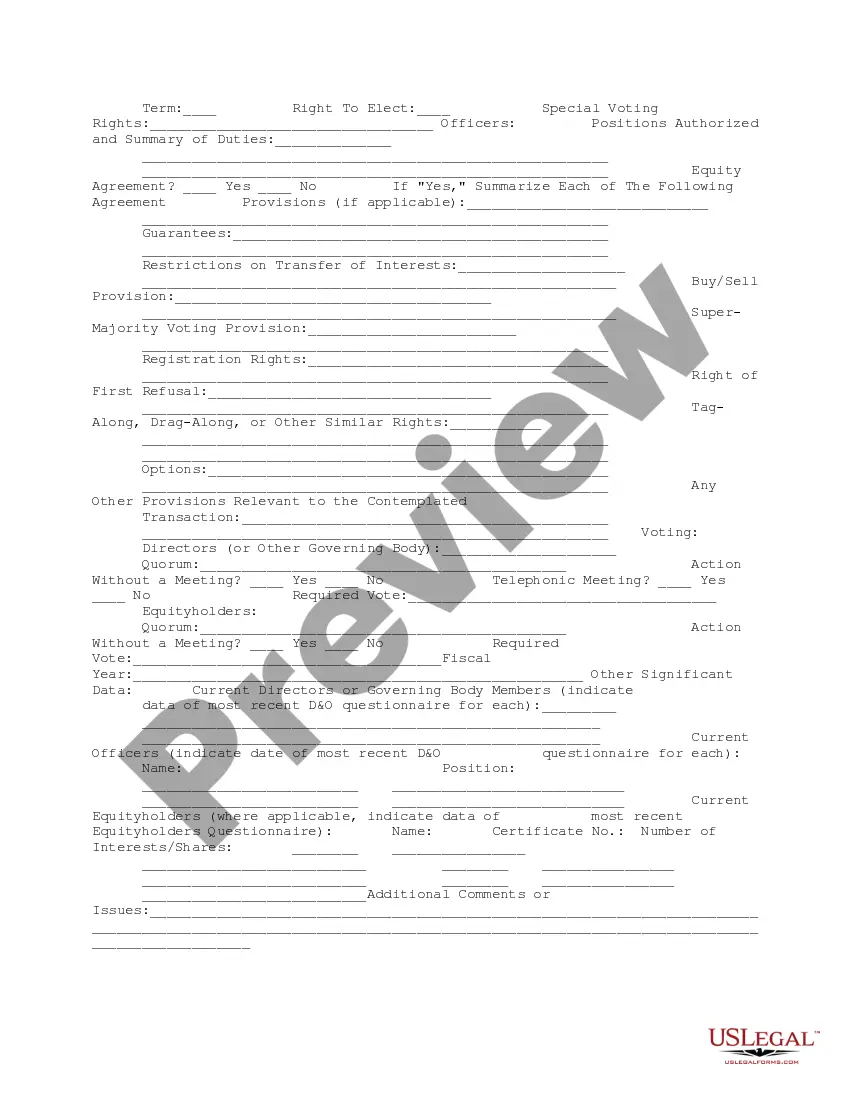

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Illinois Company Data Summary

Description

How to fill out Company Data Summary?

Selecting the appropriate legal document template can be challenging. Clearly, there are numerous templates accessible online, but how can you obtain the legal form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Illinois Company Data Summary, which can be utilized for both business and personal purposes.

All forms are reviewed by professionals and comply with state and federal regulations.

Once you are confident the form is appropriate, select the Purchase now button to acquire the form. Choose the pricing plan you prefer and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Illinois Company Data Summary. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the platform to obtain professionally crafted documents that meet state requirements.

- If you are already a member, Log In to your account and click the Download button to retrieve the Illinois Company Data Summary.

- Use your account to search through the legal forms you have previously obtained.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your state/region. You can review the form using the Preview option and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search feature to find the right form.

Form popularity

FAQ

Yes, an LLC must file an annual report in Illinois to maintain its good standing. This report is crucial for keeping your Illinois Company Data Summary accurate and up-to-date. Failure to file can lead to penalties and potential dissolution. Platforms like uslegalforms provide the resources you need to ensure your LLC fulfills its annual reporting obligations.

To report a business in Illinois, you need to complete specific forms that depend on the type of business you have. Make sure to include all necessary details, such as the business name and address, in your Illinois Company Data Summary. It’s vital to submit these forms to ensure proper registration. For assistance, consider using uslegalforms, which simplifies reporting tasks.

To look up someone's business, start by using the business entity search function on the Illinois Secretary of State's website. You can enter the individual's name or the business name to find related records. This gives you access to an Illinois Company Data Summary that reveals essential details about the business, ensuring you have accurate and current information.

Checking if a business is in good standing in Illinois is simple. You can use the online business entity search through the Illinois Secretary of State's website. This tool allows you to confirm the business's status, ensuring it is compliant with state requirements, and can offer you a comprehensive Illinois Company Data Summary.

To verify the legitimacy of a business in Illinois, utilize the business entity search available on the Illinois Secretary of State's website. By searching for the company's name, you can check if it is currently registered and in good standing. This approach provides you with trustworthy details, ensuring the business operates legally and meets state regulations.

To look up a company in Illinois, you should use the Illinois Secretary of State's online database. Enter the company name or ID to access its records, which will provide you with the Illinois Company Data Summary, including registration details and current status. This straightforward process ensures you have the necessary information at your fingertips.

You can obtain a corporation's annual report or articles of incorporation by visiting the Illinois Secretary of State's office or their website. By using the business entity search feature, you can locate the specific corporation and request these documents. Additionally, our platform, US Legal Forms, offers access to various legal forms, simplifying the process of obtaining essential business documentation in Illinois.

To look up a business in Illinois, visit the Illinois Secretary of State's website. There, you can access the business entity search tool, which allows you to enter the company's name or identification number for detailed information. This process provides you with official data, including the business status and registration details, helping you obtain an Illinois Company Data Summary.

Yes, in Illinois, you need to renew your LLC every year by filing your annual report. This requirement keeps your business active and in good standing with the state. Using your Illinois Company Data Summary can aid in recalling the vital information required for your renewal. This step is crucial for the longevity and success of your business.

The annual report for an Illinois LLC is due on the first day of the anniversary month of your incorporation. To ensure timely submission, use your Illinois Company Data Summary to track important dates and details. Filing on time helps you remain compliant and maintain your LLC’s good standing. Always check for any changes in state regulations that might affect your filing requirements.