Illinois Plan of Merger between two corporations

Description

How to fill out Plan Of Merger Between Two Corporations?

Are you currently in the place in which you need to have documents for both enterprise or person functions nearly every time? There are a lot of authorized papers layouts accessible on the Internet, but discovering versions you can rely on isn`t effortless. US Legal Forms offers a huge number of kind layouts, such as the Illinois Plan of Merger between two corporations, that happen to be created in order to meet state and federal requirements.

If you are presently knowledgeable about US Legal Forms web site and have a free account, merely log in. Following that, you can acquire the Illinois Plan of Merger between two corporations template.

If you do not offer an bank account and want to begin to use US Legal Forms, adopt these measures:

- Discover the kind you want and ensure it is for your proper metropolis/area.

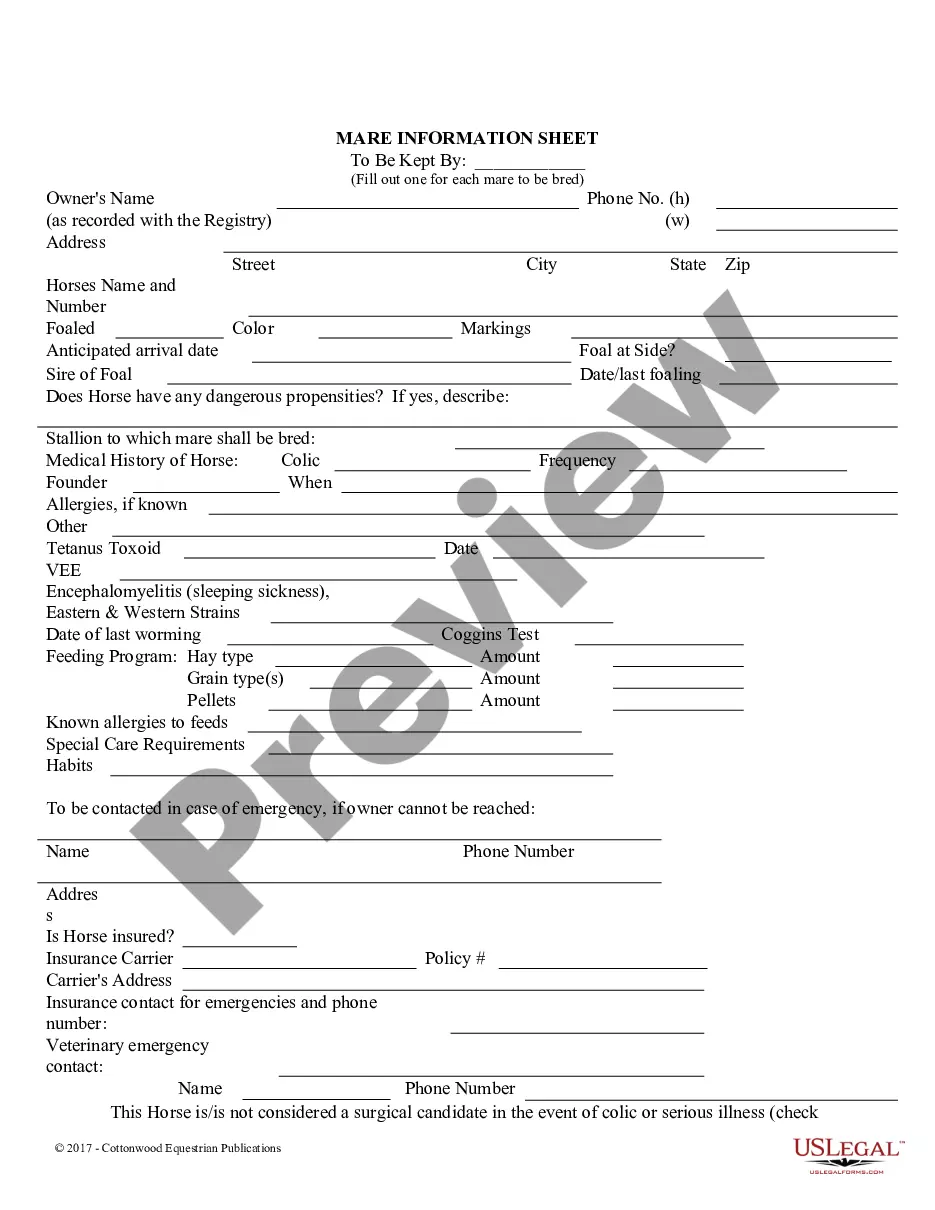

- Make use of the Preview button to review the shape.

- Browse the outline to ensure that you have selected the right kind.

- In case the kind isn`t what you are looking for, make use of the Look for industry to get the kind that fits your needs and requirements.

- Once you find the proper kind, simply click Buy now.

- Choose the rates plan you need, complete the specified info to create your bank account, and purchase the order making use of your PayPal or Visa or Mastercard.

- Decide on a convenient file file format and acquire your version.

Discover all of the papers layouts you might have purchased in the My Forms menu. You can get a extra version of Illinois Plan of Merger between two corporations anytime, if possible. Just click on the essential kind to acquire or print the papers template.

Use US Legal Forms, probably the most comprehensive variety of authorized varieties, to save some time and steer clear of errors. The assistance offers appropriately manufactured authorized papers layouts that can be used for a selection of functions. Create a free account on US Legal Forms and start making your lifestyle a little easier.

Form popularity

FAQ

Domestic BCA: Any company that files Articles of Incorporation in the State of Illinois under the Business Corporation Act of 1983, as amended is considered a domestic corporation in the State of Illinois.

All corporations must use one of the following in their names, usually at the end of the name: ?Incorporated,? ?Corporation,? ?Limited? or their abbreviations.

To form an Illinois S corp, you'll need to ensure your company has an Illinois formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

A ?professional corporation? is a corporation organized under the Professional Service Corporation Act solely for the purpose of rendering one category of professional service or related professional services and which has as its shareholders, directors, officers, agents and employees (other than ancillary personnel) ...

In a consolidation, two or more corporations combine into one new corporation, with both consolidating corporations going out of existence. The act of consolidating creates the new corporate entity automatically, and it is not necessary to incorporate a separate entity.

A foreign corporation is a corporation organized under the laws of a state or coun- try other than Illinois. For a foreign corporation to transact business in Illinois, it must qualify by procuring an Authority to Transact Business in Illinois from the Secretary of State's Department of Business Services.

Articles of Incorporation in Illinois ask for: Name. ... Initial Registered Agent's Name, Address, and Mailing Address. ... Purpose (optional) ... Authorized shares. ... Directors (optional) ... Estimated Values (optional) ... Other Provisions (optional) ... Name and address of incorporator(s)

Specific Rules for Illinois Business Names The name of a corporation or foreign corporation must contain: Shall contain, separate and apart from any other word or abbreviation in such name, the word "corporation", "company", "incorporated", or "limited", or an abbreviation of one of such words.