Agency is a relationship based on an agreement authorizing one person, the agent, to act for another, the principal. An agency can be created for the purpose of doing almost any act the principal could do. In this form, a person is being given the authority to collect money for a corporation, the principal.

Indiana Notice to Debtor of Authority of Agent to Receive Payment

Description

How to fill out Notice To Debtor Of Authority Of Agent To Receive Payment?

If you intend to finalize, acquire, or create sanctioned document templates, utilize US Legal Forms, the most extensive collection of sanctioned forms, accessible online.

Employ the site’s straightforward and user-friendly search feature to locate the documents you need.

Numerous templates for commercial and individual purposes are organized by categories and claims, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Indiana Notice to Debtor of Authority of Agent to Receive Payment.

Every legal document template you buy is yours permanently. You will have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Finish and obtain, and print the Indiana Notice to Debtor of Authority of Agent to Receive Payment with US Legal Forms. There are countless professional and state-specific forms you can use for your business or individual needs.

- Utilize US Legal Forms to locate the Indiana Notice to Debtor of Authority of Agent to Receive Payment with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the Indiana Notice to Debtor of Authority of Agent to Receive Payment.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you choose the form for the correct city/state.

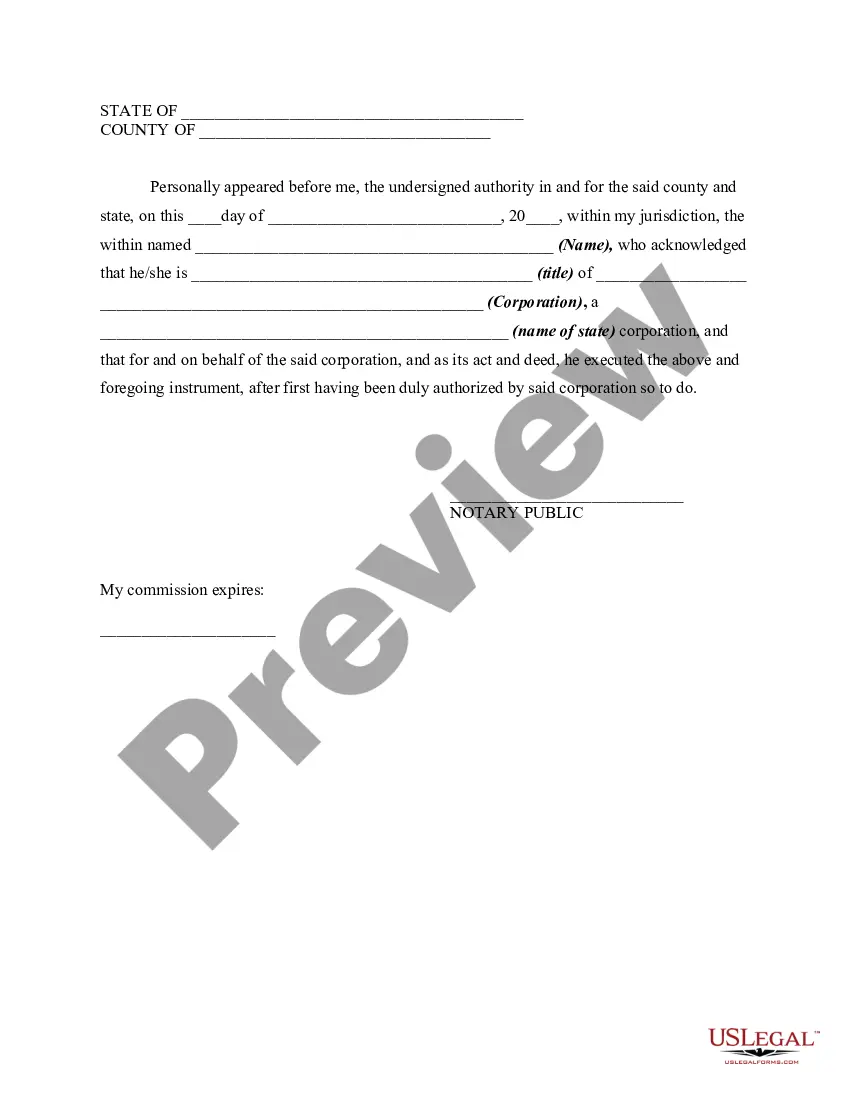

- Step 2. Utilize the Review option to inspect the form’s details. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

Form popularity

FAQ

An executor is generally liable for debts of the estate during the administration process, which can last for several months to a few years. Their responsibility involves settling all claims against the estate before distributing assets to beneficiaries. If you encounter an Indiana Notice to Debtor of Authority of Agent to Receive Payment, it underscores the importance of fulfilling financial responsibilities as an executor. For guidance, US Legal Forms offers tools and resources to help executors manage their duties effectively.

In Indiana, creditors typically have 9 months from the opening of the estate to file claims. This time frame is crucial for ensuring that all debts are settled before the estate can be distributed. If you receive an Indiana Notice to Debtor of Authority of Agent to Receive Payment, it serves as a critical reminder to address these obligations promptly. Utilizing resources from US Legal Forms can help you navigate these processes more efficiently.

Section 32-31-1-6 of the Indiana Code addresses the authority of agents to receive payments on behalf of debtors. It outlines the legal framework for how notices, like the Indiana Notice to Debtor of Authority of Agent to Receive Payment, are issued. Understanding this section can empower you in managing your financial obligations effectively. Consider consulting a legal professional for clarity on this code and how it may affect your estate.

Creditors can pursue claims against an estate for a limited time, which usually lasts for 3 to 12 months after the estate is opened. This timeline can vary based on specific circumstances, so it is critical to understand your rights as a debtor. If you have received an Indiana Notice to Debtor of Authority of Agent to Receive Payment, it likely indicates that creditors are actively seeking payment. Make sure you respond promptly to avoid potential complications.

Section 29(1), 7, 23 of the Indiana Code addresses specific stipulations regarding transactional and financial obligations among parties. Though the details can get technical, the essence lies in clarifying obligations and rights among debtors and creditors. If you encounter an Indiana Notice to Debtor of Authority of Agent to Receive Payment, familiarity with this section may provide you with valuable insights into your situation.

In Indiana, a surviving spouse does not automatically inherit everything, but they do have significant rights regarding the estate. The distribution depends on whether the deceased left a will and how many surviving heirs there are. Understanding these rights can be pivotal, especially when considering an Indiana Notice to Debtor of Authority of Agent to Receive Payment during the estate settlement process.

In Indiana, creditors typically have a limited time frame of three months to file a claim against an estate from the date of the notice. This deadline is crucial because it affects a creditor's ability to collect any debts owed. For those managing estates, being aware of timelines associated with the Indiana Notice to Debtor of Authority of Agent to Receive Payment can streamline the process of settling outstanding obligations.

Indiana Code 32 17 11 29 discusses the requirements for notices related to the rights and obligations of debtors and creditors. This code emphasizes the importance of clear communication about financial responsibilities. For anyone receiving an Indiana Notice to Debtor of Authority of Agent to Receive Payment, understanding this code can clarify your rights and obligations, making it easier to manage your payments.

Indiana Code Title 23 focuses on the regulation of various businesses and professions within the state, including financial and corporate entities. This title helps maintain standards and ensure compliance within industries. If you are dealing with financial transactions, having knowledge of Title 23 is beneficial, especially when it relates to notices like the Indiana Notice to Debtor of Authority of Agent to Receive Payment.

Indiana Code 32 17 14 23 outlines the requirements and processes for notifying debtors about the designation of an agent to accept payments. This provision is crucial as it ensures that the debtor is aware of who can legally accept their payments, thereby preventing any confusion. Understanding this code can help you navigate financial obligations, especially if you receive an Indiana Notice to Debtor of Authority of Agent to Receive Payment.