Indiana International Wholesale Agreement (Online Seller)

Description

How to fill out International Wholesale Agreement (Online Seller)?

If you want to be thorough, download, or create legally recognized document templates, utilize US Legal Forms, the most extensive range of legal forms, available online.

Utilize the site’s straightforward and convenient search to find the documents you need. Numerous templates for business and personal use are organized by categories and states or keywords.

Use US Legal Forms to obtain the Indiana International Wholesale Agreement (Online Seller) in just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access every form you obtained in your account. Check the My documents section and select a form to print or download again.

Complete and download, and print the Indiana International Wholesale Agreement (Online Seller) with US Legal Forms. There are countless professional and state-specific templates available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to retrieve the Indiana International Wholesale Agreement (Online Seller).

- You can also find forms you previously acquired in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for the correct city/state.

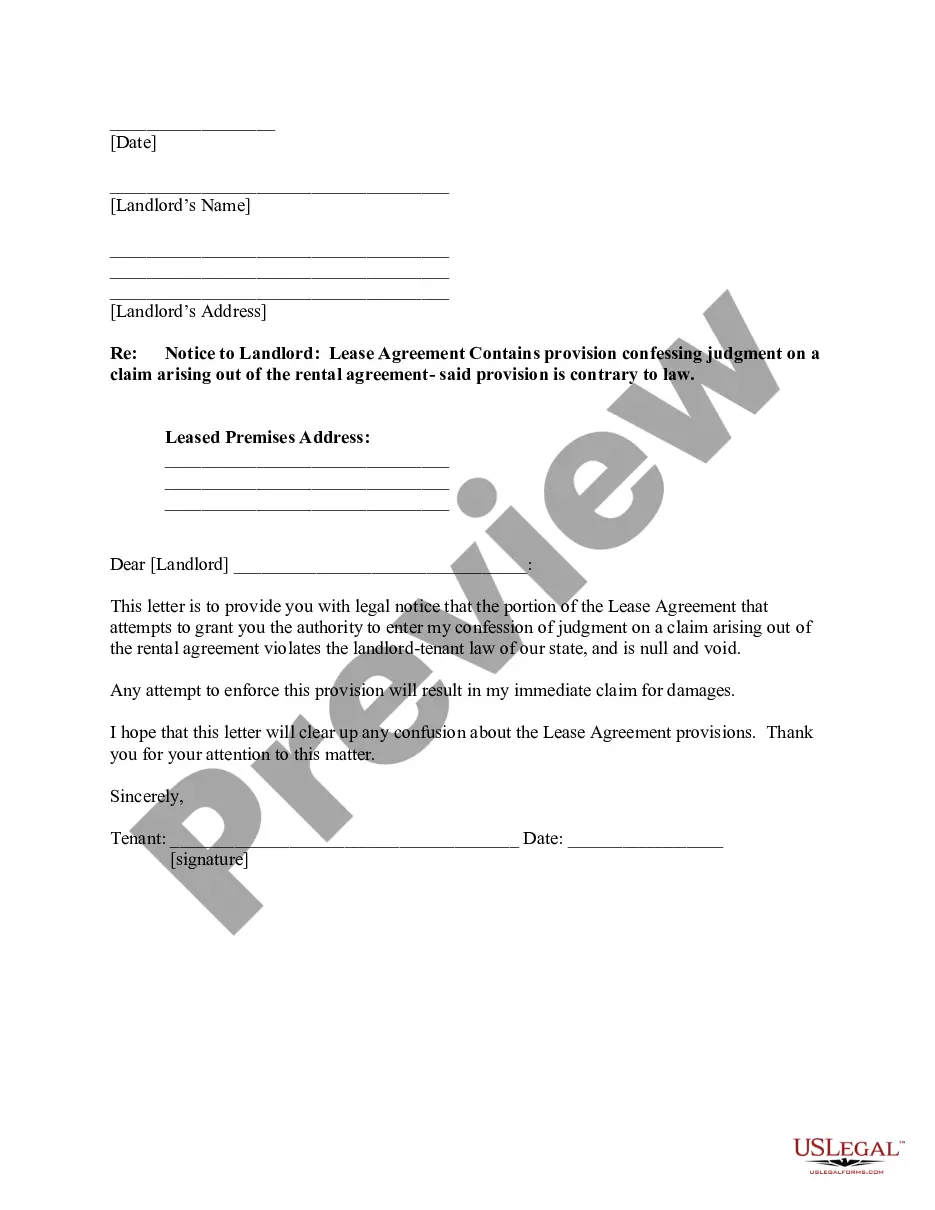

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the summary.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the page to find other versions of the legal form template.

- Step 4. Once you find the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Indiana International Wholesale Agreement (Online Seller).

Form popularity

FAQ

RECIPROCAL AGREEMENT STATES They are Kentucky, Michigan, Ohio, Pennsylvania, and Wisconsin. All salaries, wages, tips, and commissions earned in these states by an Indiana resident must be reported as if they were earned in Indiana.

What to Include In A Distributorship Agreement?Exclusive Distributor.Terms And Conditions Of Sale.Pricing.Term Of The Agreement.Marketing rights.Trademark licensing.The geographical territory covered by the agreement.Performance.More items...

Indiana Tax NexusGenerally, a business has nexus in Indiana when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.

If your business sells goods or tangible personal property, you'll need to register to collect a seven percent sales tax. This registration allows you to legally conduct retail sales in the state of Indiana.

Generally, purchases of tangible personal property, accommodations, or utilities made directly by Indiana state and local government entities are exempt from sales tax.

Yes. An out of state vendor may voluntarily register to collect Indiana sales tax even if they do not have a physical presence in Indiana or meet either of the economic nexus thresholds.

The Indiana Department of Revenue is set to start enforcing a law passed in 2017 on Oct. 1. If you buy products online from out-of-state companies, you'll be charged the state's 7 percent sales tax. The law lets the state collect the sales tax from online retailers even if they don't have a physical store in Indiana.

Indiana Tax NexusGenerally, a business has nexus in Indiana when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.