Agreements among family members for the settlement of an intestate's estate will be upheld in the absence of fraud and when the rights of creditors are met. Intestate means that the decedent died without a valid will. The termination of any family controversy or the release of a reasonable, bona fide claim in an intestate estate have been held to be sufficient consideration for a family settlement.

Indiana Agreement Between Heirs as to Division of Estate

Description

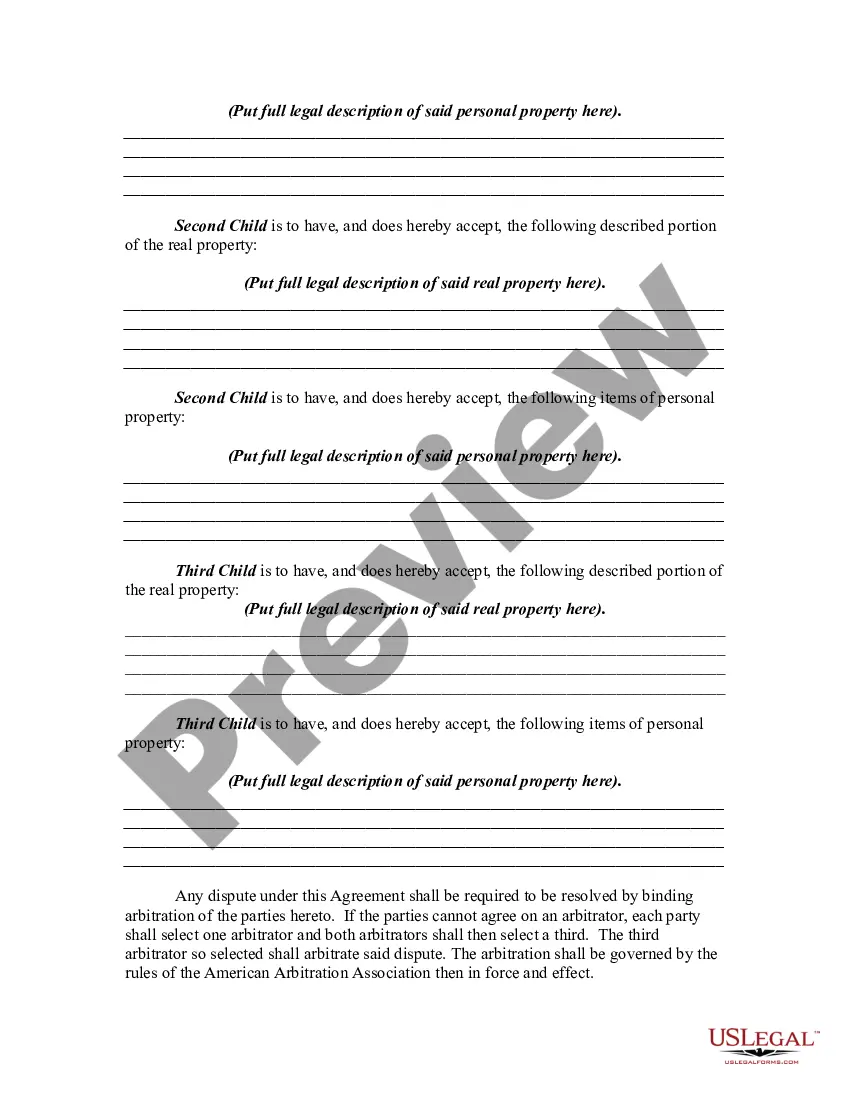

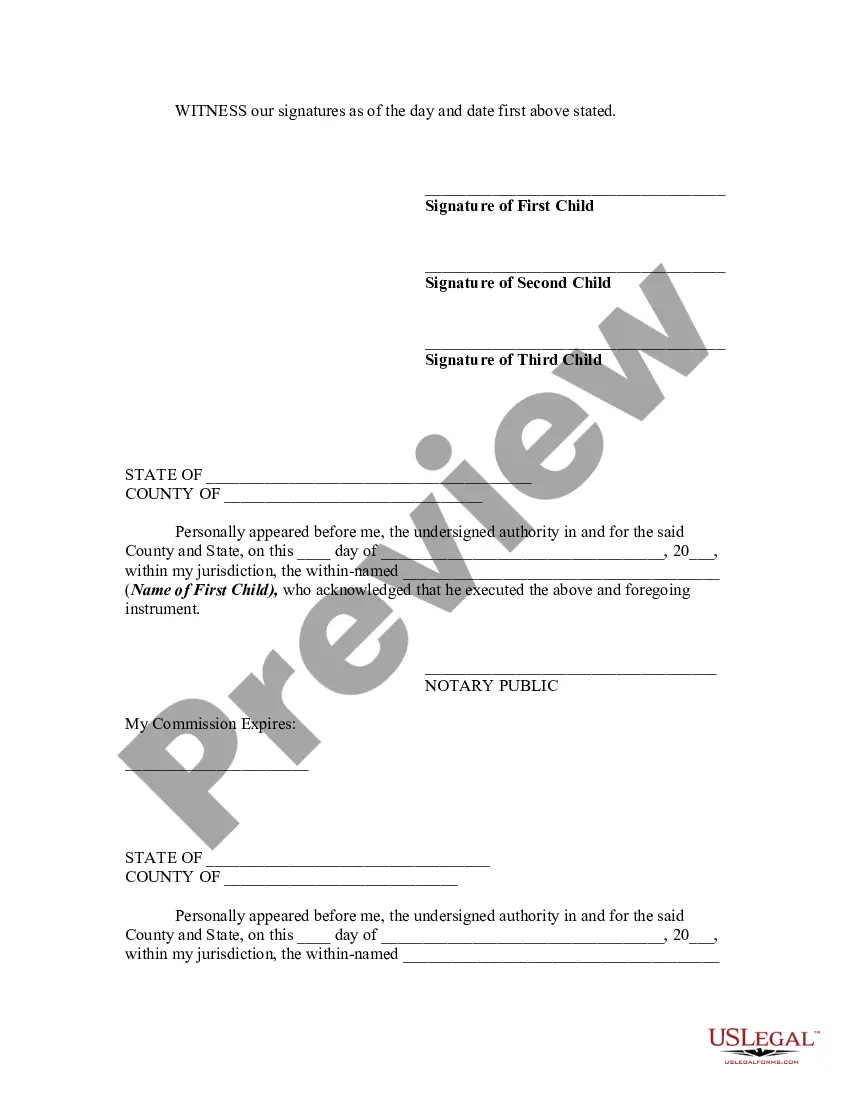

How to fill out Agreement Between Heirs As To Division Of Estate?

Choosing the best legal papers template might be a battle. Naturally, there are plenty of layouts available on the net, but how do you get the legal develop you require? Take advantage of the US Legal Forms web site. The assistance offers a huge number of layouts, such as the Indiana Agreement Between Heirs as to Division of Estate, which can be used for company and private needs. All the forms are inspected by experts and satisfy state and federal demands.

When you are currently signed up, log in for your accounts and click on the Obtain button to have the Indiana Agreement Between Heirs as to Division of Estate. Utilize your accounts to check through the legal forms you have ordered previously. Visit the My Forms tab of the accounts and obtain an additional duplicate of the papers you require.

When you are a brand new end user of US Legal Forms, allow me to share straightforward directions that you should stick to:

- Initial, make certain you have selected the correct develop for the town/area. You can look through the form using the Review button and read the form outline to ensure this is the best for you.

- In the event the develop does not satisfy your expectations, utilize the Seach field to obtain the correct develop.

- When you are positive that the form is suitable, go through the Purchase now button to have the develop.

- Select the costs plan you want and type in the necessary info. Make your accounts and purchase the transaction with your PayPal accounts or bank card.

- Choose the file format and download the legal papers template for your device.

- Complete, modify and printing and sign the acquired Indiana Agreement Between Heirs as to Division of Estate.

US Legal Forms is the largest catalogue of legal forms that you can discover numerous papers layouts. Take advantage of the service to download appropriately-made papers that stick to express demands.

Form popularity

FAQ

While the timeline can greatly vary, it typically ranges from several months to over a year, depending largely on factors like the size and complexity of the estate, the clarity of the will, and whether or not the probate process is contested.

Joint Tenancy With a Right of Survivorship A deed that lists joint tenants with the "right of survivorship" avoids the probate process. Without a "right of survivorship" clause, other family members could inherit the deceased person's share. The surviving spouse could co-own the home with other family members.

Indiana allows for small estate exceptions, where any estate valued at less than $50,000 can avoid the probate process. There are specific details regarding property in real estate though, so you need to make sure you fully understand the process here.

Even without a statutory guideline on executor fees in Indiana, the common understanding among legal professionals suggests that an executor can expect to receive about 2-5% of the estate's value. However, this percentage can vary based on the specifics of the estate and the executor's duties.

In Indiana, smaller estates can escape the need to go through probate. If a person's estate is worth less than $50,000, it may not be necessary. Affidavits must be filed, however, swearing to this.

Transfer-On-Death (TOD) assets. Indiana residents can use a transfer-on-death form to name beneficiaries for vehicles, securities, and real estate to bypass probate. Cars, small boats, stocks, bonds, brokerage accounts, land, and houses all qualify.

Who Gets What in Indiana? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no descendants or parentsspouse inherits everythingspouse and descendants from you and that spousespouse inherits 1/2 of your intestate property descendants inherit 1/2 of your intestate property5 more rows

Beneficiaries May Request an Accounting There are situations when a beneficiary will request that the executor or trustee provide an accounting. This may be a formal or informal accounting, depending on the request. Regardless, the fiduciary has a responsibility to provide an accounting when requested.

Any estate worth more than $50,000 is subject to probate in Indiana.