This office lease provision states that the parties desire to allocate certain risks of personal injury, bodily injury or property damage, and risks of loss of real or personal property by reason of fire, explosion or other casualty, and to provide for the responsibility for insuring those risks permitted by law.

Illinois Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant

Description

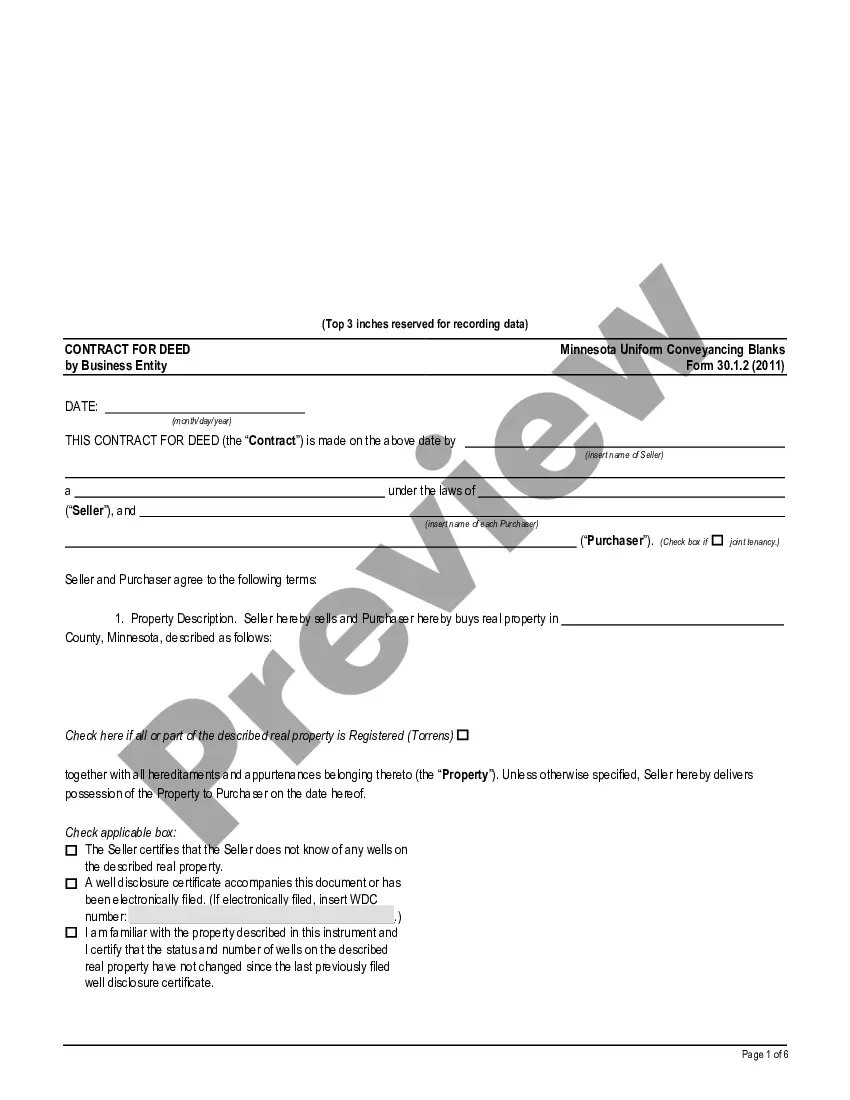

How to fill out Provision Allocation Risks And Setting Forth Insurance Obligations Of Both The Landlord And The Tenant?

If you want to complete, acquire, or produce lawful record web templates, use US Legal Forms, the biggest variety of lawful kinds, which can be found on-line. Take advantage of the site`s simple and hassle-free lookup to discover the files you want. Different web templates for enterprise and individual purposes are categorized by groups and states, or search phrases. Use US Legal Forms to discover the Illinois Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant with a number of click throughs.

When you are previously a US Legal Forms consumer, log in in your profile and then click the Obtain switch to get the Illinois Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant. You may also access kinds you previously downloaded in the My Forms tab of your respective profile.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for your appropriate metropolis/country.

- Step 2. Utilize the Review solution to look through the form`s content. Never overlook to learn the explanation.

- Step 3. When you are not happy using the develop, use the Research field on top of the screen to discover other versions of the lawful develop design.

- Step 4. After you have discovered the form you want, click on the Purchase now switch. Opt for the pricing program you like and add your accreditations to register to have an profile.

- Step 5. Procedure the purchase. You can utilize your credit card or PayPal profile to perform the purchase.

- Step 6. Choose the format of the lawful develop and acquire it on your own system.

- Step 7. Total, modify and produce or indication the Illinois Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant.

Each lawful record design you get is yours permanently. You might have acces to each develop you downloaded within your acccount. Select the My Forms section and choose a develop to produce or acquire once more.

Be competitive and acquire, and produce the Illinois Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant with US Legal Forms. There are thousands of expert and condition-distinct kinds you can utilize for your enterprise or individual requires.

Form popularity

FAQ

Sec. 9.1. (a) Other liens; attachment and satisfaction. Subsequent to the recording of the declaration, no liens of any nature shall be created or arise against any portion of the property except against an individual unit or units.

Sec. 7.28. Tax credit for donation to sponsors. The Authority may administer and adopt rules for an affordable housing tax donation credit program to provide tax credits for donations as set forth in this Section.

Specifically, Section 18.4 of the Illinois Condominium Property Act states that a condominium board must "exercise the care required of a fiduciary of the unit owners." This duty is also set out in the Illinois General Not for Profit Corporation Act.

Generally, ROFRs provide that if an owner receives a bona fide offer to buy its property on terms it wishes to accept, the owner must give the ROFR holder notice of the offer and the opportunity to match it. The ROFR holder has no obligation to match the offer and it can refuse to do so.

HB 5246 ? Document request, deadlines, and fees Starting January 1, 2023, House Bill 5246 will reduce the timeframe for condominium associations in Illinois to provide certain disclosures under Section 22.1 of the Illinois Condominium Property Act (unit resales) from 30 to 10 business days.

(e) "Common Elements" means all portions of the property except the units, including limited common elements unless otherwise specified. (f) "Person" means a natural individual, corporation, partnership, trustee or other legal entity capable of holding title to real property.

4.1. Construction, interpretation, and validity of Condominium Instruments. be deemed to have the meaning specified therein unless the context otherwise requires.

In Illinois, Section 22.1(a) of the Illinois Condominium Property Act describes the information that the owner must obtain from the board for inspection by a prospective purchaser, upon demand, in the event of any resale of a condominium unit by a unit owner other than the developer.