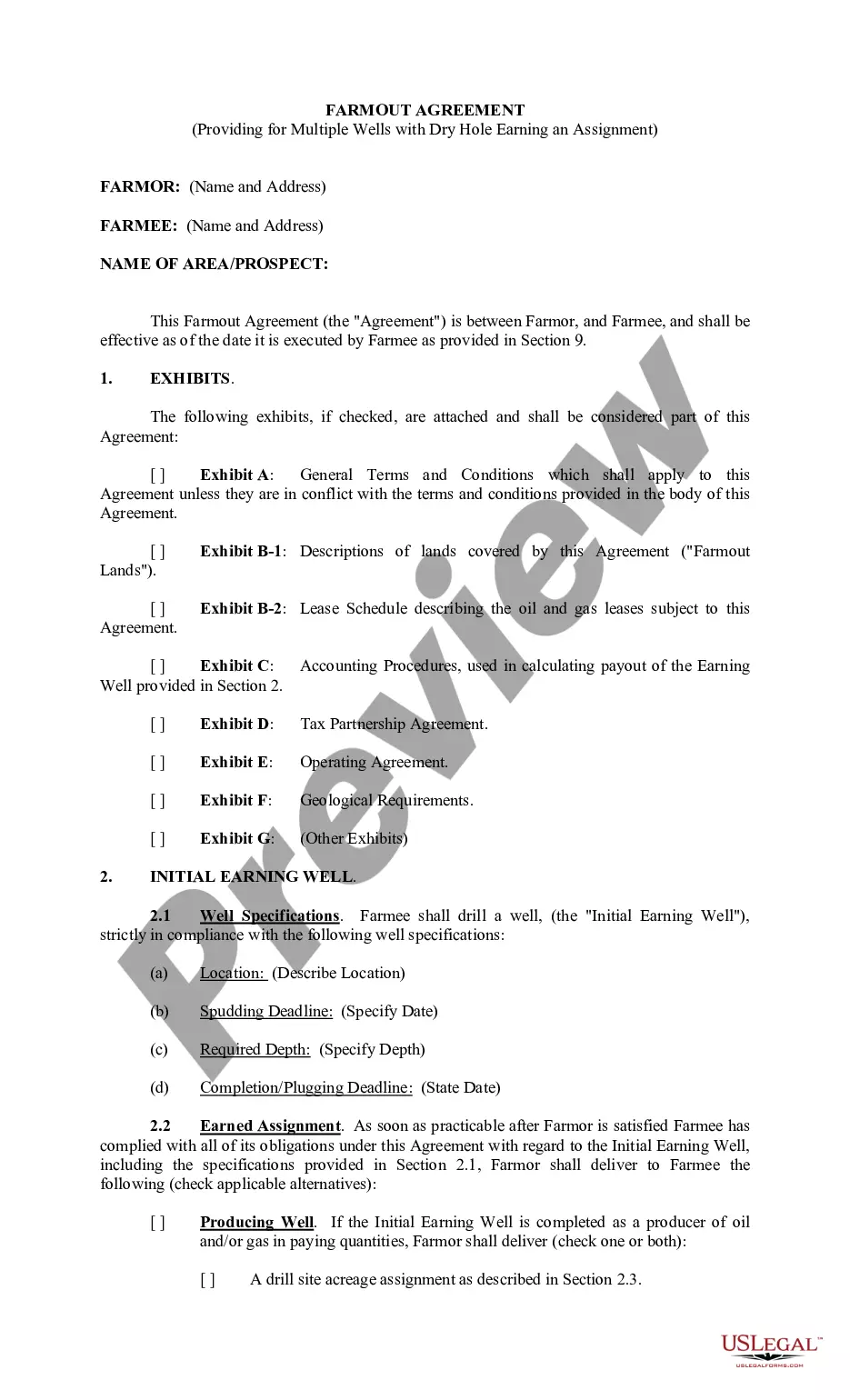

How to fill out Community Property Agreement?

Selecting the most suitable valid document format may be challenging.

Clearly, there are numerous designs accessible on the internet, but how will you secure the valid form you need.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Indiana Community Property Agreement, that you can utilize for both business and personal needs.

You can preview the form using the Review button and read the form outline to confirm it is suitable for your needs.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Indiana Community Property Agreement.

- You can use your account to browse the valid forms you have previously ordered.

- Go to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are easy guidelines you can follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Yes, the length of marriage can influence the divorce settlement in Indiana, but it is not the only factor. Courts will look at the overall circumstances, including contributions and future needs. Referencing the Indiana Community Property Agreement can provide insights into how these factors are assessed.

If you owned your house before marriage in Indiana, your wife generally cannot take it. This property is usually classified as separate property unless you have made significant changes together as a couple. The Indiana Community Property Agreement can assist in clarifying the specifics of your situation.

In Indiana, you do not need to be married for a specific duration to split assets during a divorce. The separation of assets is influenced by numerous factors, including the classification of the property and contributions made by each spouse. Using the Indiana Community Property Agreement can help you understand how to approach asset division.

There is no specific duration of marriage required to entitle a spouse to half of everything in Indiana. Instead, asset division can occur based on various circumstances and arrangements. For personalized advice, examining the Indiana Community Property Agreement is recommended.

While many people believe a wife is entitled to half of everything, this may not always be true in Indiana. Property division depends on various factors, including how assets were acquired and whether they are considered marital or separate. Engaging with the Indiana Community Property Agreement can help you navigate this complex topic.

In Indiana, if the house is solely in your name and was acquired before marriage, your wife may not be entitled to half of it. However, co-mingling assets or contributions from your wife could potentially impact your situation. Reviewing the Indiana Community Property Agreement can provide clarity on asset division in your specific circumstances.

In Indiana, a wife typically cannot take your house if you bought it before marriage. This property may be considered separate property, as long as you maintained it solely under your name. However, it's essential to consult the Indiana Community Property Agreement to understand how your assets might be treated during a divorce.

In Indiana, separation laws allow couples to live apart without formally divorcing, but they may need to address issues like support and asset division. Separation can have significant legal implications, particularly regarding property and maintenance. Using an Indiana Community Property Agreement can help effectively navigate these laws and provide a clear framework for both parties.

Yes, in Indiana, you may be required to support your wife during separation if she can demonstrate a need for financial assistance. Courts evaluate various factors, including each party's income and ability to support themselves. A well-prepared Indiana Community Property Agreement can specify support terms and help prevent future misunderstandings.

Marital assets in Indiana include nearly all property acquired during the marriage, regardless of whose name is on the title. This typically encompasses real estate, bank accounts, retirement funds, and personal belongings. An Indiana Community Property Agreement can clearly define these assets and ensure both spouses understand their rights and obligations.