Illinois Self-Employed Tour Guide Services Contract

Description

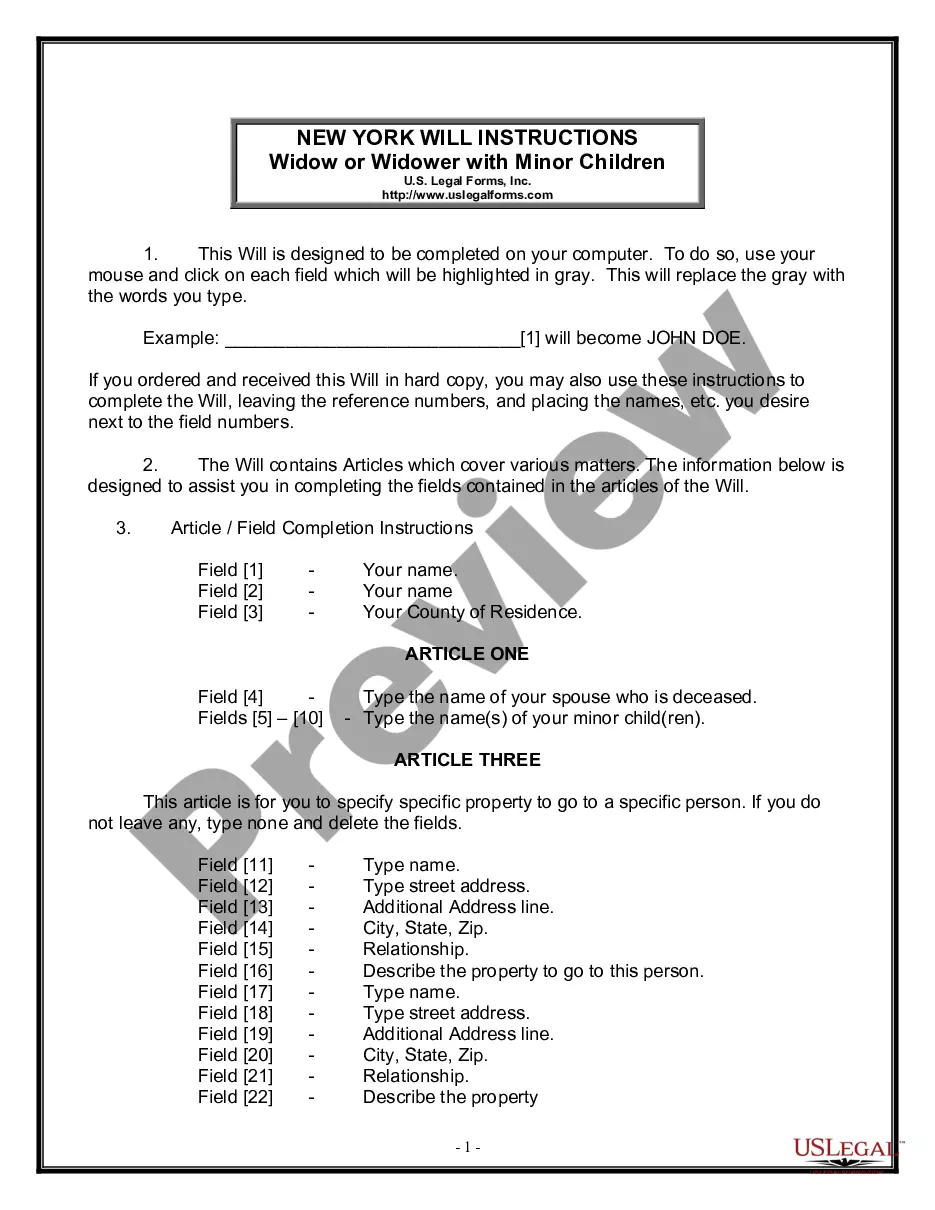

How to fill out Self-Employed Tour Guide Services Contract?

If you wish to finalize, download, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you need. Numerous templates for commercial and personal purposes are categorized by categories and states, or keywords. Use US Legal Forms to obtain the Illinois Self-Employed Tour Guide Services Contract with just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to get the Illinois Self-Employed Tour Guide Services Contract. You can also access forms you previously obtained in the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Review feature to examine the form's details. Remember to read the description. Step 3. If you are not satisfied with the document, use the Search box at the top of the screen to find other versions of the legal document template. Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to create an account. Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finish the purchase. Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Illinois Self-Employed Tour Guide Services Contract.

- Every legal document template you purchase is yours indefinitely.

- You will have access to every form you acquired within your account.

- Click the My documents section and choose a form to print or download again.

- Stay competitive and download, and print the Illinois Self-Employed Tour Guide Services Contract with US Legal Forms.

- There are numerous professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

Writing an independent contractor agreement involves outlining the scope of work, payment terms, and responsibilities of both parties. Start by clearly defining the services you will provide as part of your Illinois Self-Employed Tour Guide Services Contract. Ensure that you include terms regarding deadlines, confidentiality, and dispute resolution. Using templates from platforms like US Legal Forms can simplify this process, ensuring you cover all necessary legal aspects.

As a freelancer, you have several rights that protect your work and income. You are entitled to fair compensation for the services you provide under the terms outlined in your Illinois Self-Employed Tour Guide Services Contract. Additionally, you have the right to work with clients who respect your time and expertise. Understanding these rights can help you navigate your freelance career more effectively.

The 7 day rule in Illinois refers to the requirement that certain types of contracts, including those related to self-employment, must be executed within seven days to be enforceable. This rule ensures that all parties involved have a clear understanding of their commitments and obligations. For those providing Illinois Self-Employed Tour Guide Services, adhering to this rule can help prevent legal disputes. You should always consult legal resources or professionals to ensure compliance.

To start your own tour guide business, begin by researching your target audience and the types of tours you want to offer. Next, create a detailed business plan that includes your marketing strategy and financial projections. Implementing an Illinois Self-Employed Tour Guide Services Contract will help you establish professional relationships with clients and protect your interests as you embark on this exciting journey.

Starting a tour company can present challenges, but with the right approach, it can be a rewarding venture. You need to understand the market, develop a business plan, and manage logistics effectively. Utilizing resources like an Illinois Self-Employed Tour Guide Services Contract can simplify the process by providing a clear framework for client agreements, helping you focus on growing your business.

In many areas, including Illinois, specific licensing requirements for tour guides may vary. Generally, local municipalities set the guidelines, so it’s essential to check with your local government. Regardless of licensing, having an Illinois Self-Employed Tour Guide Services Contract can help you navigate the legal landscape and ensure your business operates smoothly.

A freelance tour guide is an independent contractor who offers guided tours without being tied to a single company. They have the flexibility to set their schedules, choose their clients, and create unique tour experiences. To operate legally in Illinois, using an Illinois Self-Employed Tour Guide Services Contract can help define your terms and ensure compliance with local regulations.

Freelance tour guides can earn varying amounts depending on several factors, such as location, experience, and the type of tours they offer. In Illinois, the average earnings for self-employed tour guides typically range from $25 to $50 per hour. However, with the right marketing and a solid Illinois Self-Employed Tour Guide Services Contract, you can maximize your income potential. By providing unique experiences and building a loyal customer base, you can significantly increase your earnings as a freelance tour guide.

Yes, you can write your own legally binding contract, provided it includes essential elements such as offer, acceptance, and consideration. Make sure to specify the terms clearly to avoid ambiguity. However, consulting templates can help ensure you meet legal standards. For a reliable Illinois Self-Employed Tour Guide Services Contract, uslegalforms provides easy-to-use templates that guide you through the process.

To write a self-employed contract, begin by detailing the services you provide and the expectations from both parties. Make sure to include payment terms and any deadlines for completion. Clarifying the nature of the working relationship is essential to prevent misunderstandings. For an Illinois Self-Employed Tour Guide Services Contract, uslegalforms has ready-made templates that simplify this process.