Illinois Petition for Creation of Historic District

Description

How to fill out Petition For Creation Of Historic District?

If you have to complete, download, or print legitimate document themes, use US Legal Forms, the largest variety of legitimate kinds, which can be found on the web. Make use of the site`s basic and hassle-free research to get the paperwork you need. Various themes for enterprise and personal uses are categorized by classes and states, or keywords and phrases. Use US Legal Forms to get the Illinois Petition for Creation of Historic District within a handful of clicks.

Should you be previously a US Legal Forms consumer, log in to the profile and click on the Download button to get the Illinois Petition for Creation of Historic District. You can also accessibility kinds you in the past saved within the My Forms tab of your own profile.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for your correct town/country.

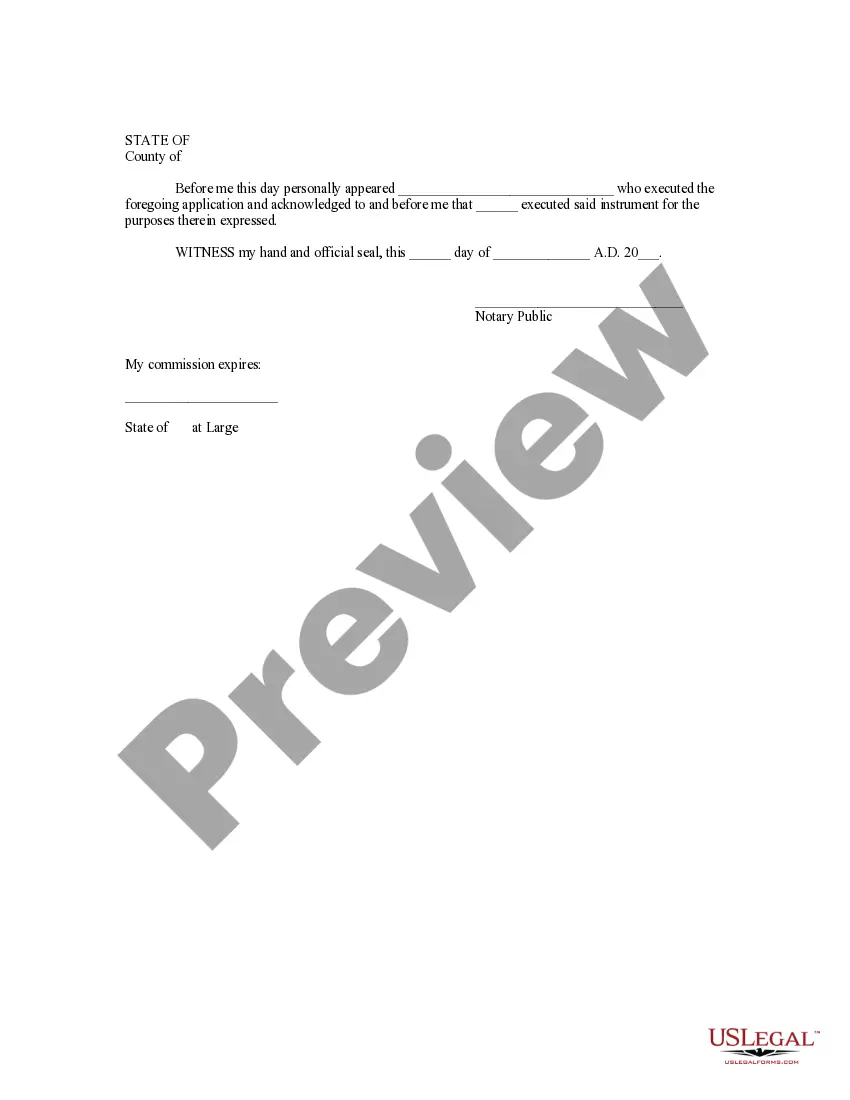

- Step 2. Take advantage of the Review method to examine the form`s articles. Do not overlook to read through the outline.

- Step 3. Should you be unhappy using the form, take advantage of the Search area towards the top of the monitor to discover other versions of the legitimate form design.

- Step 4. Upon having located the shape you need, click the Acquire now button. Pick the prices plan you prefer and include your credentials to register for the profile.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal profile to finish the financial transaction.

- Step 6. Find the file format of the legitimate form and download it on your gadget.

- Step 7. Complete, revise and print or sign the Illinois Petition for Creation of Historic District.

Each legitimate document design you purchase is the one you have forever. You may have acces to every single form you saved in your acccount. Click the My Forms portion and choose a form to print or download yet again.

Remain competitive and download, and print the Illinois Petition for Creation of Historic District with US Legal Forms. There are thousands of professional and state-distinct kinds you can use for your personal enterprise or personal needs.

Form popularity

FAQ

If you have a child in Kindergarten through 12th grade who is under age 21, you may be eligible for the Illinois Education Expense Credit. Illinois parents of these children can take a 25% tax credit on qualified educational expenses over $250.

Illinois (IL) Doesn't offer a renter's credit.

The Illinois Historic Preservation Tax Credit (IL-HTC) Program provides a state income-tax credit equal to 25% of a project's Qualified Rehabilitation Expenditures (QREs), not to exceed $3 million, to owners of certified historic structures who undertake certified rehabilitation projects.

You will qualify for the property tax credit if: your principal residence during the year preceding the tax year at issue was in Illinois, and. you owned the residence, and. you paid property tax on your principal residence (excluding any applicable exemptions, late fees, and other charges).

About. In 2008 the Illinois General Assembly passed the Illinois Film Production Tax Credit Act, offering producers a credit of 30% of all qualified expenditures, including post-production. The Illinois Film Tax Credit is currently scheduled for legislative renewal in 2032.