Indiana Sample Letter to Include Deposit Slip from Sales

Description

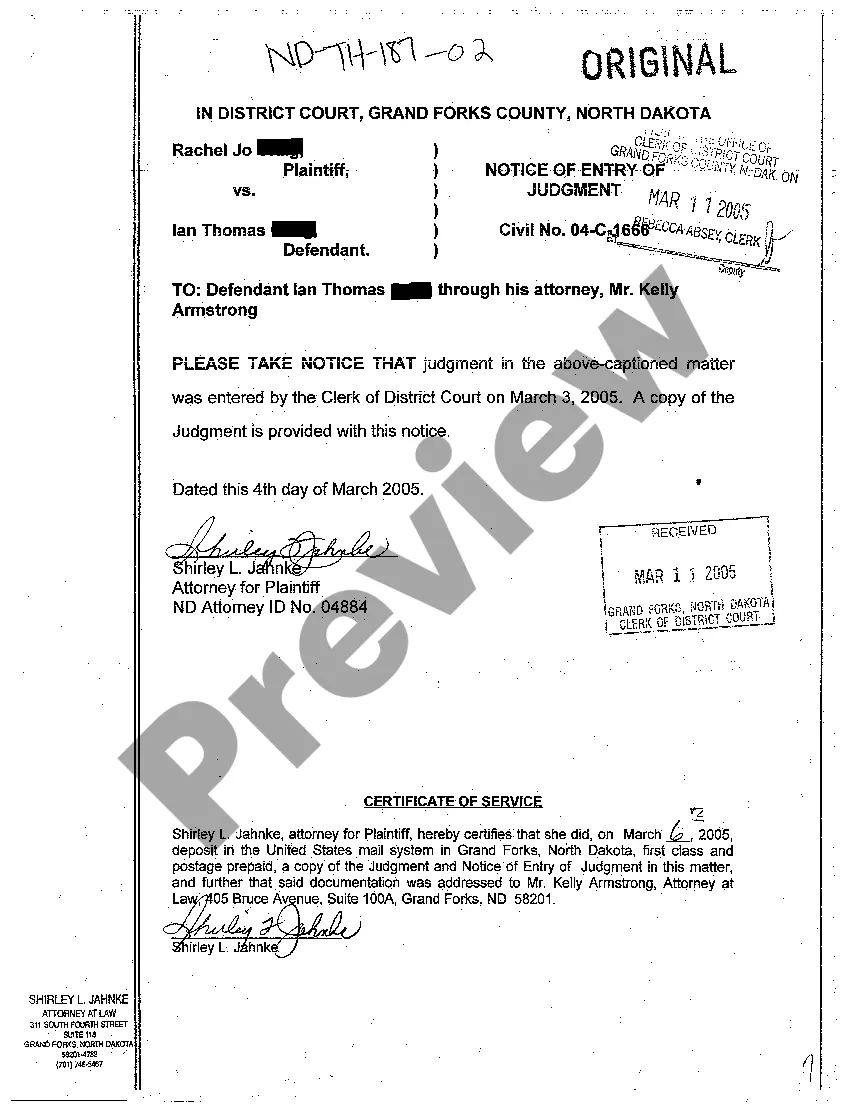

How to fill out Sample Letter To Include Deposit Slip From Sales?

If you wish to complete, obtain, or print out legal document layouts, use US Legal Forms, the biggest assortment of legal forms, which can be found on the Internet. Utilize the site`s basic and convenient look for to discover the documents you will need. Various layouts for business and personal purposes are sorted by categories and says, or search phrases. Use US Legal Forms to discover the Indiana Sample Letter to Include Deposit Slip from Sales in just a couple of click throughs.

Should you be currently a US Legal Forms buyer, log in to your account and click on the Acquire key to get the Indiana Sample Letter to Include Deposit Slip from Sales. You can also gain access to forms you previously saved inside the My Forms tab of your own account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have selected the form for that right metropolis/country.

- Step 2. Make use of the Review method to examine the form`s content. Never overlook to learn the information.

- Step 3. Should you be unhappy using the form, make use of the Look for area towards the top of the screen to find other models in the legal form format.

- Step 4. After you have found the form you will need, click on the Get now key. Pick the costs strategy you like and put your accreditations to register on an account.

- Step 5. Process the financial transaction. You can use your charge card or PayPal account to accomplish the financial transaction.

- Step 6. Select the format in the legal form and obtain it on your own product.

- Step 7. Total, modify and print out or signal the Indiana Sample Letter to Include Deposit Slip from Sales.

Every legal document format you purchase is yours eternally. You possess acces to each form you saved within your acccount. Click the My Forms portion and decide on a form to print out or obtain yet again.

Be competitive and obtain, and print out the Indiana Sample Letter to Include Deposit Slip from Sales with US Legal Forms. There are many expert and status-certain forms you may use for your personal business or personal demands.

Form popularity

FAQ

How to use business deposit slips Write in the date. Fill in the total amount you're depositing. List the check amount with check number. If you fill out a business deposit slip with multiple checks, list all the checks on the back of the deposit slip.

How to write a security deposit return letter Landlord's name and contact information. Tenant's name and contact information. Date of the letter. Amount of security deposit being returned to the tenant. Breakdown of any deductions made from the security deposit, including an explanation for each deduction.

Steps on How to Fill Out a Bank Deposit Slip: Provide personal information, including your name and your account number. Fill in additional details such as the date. If you are cashing the check or any part of the check, it is also required you sign the signature line. List the cash amount of your deposit, if any.

The proof of deposit letter verifies that the requisite funds for a large purchase or down payment have been deposited into an account and where those funds come from. As with proof of funds, this document is commonly required when someone is applying for a mortgage to buy a house.

A Verification of Deposit form is a document that is part of a personal mortgage loan application package and is used as a risk-mitigation measure. It is sent from one financial institution to another to confirm either that a customer's: cash deposit amounts as reported on the loan application are correct.

I'm the former tenant of [your previous address]. I'm contacting you about the refund of my tenancy deposit. My tenancy ended on [tenancy end date]. The property has been left in good order and the rent was fully paid.

Whereas a cash security deposit leaves the tenant's account and can tie up a considerable amount of working capital, a letter of credit keeps the money in their account where it can earn interest.