Indiana Assignment to Living Trust

What is this form?

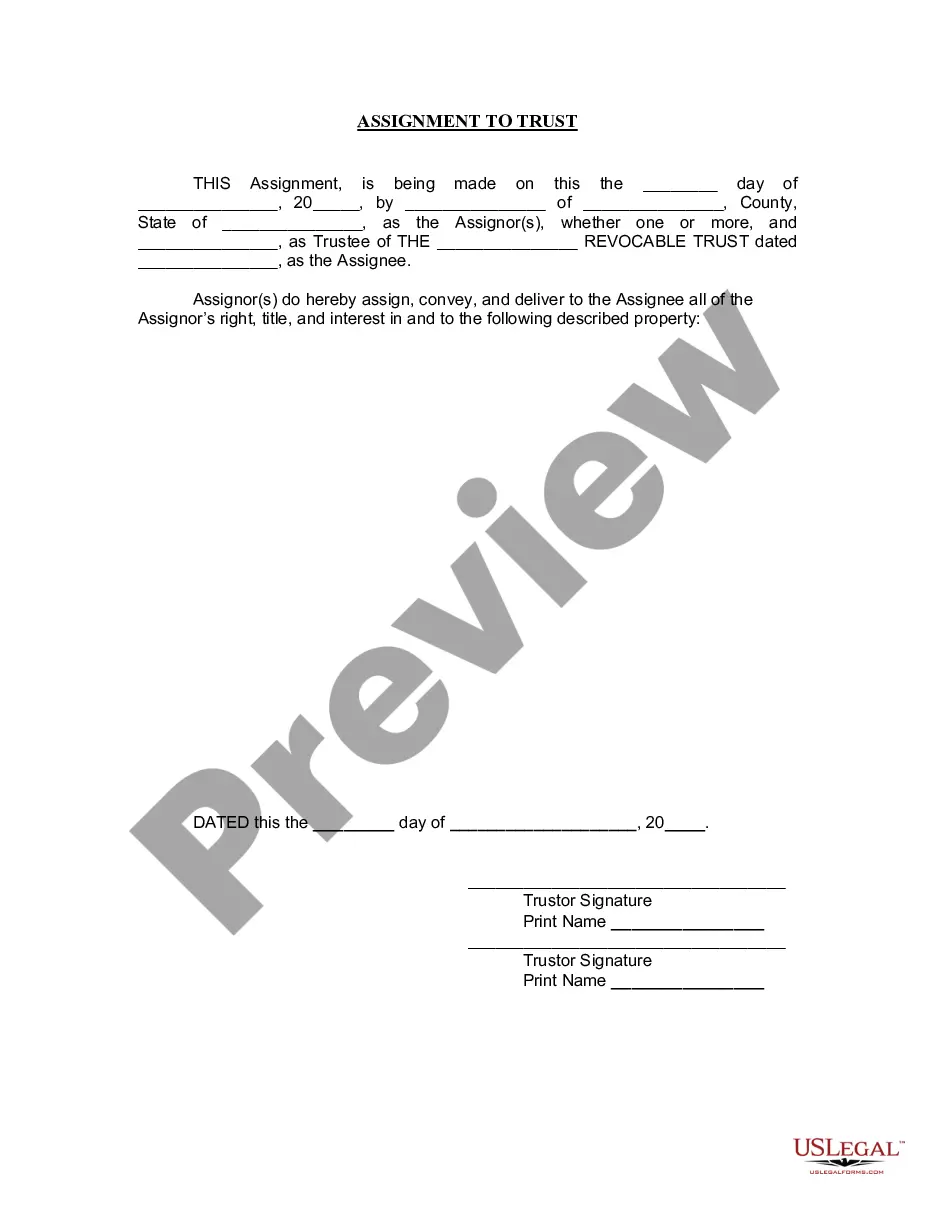

The Assignment to Living Trust form allows a person to assign their rights and interests in specific property to a living trust. A living trust is a legal entity created during a person's lifetime, designed to hold and manage assets, typically for estate planning purposes. This form is essential for formalizing the transfer of property into the trust, distinguishing it from other property transfer documents.

Key parts of this document

- Assignment Date: The date on which the assignment is made.

- Assignor Information: The name and address of the person assigning the property.

- Trustee Information: The name of the trustee responsible for managing the trust.

- Trust Name: The specific name of the revocable trust being assigned to.

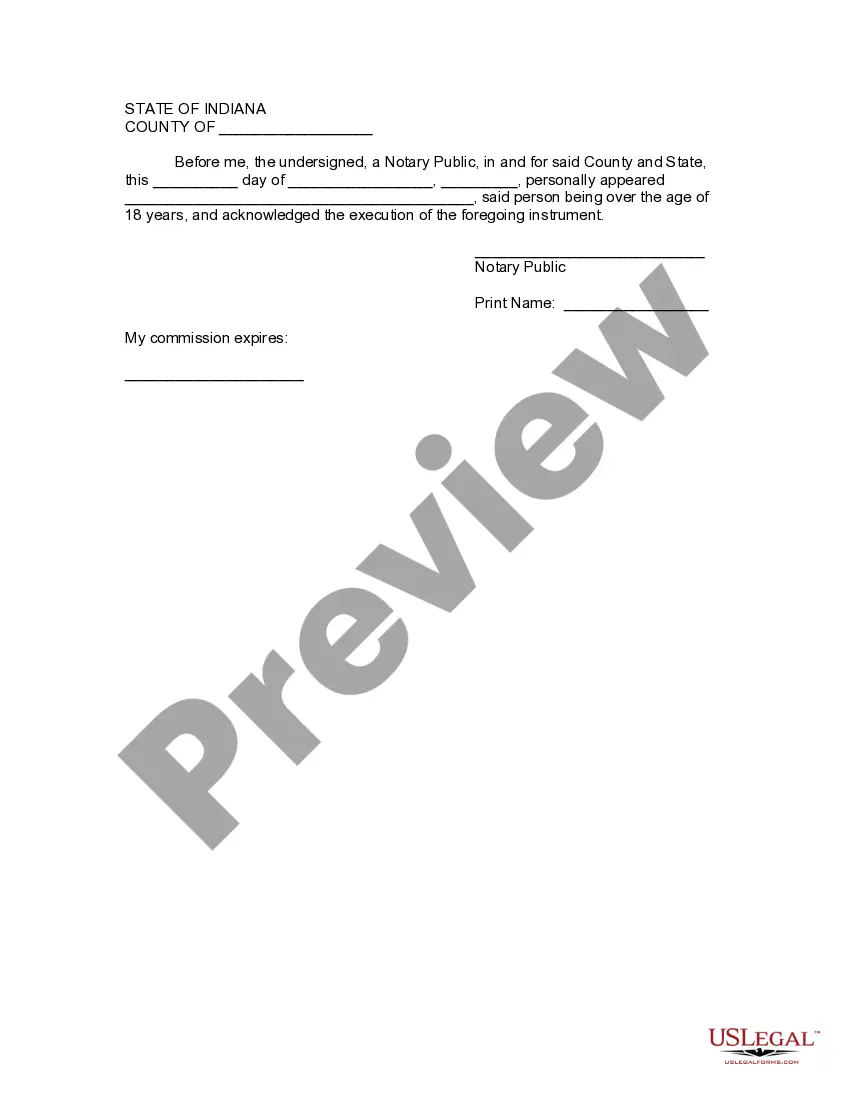

- Notary Statement: A section that requires notarization of the document for legal validity.

When to use this document

This form is used when an individual wishes to transfer ownership of specific property, such as real estate or personal belongings, into a living trust. It is often utilized during the estate planning process to ensure that assets are managed according to the individualâs wishes while avoiding probate after death.

Who should use this form

- Individuals who have created a living trust and want to assign property to it.

- Estate planners assisting clients with transferring assets into a trust.

- Property owners looking to streamline the management of their assets for estate purposes.

Completing this form step by step

- Identify the assignment date at the top of the form.

- Enter the full legal name and address of the Assignor.

- Specify the name of the Trustee and the name of the Living Trust.

- Fill in the date and location for the notarization section.

- Have the Assignor sign the document in front of a notary public.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to sign the document before a notary.

- Inaccurately filling in the Assignor or Trustee information.

- Omitting the date of the assignment or the trust's details.

Benefits of completing this form online

- Convenience: Download and fill out the form at your own pace.

- Editability: Easily modify the form for specific needs before finalizing it.

- Reliability: Access forms drafted by licensed attorneys to ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.