Indiana Consulting Agreement - with Former Shareholder

Description

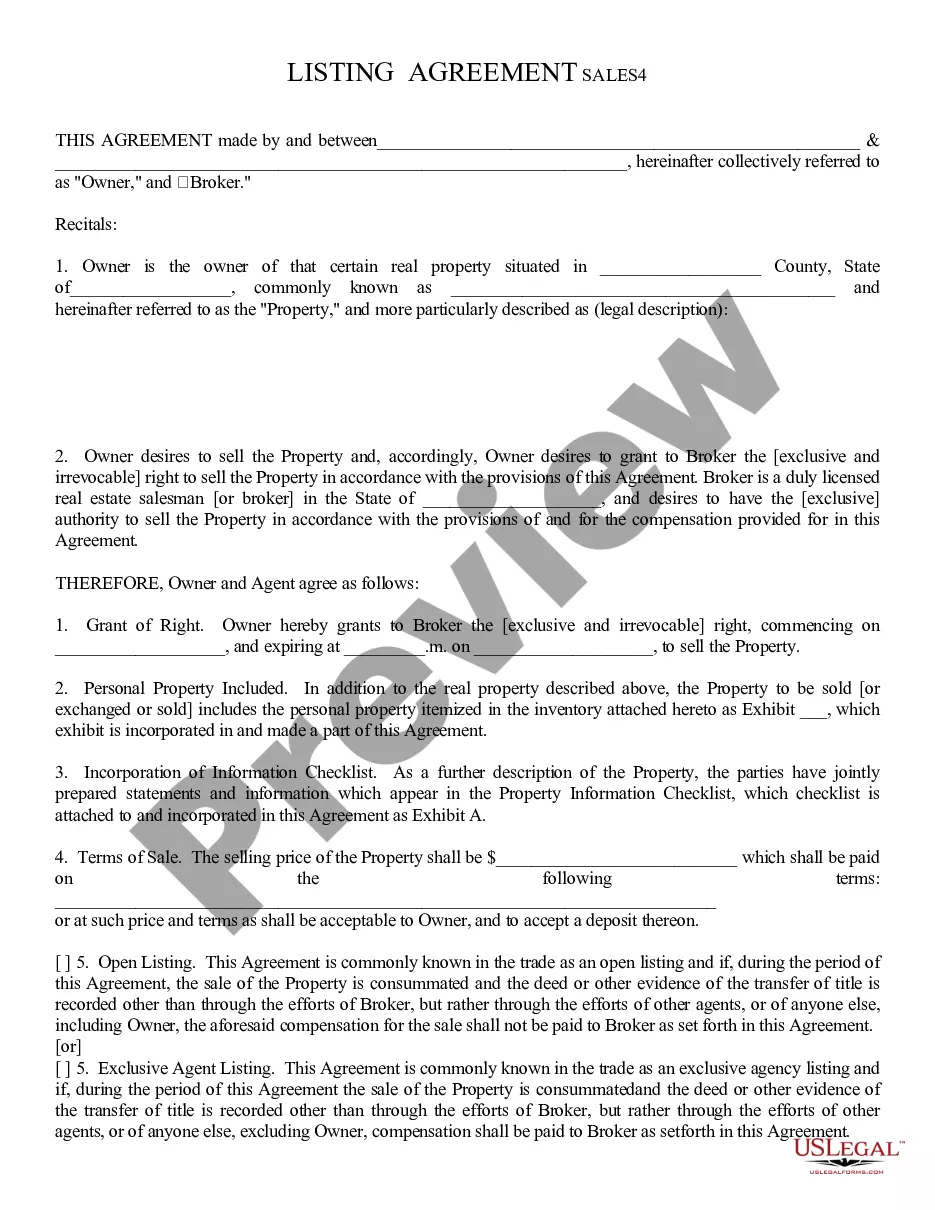

How to fill out Consulting Agreement - With Former Shareholder?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords.

You can find the latest editions of forms such as the Indiana Consulting Agreement - with Former Shareholder in just moments.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, validate your choice by clicking on the Get now button. Then, select your preferred pricing plan and provide your details to create an account.

- If you currently hold a monthly subscription, Log In to retrieve the Indiana Consulting Agreement - with Former Shareholder from your US Legal Forms library.

- The Acquire button will appear on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click on the Review button to examine the form’s content.

Form popularity

FAQ

All LLCs and corporations operating in Indiana must file a business entity report annually. This requirement helps maintain accurate records and ensures compliance with state regulations. If you are unfamiliar with the process, using resources like uslegalforms to create an Indiana Consulting Agreement - with Former Shareholder can streamline your operations and compliance.

Yes, Indiana does allow for the formation of single-member LLCs. This structure allows individuals to enjoy the benefits of limited liability while maintaining complete control over the business. If you are moving forward with a single-member LLC, consider drafting an Indiana Consulting Agreement - with Former Shareholder to ensure clear policies and practices.

If an operating agreement is not signed, your LLC may default to the state's statutory rules. This situation can lead to misunderstandings and disputes among members since roles and responsibilities may not be explicitly defined. Creating an Indiana Consulting Agreement - with Former Shareholder will provide your LLC an essential framework to avoid these issues.

Yes, registering your business with the Indiana Secretary of State is necessary for formal recognition. This registration ensures your LLC operates legally and helps maintain compliance with state requirements. Additionally, crafting an Indiana Consulting Agreement - with Former Shareholder can bolster your business's credibility and operations.

While Indiana law does not strictly require LLCs to have an operating agreement, it is highly recommended. An operating agreement helps define ownership, management structure, and operational procedures, which can prevent disputes later. By preparing an Indiana Consulting Agreement - with Former Shareholder, you protect your interests and clarify expectations among members.

Yes, you can write your own operating agreement for your LLC in Indiana. However, it's essential to ensure that your document clearly outlines the roles, responsibilities, and agreements among members. Using a well-structured template, such as those offered by uslegalforms, can help you create an Indiana Consulting Agreement - with Former Shareholder that meets legal standards.

While Indiana does not mandate an operating agreement for all businesses, having one is highly recommended. An operating agreement can clarify the management structure and operational procedures of your business. If you're entering into an Indiana Consulting Agreement - with Former Shareholder, consider drafting an operating agreement to ensure all aspects of your business relationship are well-defined and agreed upon.

A consulting agreement is indeed a type of contract, but not all contracts are consulting agreements. Specifically, an Indiana Consulting Agreement - with Former Shareholder outlines the terms and responsibilities specific to consultancy, helping to define the business relationship clearly. It serves as a formal document that both parties can rely on.

Yes, there is a distinction between a contract and an agreement. A contract is a legally enforceable agreement, while an agreement may not always carry legal weight. For an Indiana Consulting Agreement - with Former Shareholder, you ensure both parties understand their obligations clearly, which is crucial for drafting a solid contract.

A Master Services Agreement (MSA) in consulting is a contract that outlines the general terms and conditions between parties engaging in multiple projects. It establishes basic guidelines, helping streamline future agreements without renegotiating terms each time. This can be particularly advantageous in maintaining long-term relationships while providing flexibility for future consulting engagements.