Indiana 51574- Articles of Entity Conversion: Conversion of A Corporation Into A Limited Liability is a process by which a corporation is converted into a limited liability company or LLC. This process is used in Indiana under Indiana Code Title 23, Chapter 1, Article 15, Section 51574. The process involves filing Articles of Entity Conversion with the Indiana Secretary of State, which contains basic information about the corporation and the LLC, such as the names, addresses, and purpose of the entity. This process is beneficial for businesses that want to take advantage of the advantages of the LLC structure such as limited liability, tax benefits, and flexible management options. There are two types of Indiana 51574- Articles of Entity Conversion: conversion of a Domestic Corporation into a Domestic LLC and conversion of a Foreign Corporation into a Domestic LLC.

Indiana 51574- Articles of Entity Conversion: Conversion of A Corporation Into A Limited Liability

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana 51574- Articles Of Entity Conversion: Conversion Of A Corporation Into A Limited Liability?

If you are searching for a method to adequately prepare the Indiana 51574- Articles of Entity Conversion: Transformation of A Corporation Into A Limited Liability without enlisting a legal expert, then you are exactly in the right place.

US Legal Forms has established itself as the most comprehensive and dependable repository of formal templates for every personal and business situation. Each document you find on our online platform is crafted in accordance with national and state regulations, ensuring that your paperwork is organized correctly.

Another fantastic aspect of US Legal Forms is that you will never lose the documents you have purchased - you can access any of your downloaded templates in the My documents section of your profile whenever needed.

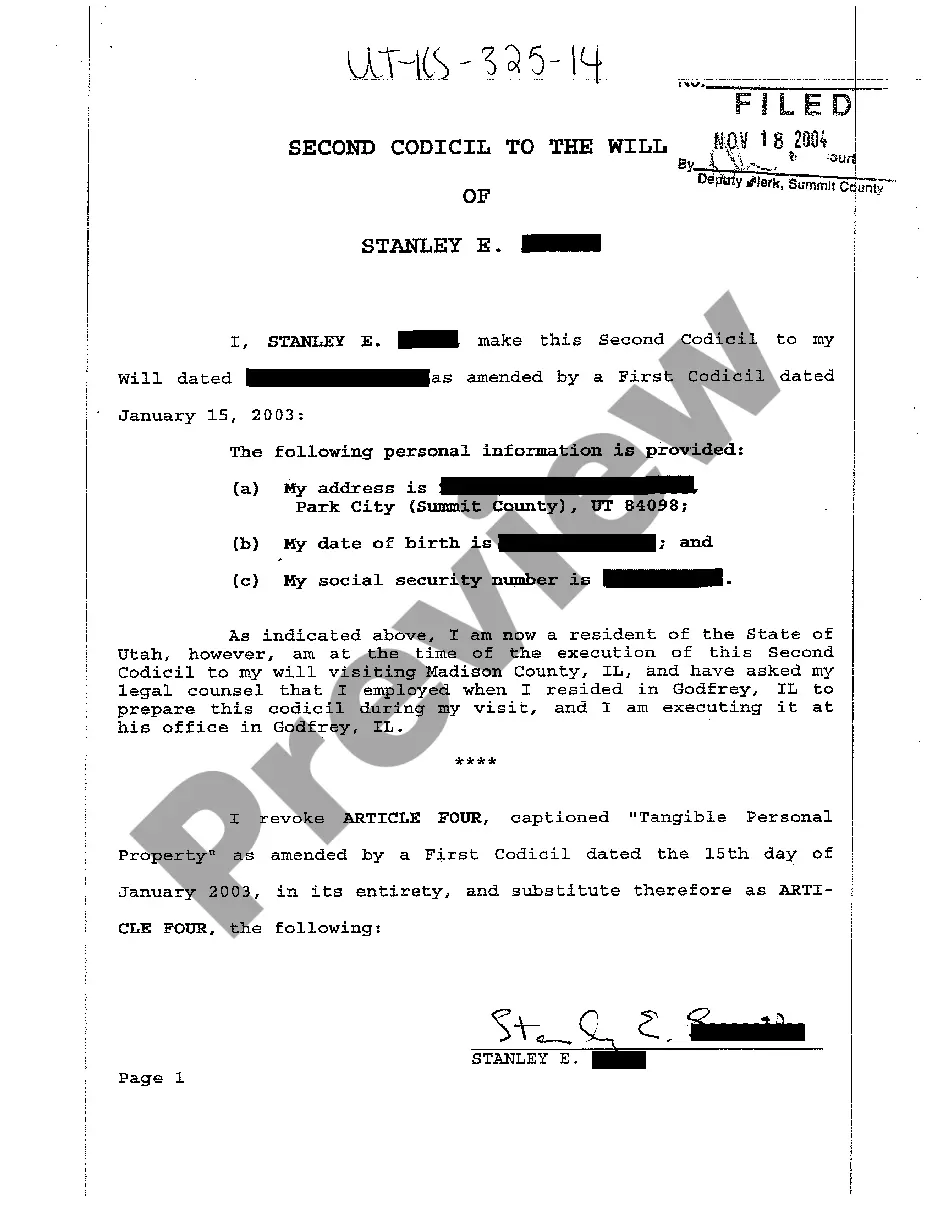

- Verify that the document displayed on the page aligns with your legal needs and state regulations by examining its text description or exploring the Preview mode.

- Input the document title in the Search tab at the top of the page and choose your state from the list to locate an alternative template in case of any discrepancies.

- Repeat the content validation process and click Buy now when you feel assured about the paperwork meeting all requirements.

- Log in to your account and select Download. Register for the service and choose a subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be accessible for download immediately afterward.

- Decide in which format you wish to save your Indiana 51574- Articles of Entity Conversion: Transformation of A Corporation Into A Limited Liability and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it promptly or print it to prepare your hard copy manually.

Form popularity

FAQ

The Certificate of Conversion, also known as the Articles or Statement of Conversion, is the document that officially puts your business entity conversion into effect. This conversion document includes basic information about both your converting and converted entities.

Three ways to change from one form of entity to another are dissolution/formation, inter-entity merger, and statutory conversion.

File a Certificate of Conversion (Form CONV-1A (PDF)) online at bizfileOnline.sos.ca.gov, by mail, or in person; The filing fee is $150 if a California Corp is involved; and $30 for all others.

This process of changing formal entity types is known as a ?conversion.? A conversion is a statutory transaction in which one type of business entity becomes a different type of business entity?such as an LLC becoming a Limited Partnership.

What is a business conversion? A conversion is a filing that is made with the state of incorporation allowing a company to change from one business type to another.

Change is often required as the business grows. The three key reasons to change the form of your business are tax burdens, corporate governance requirements, and liability protection. Tax Burden.

If the S Corp's assets have increased between the time of the formation of the business and the time of the conversion to an LLC, a capital gain is realized. This means that the shareholders must pay capital gains tax on the amount of that gain.

Converted-Out: The business entity converted to another type of business entity or to the same type under a different jurisdiction as provided by statute. The name of the new entity can be obtained by ordering a copy of the filed conversion document containing the name of the new entity, or by ordering a status report.