Indiana Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

You might spend hours online searching for the legal document template that meets your federal and state guidelines.

US Legal Forms offers thousands of legal documents reviewed by experts.

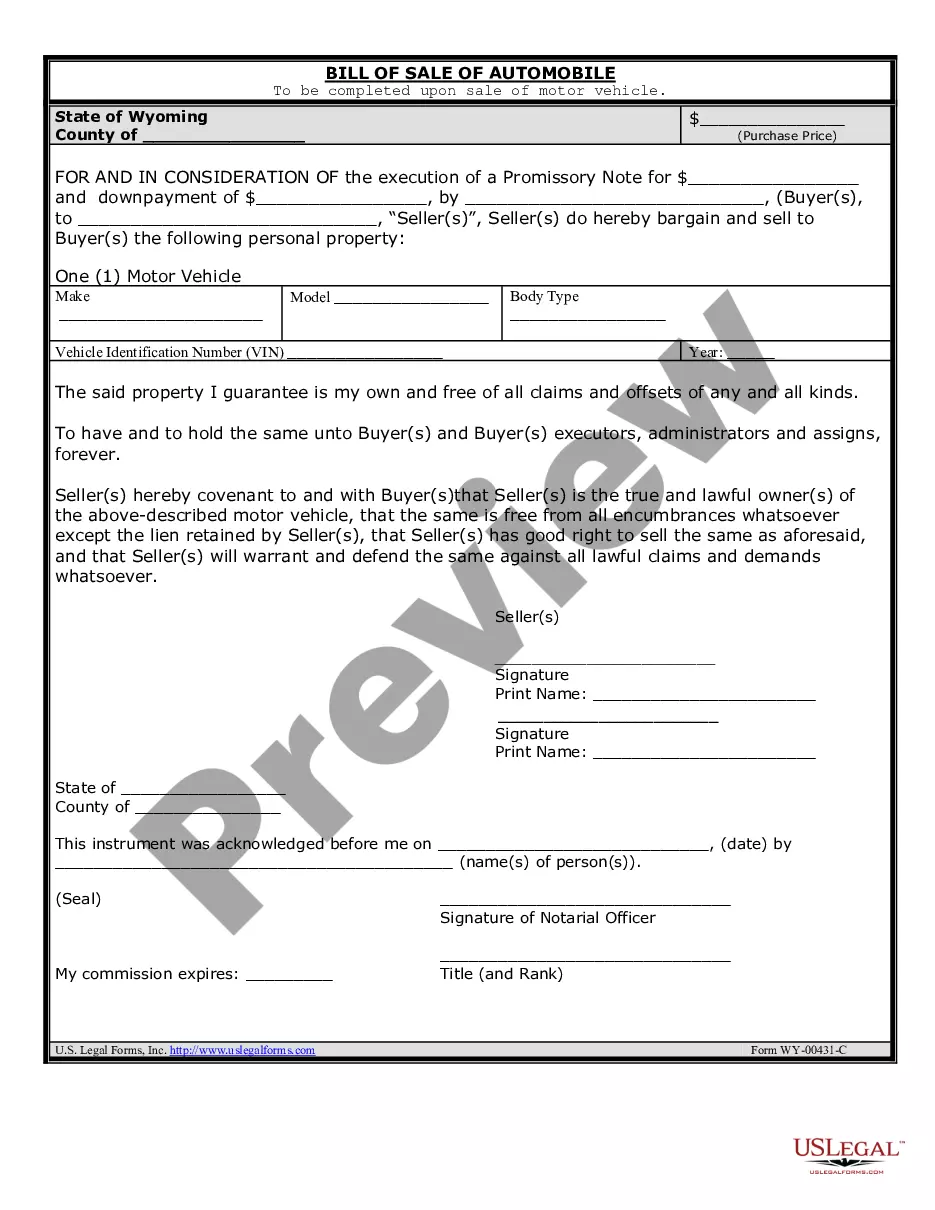

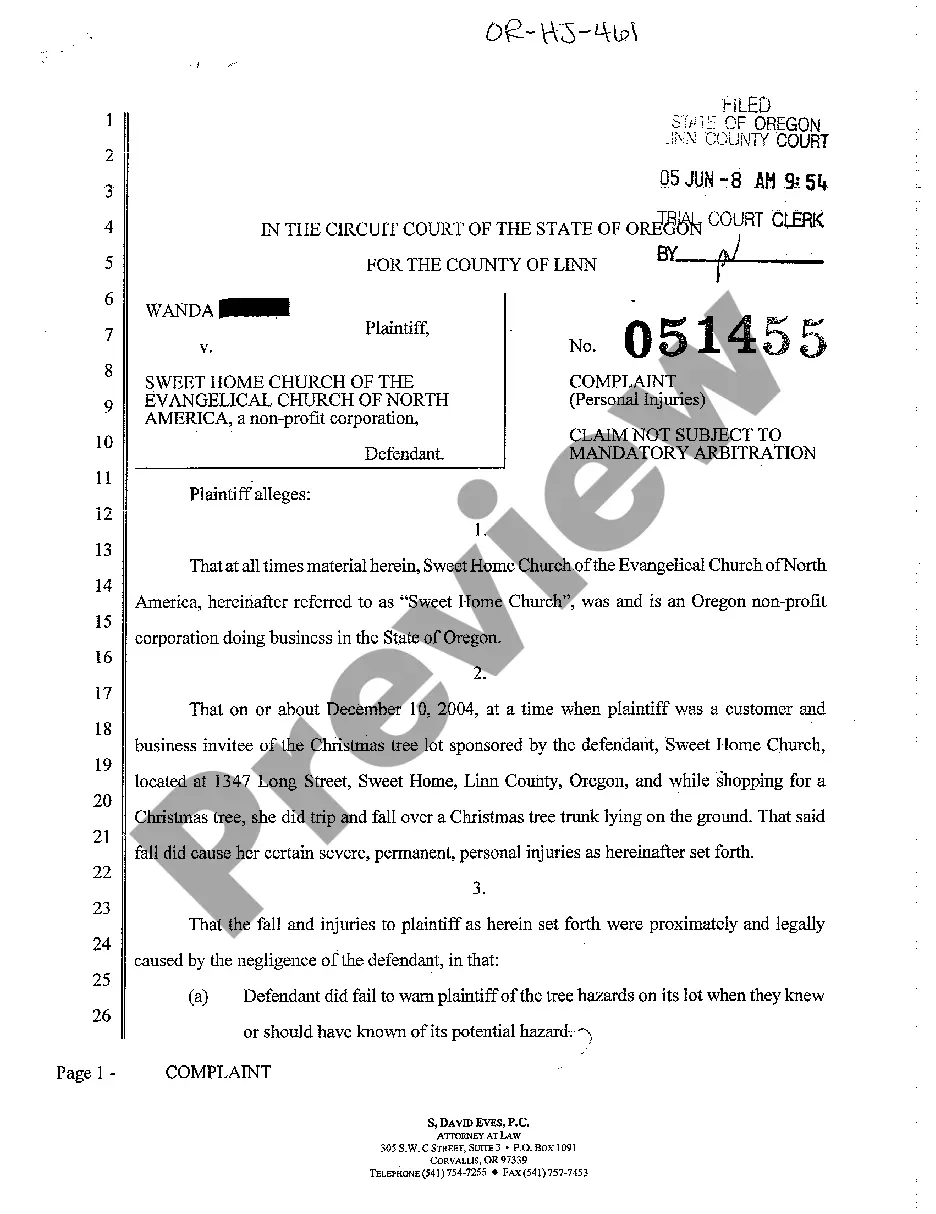

You can download or print the Indiana Security Agreement regarding Sale of Collateral by Debtor from our service.

First, ensure that you have chosen the correct document template for your desired county/area. Review the document information to confirm you have selected the appropriate form. If available, utilize the Review button to examine the document template as well. If you wish to find another version of the form, use the Search section to locate the template that satisfies your needs and requirements. Once you have discovered the desired template, click Purchase now to proceed. Select the price plan you prefer, input your credentials, and register for an account with US Legal Forms. Complete the payment process using your credit card or PayPal account to settle the legal document. Choose the format of your document and download it to your device. Make adjustments to the document if necessary. You may fill out, revise, sign, and print the Indiana Security Agreement regarding Sale of Collateral by Debtor. Download and print thousands of document templates using the US Legal Forms Website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already own a US Legal Forms account, you may Log In and click the Download button.

- After that, you can fill out, revise, print, or sign the Indiana Security Agreement regarding Sale of Collateral by Debtor.

- Every legal document template you download becomes your property permanently.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

A security interest in the collateral becomes enforceable through attachment, which requires that the secured party's interest is supported by a valid security agreement. The Indiana Security Agreement involving Sale of Collateral by Debtor sets the foundation for this attachment. Ensuring that all criteria are met will lead to effective enforcement of your security interest.

The description of collateral in a security agreement must be specific enough to identify the property covered under the agreement. In an Indiana Security Agreement involving Sale of Collateral by Debtor, a well-defined description helps avoid ambiguity and provides clarity for all parties involved. This clear detail aids in enforcement should any issues arise.

To perfect a security interest in securities, the secured party must have control over the securities, which typically involves either physical possession or a control agreement with the securities intermediary. This is a crucial step in securing your rights under the Indiana Security Agreement involving Sale of Collateral by Debtor. Following these measures will help protect your financial interests effectively.

You can perfect a security interest in a general intangible by filing a financing statement with the appropriate state authority. This action must be clearly referenced in your Indiana Security Agreement involving Sale of Collateral by Debtor to ensure clarity in rights. Be aware of the nuances involved in different intangibles to avoid complications.

To perfect a security interest in a negotiable document, you must take possession of the document itself or use a control agreement if applicable. The secured party must also ensure that the conditions set forth in the Indiana Security Agreement involving Sale of Collateral by Debtor are met. Proper perfection minimizes potential disputes and strengthens your security position.

The four methods of perfection include filing a financing statement, taking possession of the collateral, controlling the collateral, and automatic perfection through specific scenarios. Each method applies differently depending on the type of collateral involved. Understanding these methods is essential when creating an Indiana Security Agreement involving Sale of Collateral by Debtor, as it affects the priority of your claim.

To perfect a security agreement under the UCC, the secured party must take certain actions to establish rights to the collateral. Typically, this involves filing a financing statement with the appropriate state office. For an Indiana Security Agreement involving Sale of Collateral by Debtor, it is crucial to follow state-specific rules to ensure your security interest is enforceable.

A security agreement establishes the relationship between a borrower and a lender regarding specific collateral, allowing the lender to claim that collateral if the borrower defaults. A lien, however, is the legal right or interest that a lender has in a borrower’s property, granted until the underlying obligation is satisfied. While both terms relate to securing interest, the security agreement is more about the contractual terms, whereas the lien involves the legal claim itself. For an Indiana Security Agreement involving Sale of Collateral by Debtor, both concepts are essential to understand.

A security agreement outlines the terms and conditions under which a debtor grants a lender a security interest in collateral. On the other hand, a UCC filing is the public record that helps protect the lender's rights by notifying others that the lender has a claim to the collateral. Essentially, while the security agreement details the relationship between the debtor and lender, the UCC filing serves as a public notice of that relationship. Understanding these differences is crucial when dealing with an Indiana Security Agreement involving Sale of Collateral by Debtor.

To file an Indiana Security Agreement involving Sale of Collateral by Debtor, you typically file it with the Secretary of State's office. This filing helps to perfect your security interest in the collateral. Additionally, it is wise to check if there are any local recording offices where specific types of collateral may need to be filed. Using USLegalForms can simplify this process by providing you with the necessary documents and guidance.