Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

How to fill out Outside Project Manager Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an extensive selection of legal form templates that you can download or create.

By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor in just minutes.

If you possess a subscription, Log In and download the Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms within the My documents section of your account.

Make changes. Complete, edit, print, and sign the downloaded Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor.

Each format you add to your account does not expire and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Access the Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal requirements.

- To use US Legal Forms for the first time, here are simple instructions to get started.

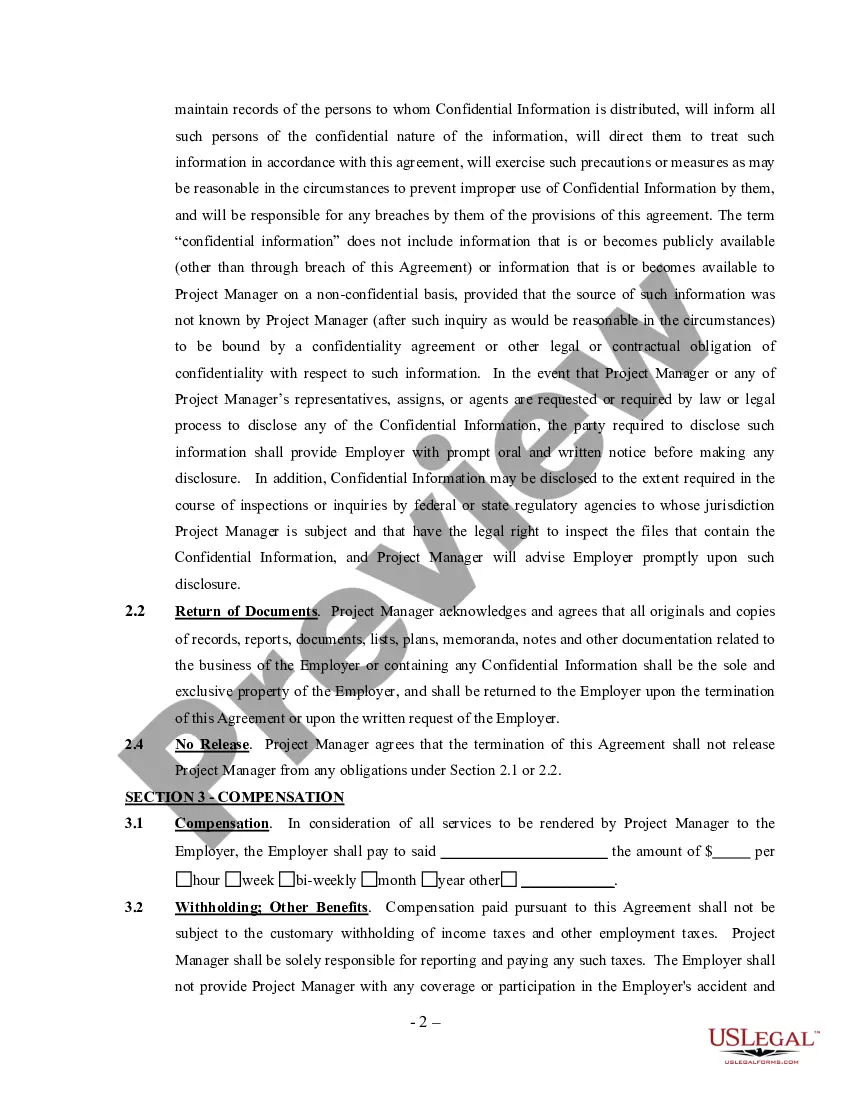

- Make sure you have selected the correct form for your area/region. Click the Preview button to review the form's contents. Check the form summary to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by selecting the Buy Now button. Next, choose the pricing plan you prefer and provide your details to create an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

Writing an independent contractor agreement involves outlining the terms and conditions of the working relationship. Start with the project details, payment information, and timelines. You can simplify this process by using a professional template from US Legal Forms, specifically tailored to create an Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor, ensuring accuracy and compliance with local laws.

Yes, non-disclosure agreements (NDAs) can apply to independent contractors to protect sensitive information related to a project. Including an NDA within the Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor is wise if confidentiality is crucial for your business. This ensures that both parties clearly understand their obligations regarding proprietary information.

An independent contractor typically fills out several key documents, including the independent contractor agreement, W-9 form for tax purposes, and any additional licensing or registration paperwork. It's important to maintain clear records of these documents. Utilizing a comprehensive platform like US Legal Forms can streamline this process by providing all necessary templates for the Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor agreement, first, gather the necessary information about the project and parties involved. Clearly define the scope of work, payment structure, and deadlines. For a reliable template, consider using the Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor available on US Legal Forms, ensuring that your agreement meets legal standards.

The 7 day rule in Illinois refers to the requirement that certain agreements, including those for project management, must be executed within seven days of the final negotiation. This rule can be crucial for individuals working under an Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor. It helps safeguard both parties by ensuring timely commitment to agreed terms. To simplify the process, explore US Legal Forms for efficient contract templates that adhere to this regulation.

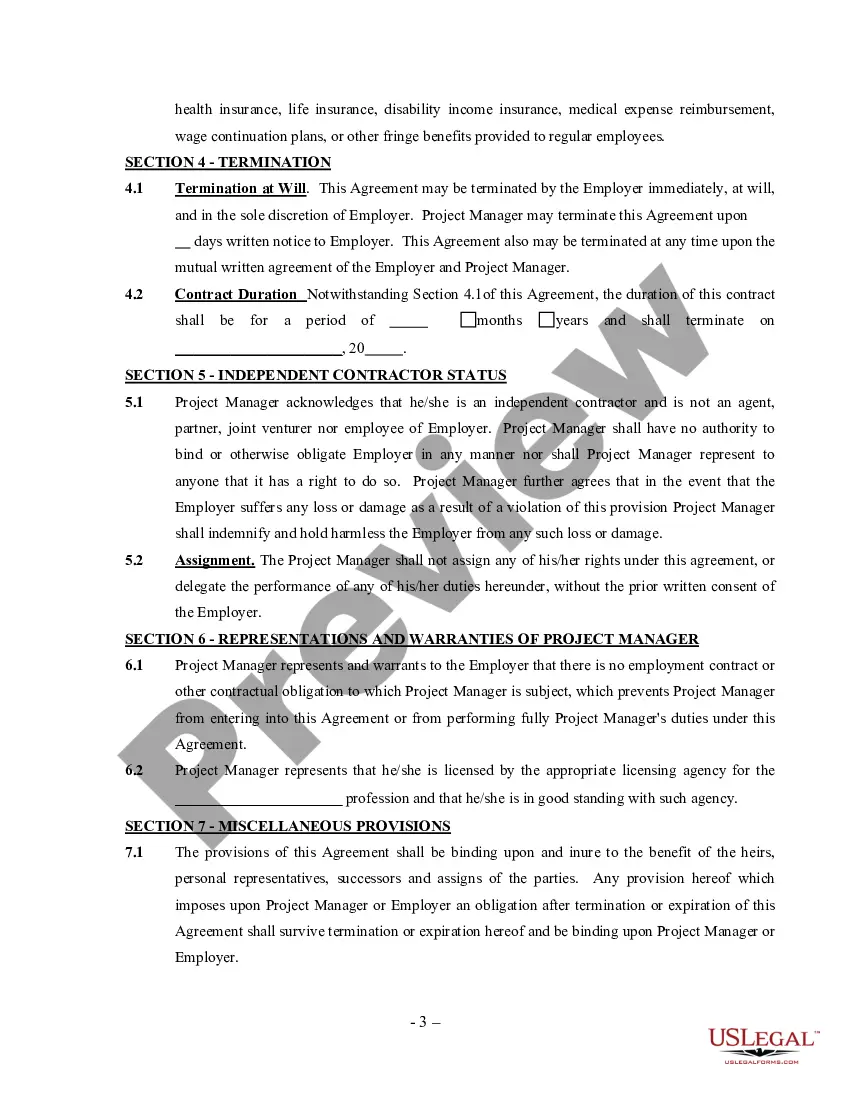

The Illinois Freedom to Work Act does not apply to independent contractors like those involved in an Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor. This law primarily addresses non-compete agreements between employers and employees. As an independent contractor, you have more flexibility in negotiating your terms, which can lead to better opportunities. For a clear and compliant project manager agreement, consider using US Legal Forms for the right templates.

To create an independent contractor agreement, start by outlining the services to be provided and the compensation structure. Clearly specify the start and end dates, confidentiality clauses, and any other critical terms. Utilizing a platform like UsLegalForms can simplify this process, providing templates specifically designed for an Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor, ensuring you cover all necessary components.

When employing an independent contractor in Illinois, it's essential to have a clear agreement that outlines the scope of work, payment terms, and deadlines. This is typically done through an Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor. Additionally, ensure that you collect necessary tax forms, such as the W-9, to keep everything compliant and organized.

In Illinois, freelance law outlines the rights and responsibilities of freelance workers and their clients. It emphasizes the importance of a written contract to define the terms of work, payment, and other conditions. This is especially relevant when forming an Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor. Understanding these laws helps protect both parties and ensures a smooth working relationship.

Yes, an employee can serve as an independent contractor for another company. This dual role is common and can benefit both parties. However, it’s important to ensure that the independent contractor work does not conflict with the primary job. Using an Illinois Outside Project Manager Agreement - Self-Employed Independent Contractor can help set clear boundaries and protect both the employee and the employers.