Illinois Software License Subscription Agreement

Description

How to fill out Software License Subscription Agreement?

Are you presently in a circumstance where you frequently require documents for organizational or personal purposes? There are numerous reliable document templates accessible online, but sourcing forms you can depend on is not easy. US Legal Forms offers a vast selection of form templates, including the Illinois Software License Subscription Agreement, which are crafted to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Illinois Software License Subscription Agreement template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Discover the form you need and ensure it is for the correct city/region. Use the Preview feature to examine the form. Review the description to confirm you have selected the appropriate form. If the form does not meet your expectations, take advantage of the Search field to find the form that aligns with your requirements. Once you find the right form, click Get now. Choose the pricing plan you desire, complete the necessary details to create your account, and pay for your order using your PayPal or credit card. Select a convenient file format and download your copy.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Access all the document templates you have purchased in the My documents list.

- You can obtain an additional copy of the Illinois Software License Subscription Agreement at any time if needed.

- Simply select the required form to download or print the document template.

- Utilize US Legal Forms, the most comprehensive collection of legitimate forms, to save time and avoid mistakes.

- The service provides professionally crafted legal document templates that can be used for various purposes.

- Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

To write a license agreement, start with a clear introduction that identifies the parties and the purpose of the agreement. Include detailed sections on licensing rights, obligations, payment terms, and termination clauses. If you are drafting an Illinois Software License Subscription Agreement, consider consulting resources from uslegalforms to ensure you cover all legal requirements and protect your interests.

To draft a license agreement, start by defining the parties involved and the intellectual property in question. Include essential terms such as the scope of use, payment structure, and duration of the license. For an Illinois Software License Subscription Agreement, consider using templates available on platforms like uslegalforms to ensure all necessary elements are included and compliant with legal standards.

Examples of licensing agreements include music licensing for streaming services, trademark licensing for brands, and software licensing agreements like the Illinois Software License Subscription Agreement. Each type of agreement allows the licensee to use the licensor's property while adhering to specific terms. These agreements play a crucial role in various industries by facilitating access to essential resources.

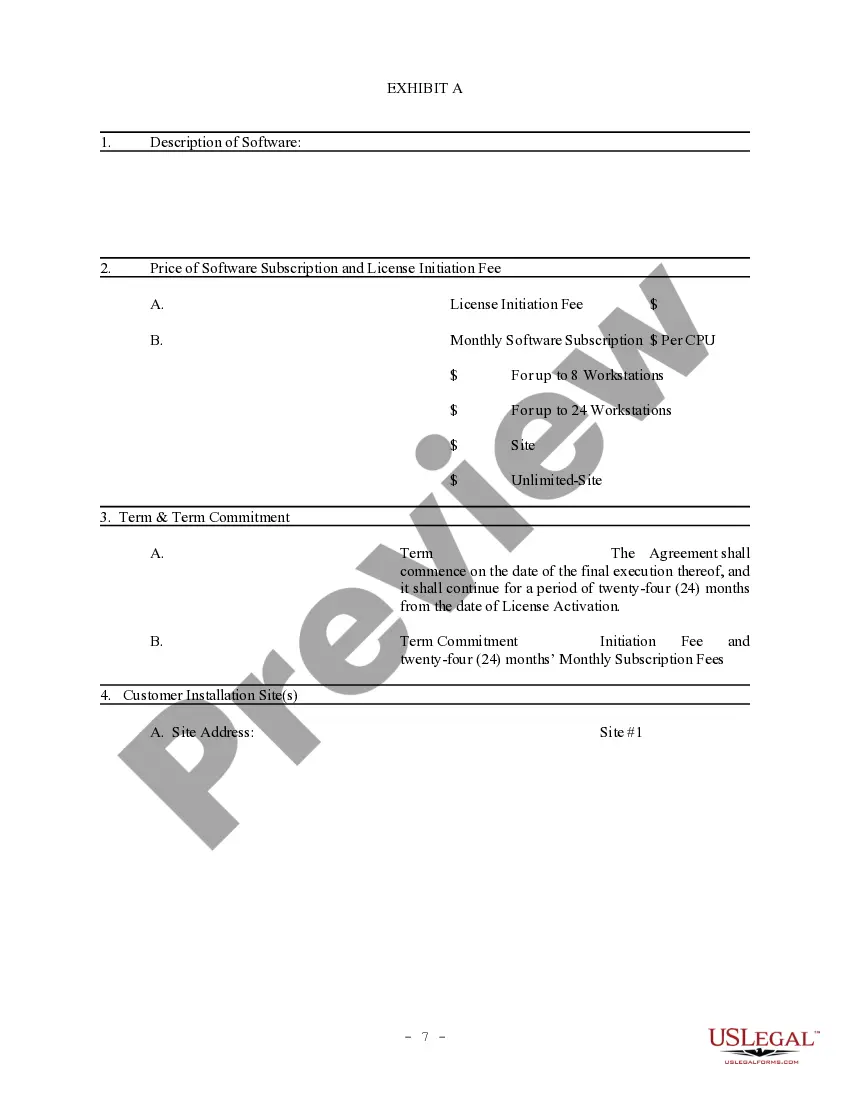

Clauses in a software license agreement typically include licensing rights, payment terms, limitation of liability, and termination conditions. The Illinois Software License Subscription Agreement may also include clauses regarding maintenance, support, and updates. Each clause serves to protect both parties and ensure clarity regarding the terms of software usage.

A licensing agreement is a legal contract that allows one party to use another party's intellectual property, such as software, under defined conditions. In the context of an Illinois Software License Subscription Agreement, it specifies how the software can be used, the duration of the license, and the fees involved. This agreement protects the rights of the creator while granting users access to valuable tools.

A typical licensing deal involves an agreement where one party, the licensor, permits another party, the licensee, to use their software under specific terms. The Illinois Software License Subscription Agreement outlines the duration of the license, payment terms, and any restrictions on use. This agreement ensures both parties understand their rights and obligations, fostering a mutually beneficial relationship.

To set up a licensing agreement, first, clearly define the terms of use, including payment structure, duration, and rights. It's essential to consult legal resources or platforms like USLegalForms to draft a comprehensive Illinois Software License Subscription Agreement. This ensures that both parties understand their obligations and protects your interests.

A software license grants rights to use the software, while a subscription refers to the payment model for accessing that software. Licenses can be perpetual or time-limited, whereas subscriptions require ongoing fees. Understanding these distinctions is vital when creating an Illinois Software License Subscription Agreement to ensure all terms are clearly articulated.

Yes, a software license agreement is a legally binding contract between the software provider and the user. This agreement outlines the rights and responsibilities of both parties regarding software use. An Illinois Software License Subscription Agreement specifically details subscription terms, ensuring clarity and legal protection for both sides.

Buying software typically involves a one-time payment for a perpetual license, allowing you to use the software indefinitely. In contrast, a subscription service requires regular payments for access, which may include additional benefits like updates and support. When choosing between the two, consider the flexibility of an Illinois Software License Subscription Agreement to best suit your needs.