Indiana Employment Order (Chapter 11 Only) is a legal remedy available to employers in the state of Indiana which allows them to place an order with the state's Department of Workforce Development to garnish wages from a delinquent employee. This order is most commonly used when an employee has failed to pay a court-ordered debt, such as child support or other court-ordered financial obligations. This order allows an employer to withhold wages from an employee's paycheck and send them directly to the recipient of the order. The two main types of Indiana Employment Order (Chapter 11 Only) are Non-Voluntary and Voluntary. Non-Voluntary orders are typically issued by a court and are not negotiable. Voluntary orders, on the other hand, are agreements between an employer and an employee which allow the employer to garnish wages from the employee's paycheck in order to satisfy a debt. In either case, the employer must comply with the order and send the withheld wages directly to the recipient of the order.

Indiana Employment, Order (Chapter 11 Only)

Description

How to fill out Indiana Employment, Order (Chapter 11 Only)?

How much time and resources do you typically allocate for drafting formal documentation.

There’s a more advantageous option for obtaining such forms than employing legal professionals or spending countless hours searching the internet for an appropriate template.

Another advantage of our library is that you can access previously obtained documents that you securely store in your profile in the My documents tab. Retrieve them at any time and redo your paperwork as often as necessary.

Conserve time and effort managing official documents with US Legal Forms, one of the most reliable online services. Join us today!

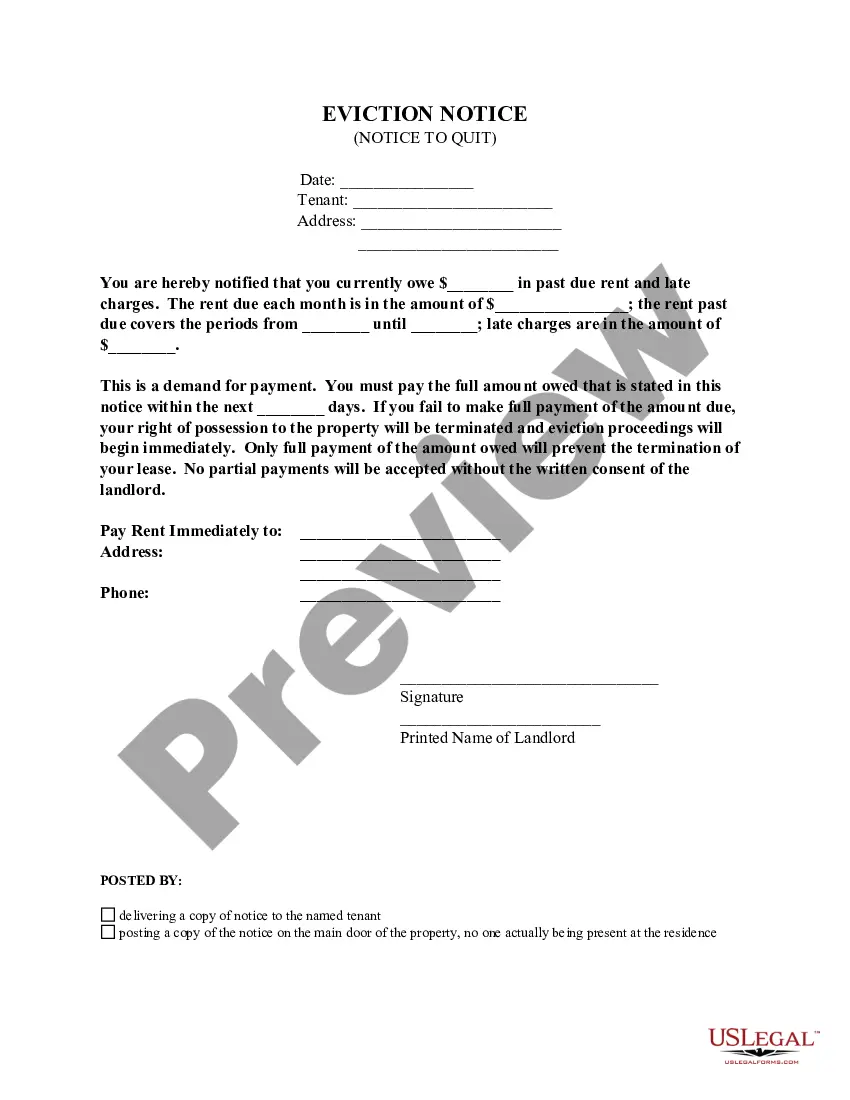

- Browse the form content to ensure it aligns with your state regulations. To do this, review the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, locate another one using the search tab at the top of the page.

- If you already possess an account with us, Log In and retrieve the Indiana Employment, Order (Chapter 11 Only). If not, continue to the next steps.

- Click Buy now once you identify the correct document. Choose the subscription plan that best fits you to access our library's complete services.

- Create an account and pay for your subscription. You can process the transaction with your credit card or via PayPal—our service is entirely secure for this.

- Download your Indiana Employment, Order (Chapter 11 Only) to your device and complete it on a printed hard copy or digitally.

Form popularity

FAQ

Investors should understand that existing shares of common stock in a company filing for Chapter 11 usually are canceled, even if the company emerges and returns to profitability. Also, keep in mind that stockholders will not receive dividends during a bankruptcy proceeding.

Chapter 11 Many employees may remain at work and continue to be paid and receive benefits. However, some may be laid off. If the laid-off employees are owed wages and benefits they become creditors of the company.

Chapter 11 bankruptcy is a legal process in the United States whereby a failing business can be protected from creditors while it reorganizes its debts and operations. This allows a business to continue operating while it works on a plan to repay its creditors and future operations.

There are no specified limits on the length of a Chapter 11 plan. A Chapter 11 plan must be long enough to convince the court and creditors that the debtor is making a good faith effort to pay as much of its debt as is realistically possible.

The most commonly sought exceptions are actions by parties to securities contracts to close out open positions; eviction of a debtor by a landlord where the lease has been fully terminated prior to the bankruptcy filing; actions by taxing authorities to conduct tax audits, issue deficiency notices, demand tax returns

In a Chapter 11 bankruptcy proceeding, if a company or individual filer (the ?debtor?) is unable to pay its creditors in full, the absolute priority rule bars owners from retaining their interests unless the owners contribute ?new value? to the business.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

In a Chapter 11 bankruptcy or ?reorganization,? the employer remains in business and tries to reorganize and emerge from bankruptcy as a financially sound company. Many employees may remain at work and continue to be paid and receive benefits.