The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

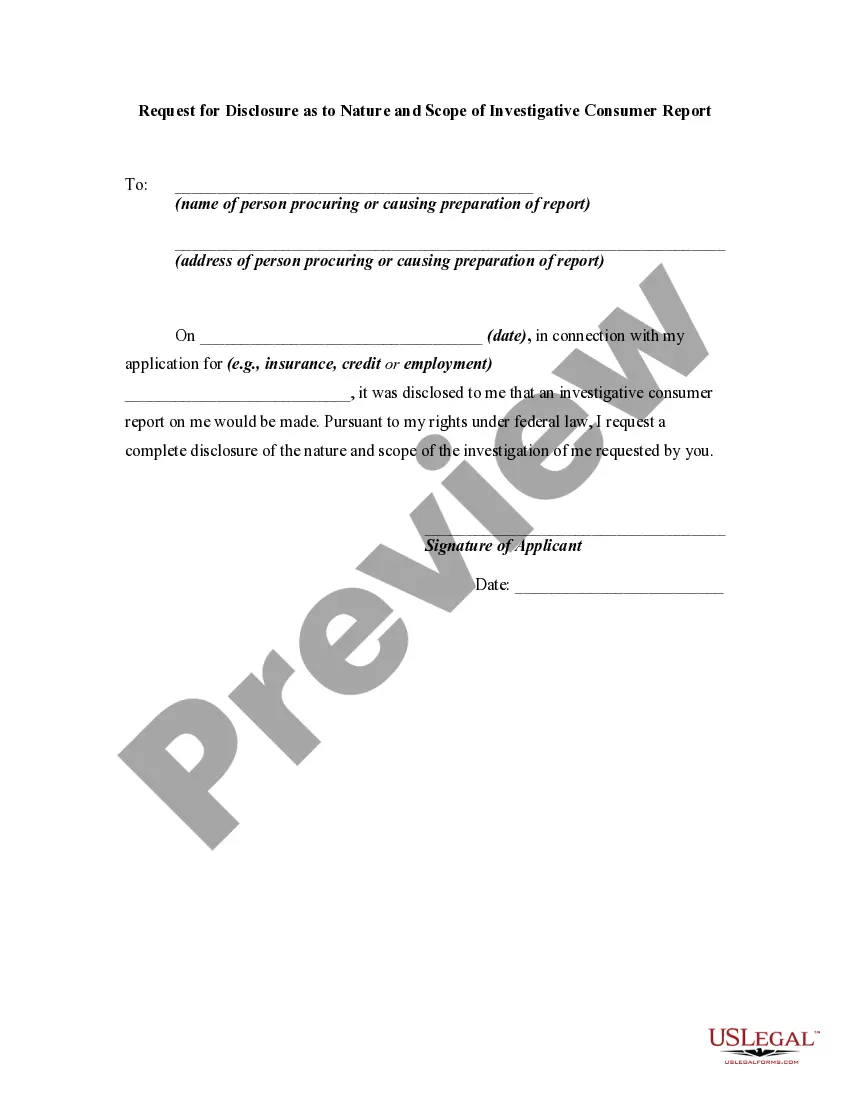

Indiana Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Denial Of Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

It is possible to invest hours on-line searching for the lawful document web template that fits the federal and state needs you require. US Legal Forms gives a huge number of lawful types which are evaluated by professionals. You can actually download or produce the Indiana Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency from the support.

If you already have a US Legal Forms accounts, you are able to log in and click the Down load option. Next, you are able to comprehensive, change, produce, or sign the Indiana Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency. Each and every lawful document web template you buy is your own property for a long time. To obtain yet another version of any obtained form, proceed to the My Forms tab and click the corresponding option.

If you work with the US Legal Forms website the first time, stick to the straightforward recommendations listed below:

- Very first, make sure that you have chosen the proper document web template for the county/city of your liking. Read the form explanation to make sure you have selected the proper form. If readily available, take advantage of the Preview option to check throughout the document web template at the same time.

- In order to find yet another variation of your form, take advantage of the Lookup field to find the web template that meets your requirements and needs.

- Once you have located the web template you desire, simply click Acquire now to proceed.

- Choose the pricing program you desire, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the deal. You may use your bank card or PayPal accounts to purchase the lawful form.

- Choose the format of your document and download it in your product.

- Make alterations in your document if required. It is possible to comprehensive, change and sign and produce Indiana Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Down load and produce a huge number of document web templates while using US Legal Forms web site, that provides the biggest selection of lawful types. Use skilled and status-distinct web templates to take on your small business or personal requirements.

Form popularity

FAQ

Ing to the Equal Credit Opportunity Act, lenders are required to tell you why you've been turned down, if credit played a role. They must include a letter with the specific details, as well as the name of the credit reporting agency that supplied the information they were using.

If a lender rejects your application, it's required under the Equal Credit Opportunity Act (ECOA) to tell you the specific reasons your application was rejected or tell you that you have the right to learn the reasons if you ask within 60 days.

The Equal Credit Opportunity Act (ECOA) prohibits discrimination in any aspect of a credit transaction. It applies to any extension of credit, including extensions of credit to small businesses, corporations, partnerships, and trusts.

Notifications ? 12 CFR 1002.9 A creditor must notify an applicant of action taken on the applicant's request for credit, whether favorable or adverse, within 30 days after receiving a completed application.

A creditor must disclose the principal reasons for denying an application or taking other adverse action. The regulation does not mandate that a specific number of reasons be disclosed, but disclosure of more than four reasons is not likely to be helpful to the applicant.

The statute provides that its purpose is to require financial institutions and other firms engaged in the extension of credit to ?make credit equally available to all creditworthy customers without regard to sex or marital status.? Moreover, the statute makes it unlawful for ?any creditor to discriminate against any ...

They do not meet the creditor's minimum income requirement; They have not been living at your address or working at your job for the required amount of time; They are too near their credit limits; and.

A statement of action taken by the creditor. Either a statement of the specific reasons for the action taken or a disclosure of the applicant's right to a statement of specific reasons and the name, address, and telephone number of the person or office from which this information can be obtained.