Illinois Convertible Note Financing

Description

Just like any other debt investment, senior convertible notes offer investors the ability to earn interest. Rather than cash payments, however, the interest payments typically will accrue and the amount the company owes the investor will increase over time.

Bothstartup companiesand well-established companies may opt to issue senior convertible notes to raise funds from investors. This type of company financing has the advantage of being fairly simple to execute. This means the process of issuing the notes is relatively inexpensive for companies and it allows them quicker access to investor funding."

How to fill out Convertible Note Financing?

If you wish to total, down load, or produce legal papers themes, use US Legal Forms, the greatest assortment of legal kinds, which can be found on the web. Utilize the site`s easy and practical search to find the files you require. Various themes for business and person uses are categorized by categories and claims, or search phrases. Use US Legal Forms to find the Illinois Convertible Note Financing with a few mouse clicks.

Should you be presently a US Legal Forms customer, log in to the profile and then click the Down load option to get the Illinois Convertible Note Financing. You may also entry kinds you previously delivered electronically inside the My Forms tab of your respective profile.

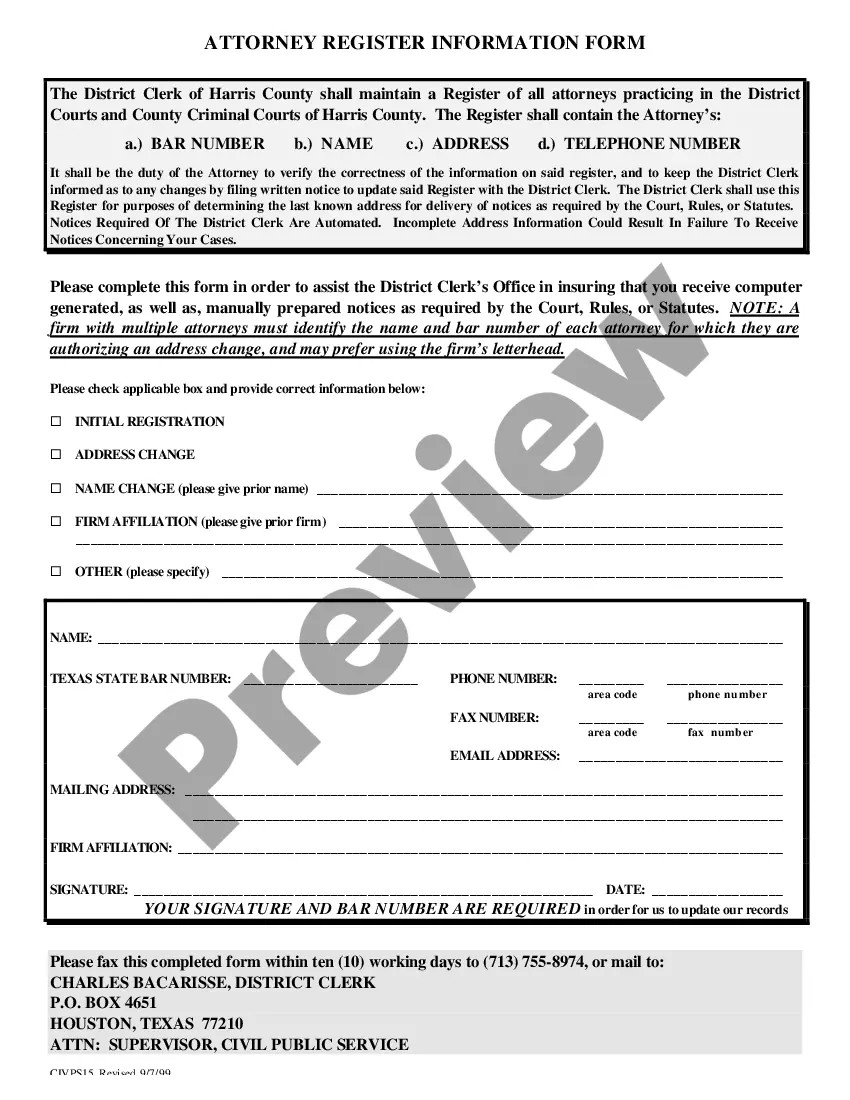

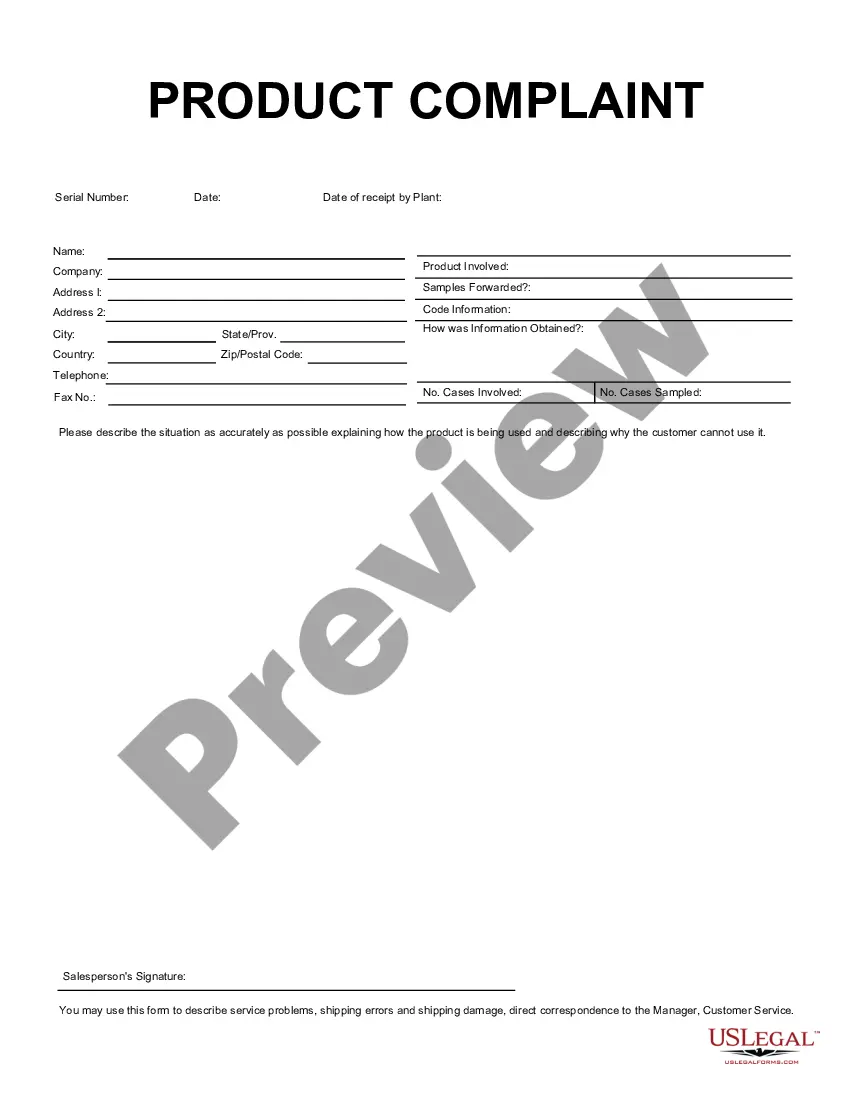

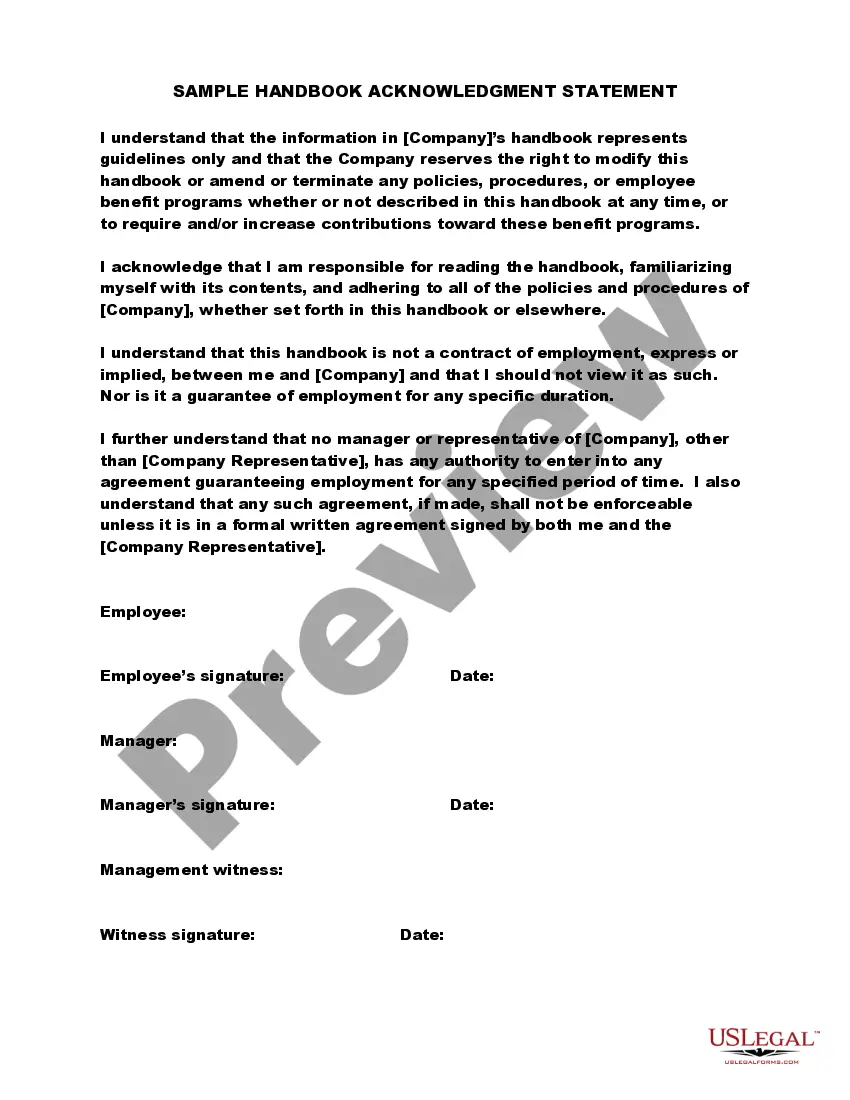

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape for your right metropolis/nation.

- Step 2. Make use of the Preview option to examine the form`s information. Do not overlook to read the information.

- Step 3. Should you be unhappy together with the kind, make use of the Lookup industry towards the top of the display to get other models of your legal kind format.

- Step 4. After you have located the shape you require, click on the Buy now option. Opt for the prices plan you like and include your credentials to register for the profile.

- Step 5. Process the transaction. You should use your credit card or PayPal profile to finish the transaction.

- Step 6. Select the file format of your legal kind and down load it on your device.

- Step 7. Complete, modify and produce or indicator the Illinois Convertible Note Financing.

Each legal papers format you acquire is your own eternally. You may have acces to each and every kind you delivered electronically within your acccount. Click on the My Forms section and decide on a kind to produce or down load once more.

Compete and down load, and produce the Illinois Convertible Note Financing with US Legal Forms. There are thousands of expert and status-distinct kinds you may use for the business or person demands.

Form popularity

FAQ

Simply multiply the convertible note's interest rate by the number of years that have passed since the convertible note was issued. In this case, we would multiply 6% by 5 to get an accrued interest of 30%.

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity.

Conversion to Equity - Accounting for Convertible Debt When the note converts, usually during a new funding round, the liability moves to the equity section of the balance sheet. At this stage, the convertible note is settled, and new equity instruments, typically preferred shares, are issued to the investor.

The conversion price of the convertible security is the price of the bond divided by the conversion ratio. If the bonds par value is $1000, the conversion price is calculated by dividing $1000 by 5, or $200.

In a convertible note, the loan will convert into equity when you raise what's known as a qualified financing. A qualified financing is equity financing (not a SAFE or Convertible Note round) above a certain threshold, usually $1 million.

A note holder invests $200k and in return will receive 20% off future share prices after the startup gets its Series A funding. Let's say the startup raises $10m in funding. If the preferred stock price is $1.00 and the investor receives a 20% discount, then the note will convert at $0.80 per share.

Even in the case of stated interest that is paid periodically, a holder of a convertible note may be taxed on interest that has accrued since the most recent interest payment date but has not yet been paid at the time of conversion.

Convertible loan notes can lead to dilution of existing shareholders' equity when the notes convert. This can be a disadvantage for start-ups that want to maintain control over their company.