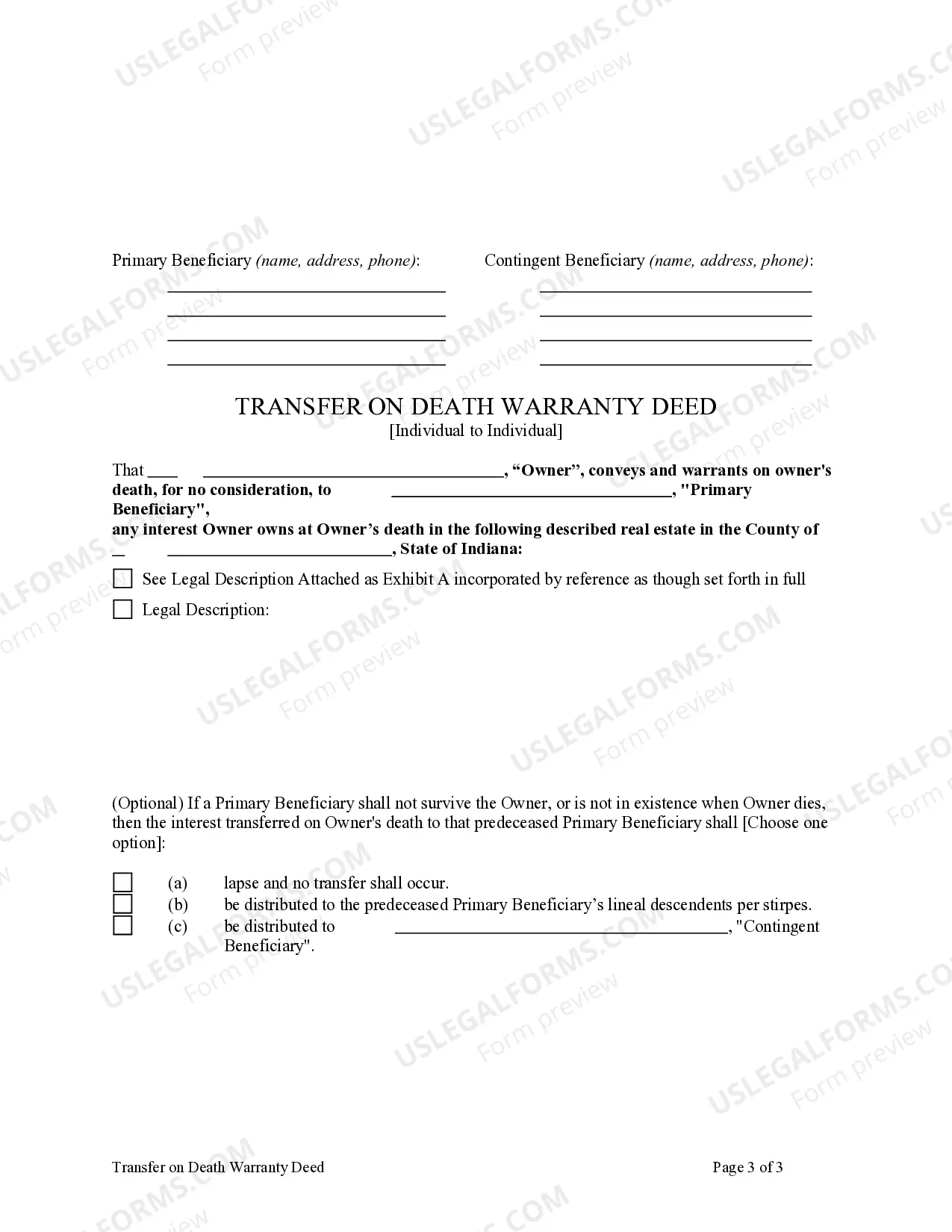

This form is a Beneficiary or Transfer on Death Warranty Deed where the Grantor is an individual and the Grantee is an individual. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. The Deed has provisions for a contingent and a secondary contingent beneficiary. This deed complies with all state statutory laws.

Indiana Beneficiary Transfer on Death Warranty Deed from Individual to Individual

Description

Definition and meaning

The Indiana Beneficiary Transfer on Death Warranty Deed from Individual to Individual is a legal document that allows an individual, referred to as the "Owner," to transfer their property to a designated beneficiary upon their death without the need for probate. This deed ensures that the property will pass directly to the beneficiary, making the process smoother and quicker for the recipients.

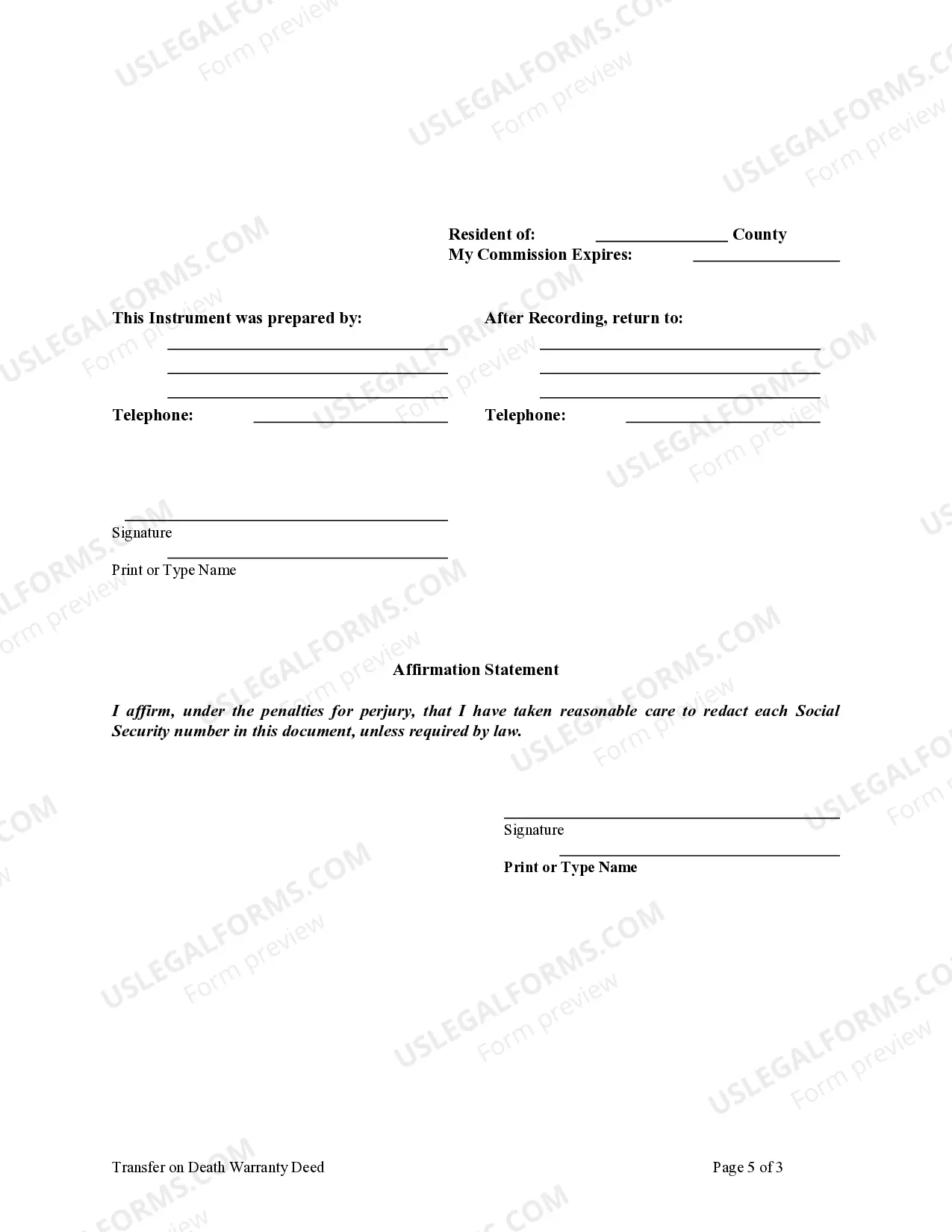

How to complete a form

To fill out the Indiana Beneficiary Transfer on Death Warranty Deed, you should:

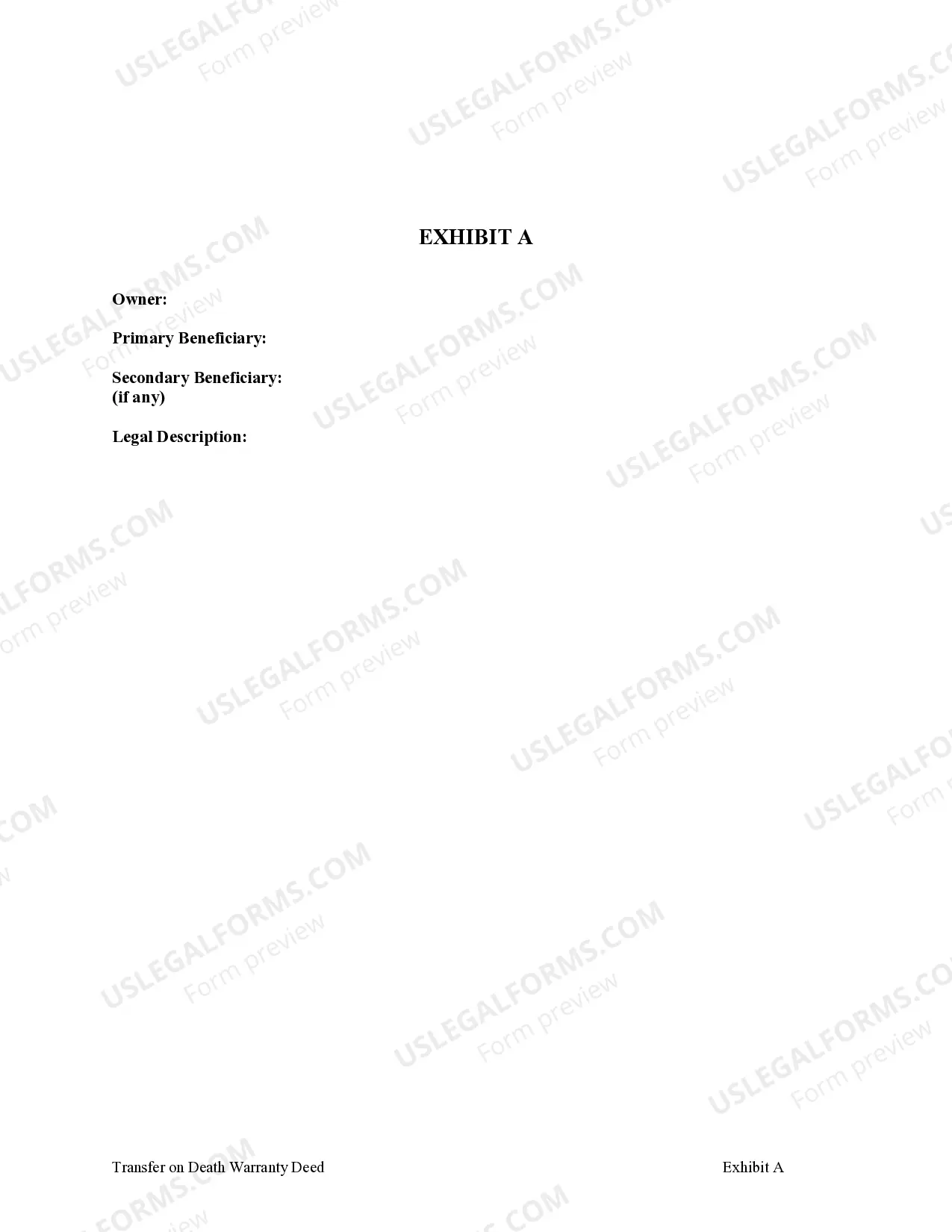

- Enter the Owner's name and the Primary Beneficiary's name.

- Provide the legal description of the property, which can be obtained from local tax records.

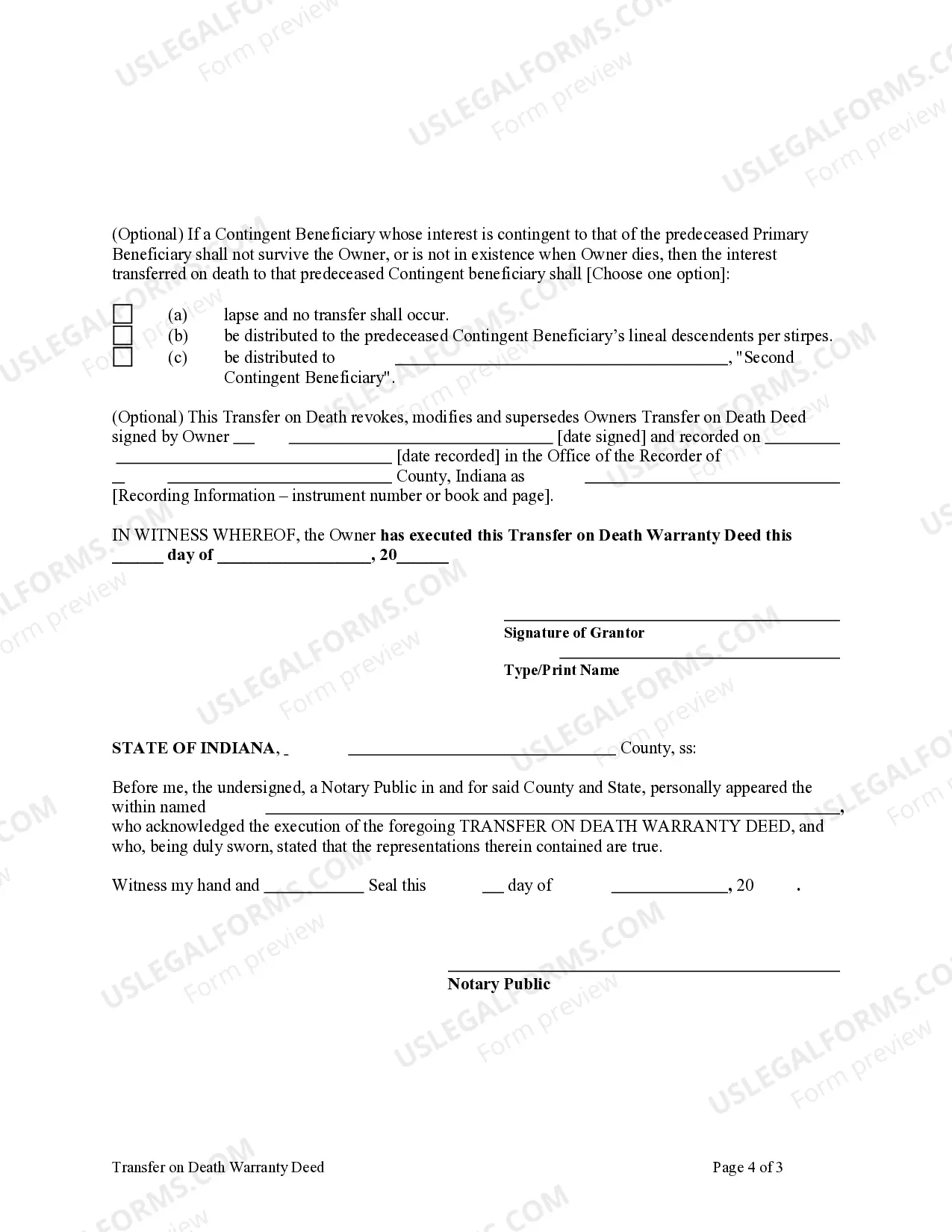

- Choose the option for contingent beneficiaries if applicable.

- Sign the document in the presence of a Notary Public.

Make sure to review the completed form for accuracy before submitting it.

Who should use this form

This form is suitable for individuals who wish to ensure their property is transferred to a specified individual or individuals after their death, without going through probate. It is particularly beneficial for property owners in Indiana who want to simplify the transfer of their assets and avoid potential legal complications for their heirs.

Key components of the form

The key components of the Indiana Beneficiary Transfer on Death Warranty Deed include:

- The name and contact information of the Owner.

- The name and contact information of the Primary Beneficiary.

- A legal description of the property being transferred.

- Options for contingent beneficiaries.

- A notarization section to validate the deed.

Common mistakes to avoid when using this form

When completing the Indiana Beneficiary Transfer on Death Warranty Deed, users often make the following mistakes:

- Failing to include a complete legal description of the property.

- Not having the form notarized, which is required for it to be valid.

- Not clearly identifying all beneficiaries, including contingent beneficiaries.

- Providing incorrect or outdated contact information for the beneficiaries.

What to expect during notarization or witnessing

During the notarization process, you will need to present a valid form of identification to the Notary Public. The Notary will verify your identity and witness your signature on the form. They will then complete their portion of the document, marking it as officially notarized. Be prepared to answer any questions they may have regarding the document and its contents.

How to fill out Indiana Beneficiary Transfer On Death Warranty Deed From Individual To Individual?

Searching for Indiana Beneficiary Transfer on Death Warranty Deed from Individual to Individual templates and completing them can be a daunting task.

To conserve a great deal of time, expenses, and effort, utilize US Legal Forms to discover the appropriate sample specifically for your state in just a few clicks.

Our attorneys prepare every document, so you only need to complete them. It's that simple.

Choose your plan on the pricing page and set up an account. Indicate if you prefer to pay via credit card or PayPal. Download the template in your desired file format. You can print the Indiana Beneficiary Transfer on Death Warranty Deed from Individual to Individual form or complete it using any online editor. There’s no need to worry about making mistakes, as your template can be utilized and submitted, and printed as many times as needed. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the document.

- All your downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven’t signed up yet, you should create an account.

- Review our comprehensive instructions on how to acquire your Indiana Beneficiary Transfer on Death Warranty Deed from Individual to Individual form in mere minutes.

- To obtain a qualified template, verify its relevance for your state.

- Examine the form using the Preview feature (if it’s offered).

- If there’s a description, read it to understand the details.

- Click on the Buy Now button if you've located what you're looking for.

Form popularity

FAQ

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Discuss the terms of the deed with the new owners. Hire a real estate attorney to prepare the deed. Review the deed. Sign the deed in front of a notary public, with witnesses present. File the deed on public record.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

POST DATE: 8.9. 19. A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

File a petition in probate court. The first step to transferring the property to the rightful new owners is to open up a case in probate court. Petition the court for sale and convey the property to the purchaser. Next, you must petition the court to sell the property.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.