This pamphlet provides an overview on the dissolution of a limited liability company (LLC). Topics included cover the reasons for dissolution, different types of dissolution, and steps needed to dissolve an LLC.

Illinois USLegal Pamphlet on Dissolving an LLC

Description

How to fill out USLegal Pamphlet On Dissolving An LLC?

If you want to be thorough, download, or create official document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Utilize the site's straightforward and convenient search feature to find the documents you require. A range of templates for business and personal purposes are categorized by regions and states, or by keywords.

Use US Legal Forms to locate the Illinois USLegal Pamphlet on Dissolving an LLC in just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to each form you saved in your account. Click on the My documents section and select a form to print or download again.

Complete and download, and print the Illinois USLegal Pamphlet on Dissolving an LLC with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to obtain the Illinois USLegal Pamphlet on Dissolving an LLC.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for the correct area/region.

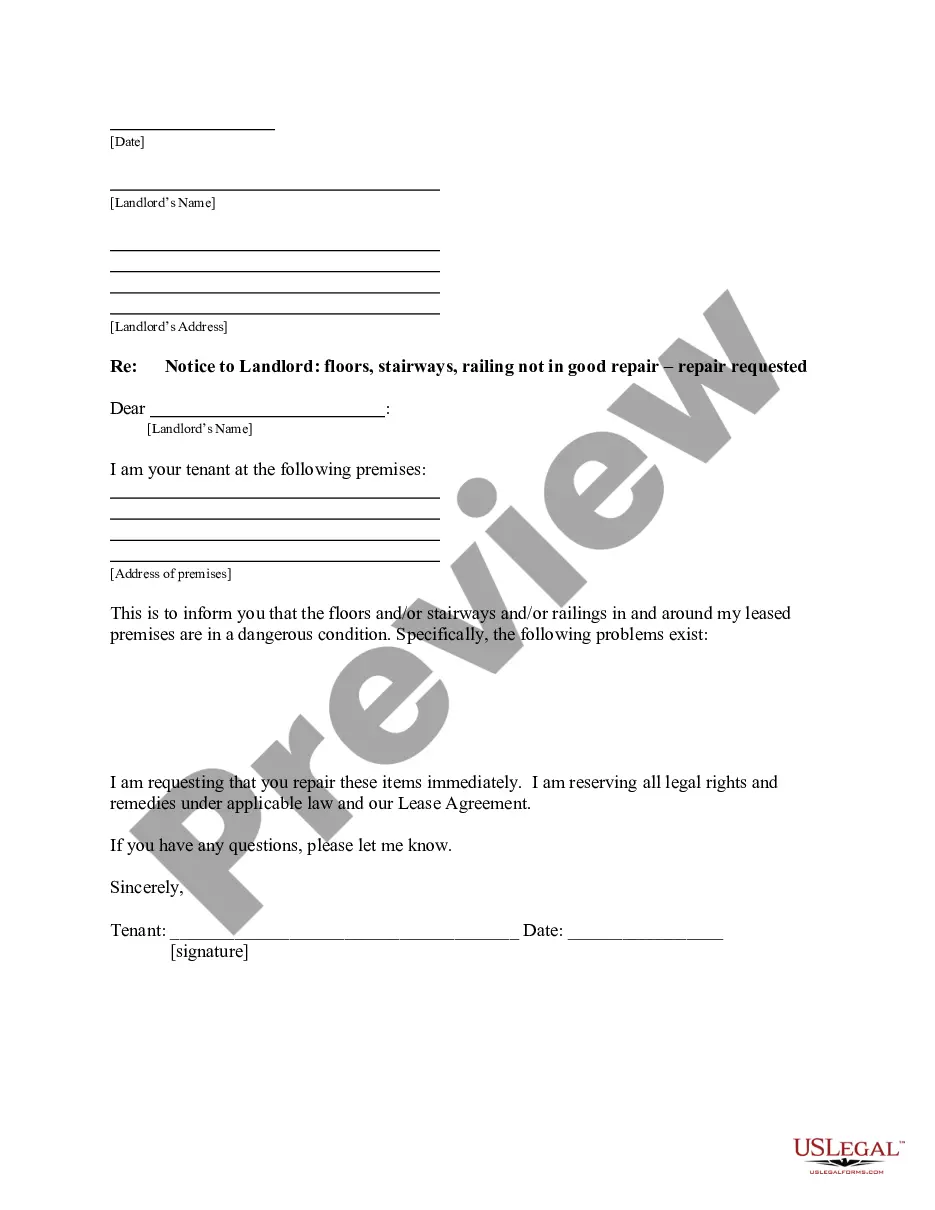

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Illinois USLegal Pamphlet on Dissolving an LLC.

Form popularity

FAQ

To fully dissolve your LLC, you need to follow a series of steps. Start by notifying all members and creditors, then settle any outstanding debts. Next, file the necessary dissolution documents with the state, which you can easily find in the Illinois USLegal Pamphlet on Dissolving an LLC. This guide will provide you with the information needed to ensure a complete and proper dissolution.

To dissolve an LLC in Illinois, begin by filing the appropriate paperwork with the Secretary of State. You must submit the Articles of Dissolution, which can be found in the Illinois USLegal Pamphlet on Dissolving an LLC. Ensure that all outstanding debts and obligations are settled before submitting your dissolution documents. Following these steps will help you complete the process smoothly.

To dissolve/terminate your domestic LLC in Illinois, you must submit the completed form LLC-35-15, Statement of Termination in duplicate to the Illinois Secretary of State by mail or in person along with the filing fee.

An articles of dissolution form (Form BCA 12.20) is available for download from the SOS website. You must submit two copies of the articles. There is a $5 fee to file the articles. Your filing usually will be processed in 7-10 days.

How do you dissolve an Illinois Corporation? To dissolve your corporation in Illinois, you submit in duplicate the completed BCA 12.20, Articles of Dissolution form by mail or in person to the Secretary of State along with the filing fee.

To dissolve an LLC in Illinois, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Illinois LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

Is there a filing fee to dissolve or cancel an Illinois LLC? To dissolve your LLC or corporation in Illinois, there is a $5 filing fee required.

How do you dissolve an Illinois Corporation? To dissolve your corporation in Illinois, you submit in duplicate the completed BCA 12.20, Articles of Dissolution form by mail or in person to the Secretary of State along with the filing fee.

To dissolve/terminate your domestic LLC in Illinois, you must submit the completed form LLC-35-15, Statement of Termination in duplicate to the Illinois Secretary of State by mail or in person along with the filing fee.

Your filing usually will be processed in a week to 10 days. Expedited processing is available for an additional fee by in-person request in Chicago or Springfield. An articles of dissolution form is available for download from the SOS website.