Illinois Qualified Investor Certification and Waiver of Claims

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims.

How to fill out Qualified Investor Certification And Waiver Of Claims?

Are you within a position the place you require documents for both enterprise or personal purposes nearly every day time? There are plenty of lawful document themes accessible on the Internet, but finding versions you can trust isn`t easy. US Legal Forms offers a large number of develop themes, much like the Illinois Qualified Investor Certification and Waiver of Claims, that happen to be composed to fulfill state and federal demands.

Should you be presently acquainted with US Legal Forms internet site and have a free account, merely log in. Next, it is possible to obtain the Illinois Qualified Investor Certification and Waiver of Claims format.

If you do not offer an bank account and would like to begin using US Legal Forms, adopt these measures:

- Find the develop you want and ensure it is for that right metropolis/area.

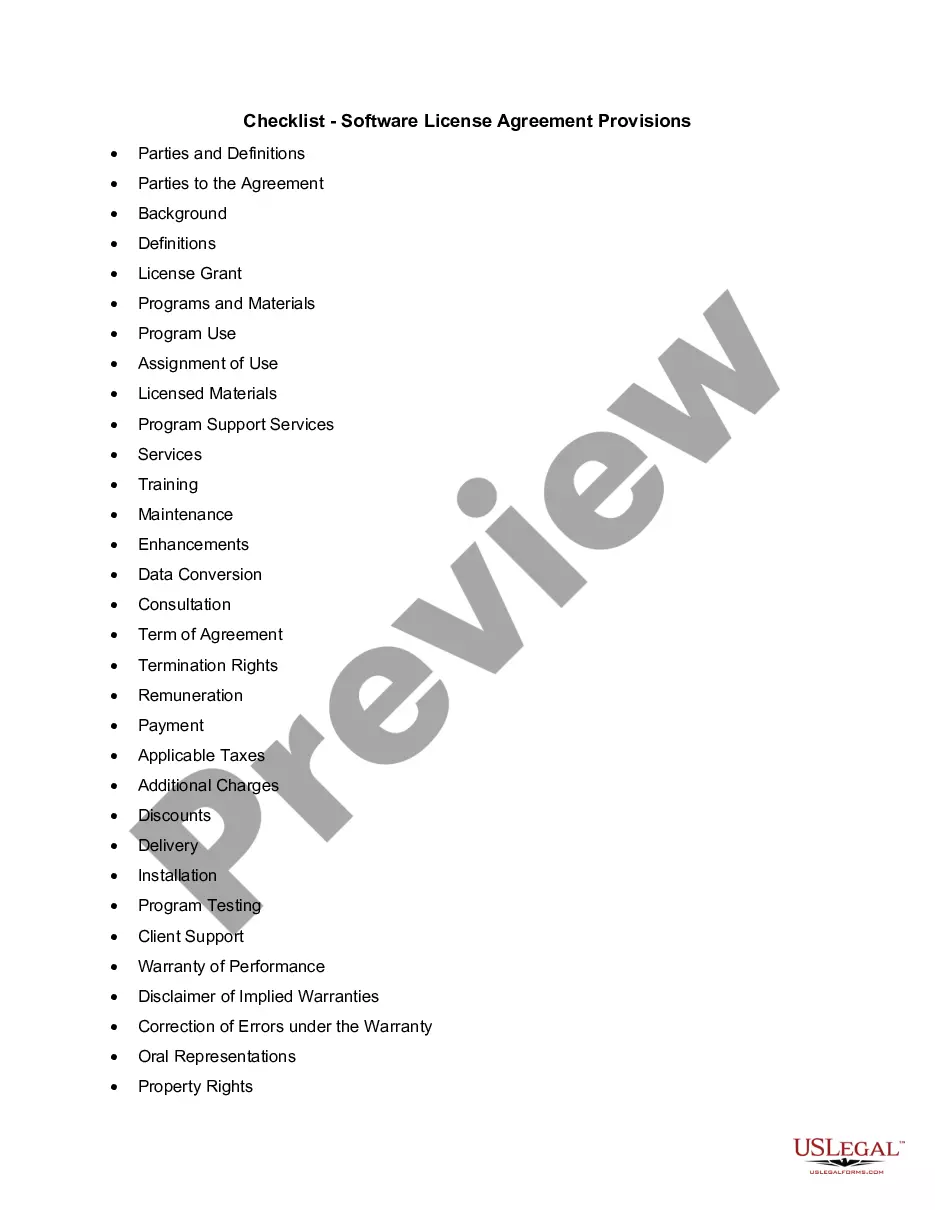

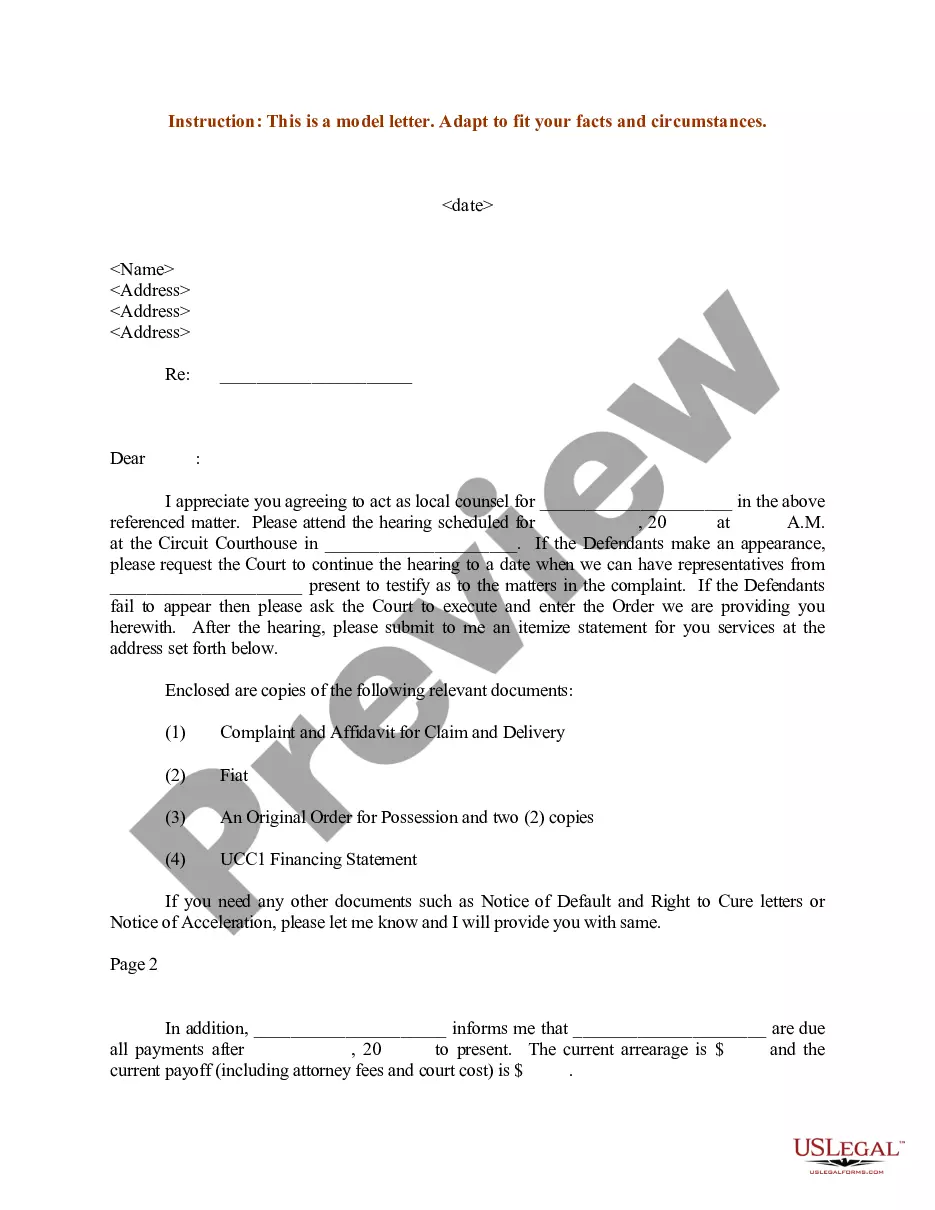

- Utilize the Review option to analyze the form.

- See the description to actually have chosen the correct develop.

- When the develop isn`t what you`re seeking, take advantage of the Look for area to obtain the develop that suits you and demands.

- If you find the right develop, click Purchase now.

- Pick the prices strategy you need, submit the desired info to make your money, and pay for your order making use of your PayPal or charge card.

- Decide on a hassle-free document structure and obtain your duplicate.

Get each of the document themes you possess bought in the My Forms menu. You may get a extra duplicate of Illinois Qualified Investor Certification and Waiver of Claims any time, if possible. Just click the necessary develop to obtain or print the document format.

Use US Legal Forms, probably the most considerable selection of lawful varieties, in order to save efforts and prevent blunders. The service offers expertly produced lawful document themes which you can use for a variety of purposes. Generate a free account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

A PTE can be a limited liability company (LLC), S Corporation, or partnership. Under this legislation, a PTE can elect to pay the PTE tax on its net income. The PTE tax is 4.95%, which is the same flat rate as the Illinois individual income tax rate.

For tax years ending on and after December 31, 2022, If the election to pay PTE tax is made, then estimated payments are based on 90 percent of the current year tax liability or 100 percent of the tax liability in the prior year. If the election to pay PTE tax is not made, then estimated payments are not required.

How do I make the election to pay PTE tax? The election to pay the PTE tax is made on Form IL-1065, Partnership Replacement Tax Return, or Form IL-1120-ST, Small Business Corporation Replacement Tax Return, for tax years ending on or after December 31, 2021, and beginning before January 1, 2026.

Partnerships and S corporations may use FTB 3893 to make a PTE elective tax payment by printing the voucher from FTB's website and mailing it to us. See instructions attached to voucher for more information. Alternatively, the PTE elective tax payment can be made electronically using Web Pay on FTB's website.

A qualifying PTE is an entity taxed as a partnership or S corporation. Who does not qualify? Who is a qualified taxpayer? To be qualified, a taxpayer must consent to have their pro rata or distributive share and guaranteed payments included in the qualified net income of the electing qualified PTE.

PTE tax allows an entity taxed as a partnership or S Corporation to make a tax payment on behalf of its partners. The business pays an elective tax of 9.3% of qualified net income to the Franchise Tax Board.

Regulation D Rule 506(c) ? Notification Filing Filing requirements include a copy of the Form D filed with the SEC and payment of the $100 filing fee. Submit Form D and pay the filing fee within 15 days after the first sale of securities to an Illinois resident. Please submit Form D and make an ACH payment via EFD.

A PTE can be a limited liability company (LLC), S Corporation, or partnership. Under this legislation, a PTE can elect to pay the PTE tax on its net income. The PTE tax is 4.95%, which is the same flat rate as the Illinois individual income tax rate.