Illinois Notice of Violation of Fair Debt Act - Improper Contact at Work

Description

How to fill out Notice Of Violation Of Fair Debt Act - Improper Contact At Work?

Have you ever found yourself in a situation where you often need documents for business or specific purposes.

There are numerous authorized document templates accessible online, but finding reliable ones can be challenging.

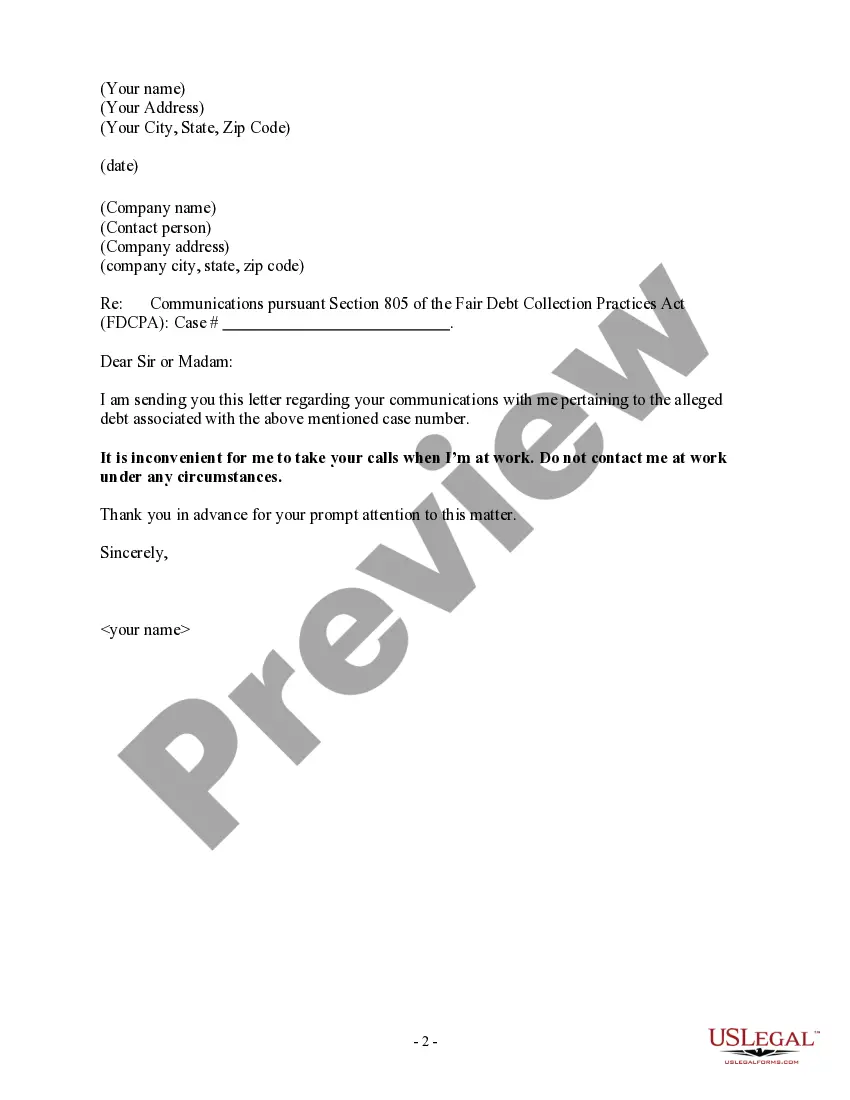

US Legal Forms offers thousands of document templates, similar to the Illinois Notice of Violation of Fair Debt Act - Improper Contact at Work, designed to comply with federal and state regulations.

Once you find the right document, click Purchase now.

Select the pricing plan you prefer, submit the required details to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your version. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Illinois Notice of Violation of Fair Debt Act - Improper Contact at Work anytime, if necessary. Just click on the desired document to download or print the template. Use US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. This service provides professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Illinois Notice of Violation of Fair Debt Act - Improper Contact at Work template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it matches your jurisdiction/area.

- Use the Preview button to review the document.

- Read the summary to confirm that you have chosen the correct document.

- If the document isn’t what you’re looking for, utilize the Search field to find the form that fits your requirements.

Form popularity

FAQ

It's not necessarily illegal for a debt collector to call you at work, but the FDCPA prohibits debt collection calls to your job if the debt collector "has reason to know" that your employer forbids those calls.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

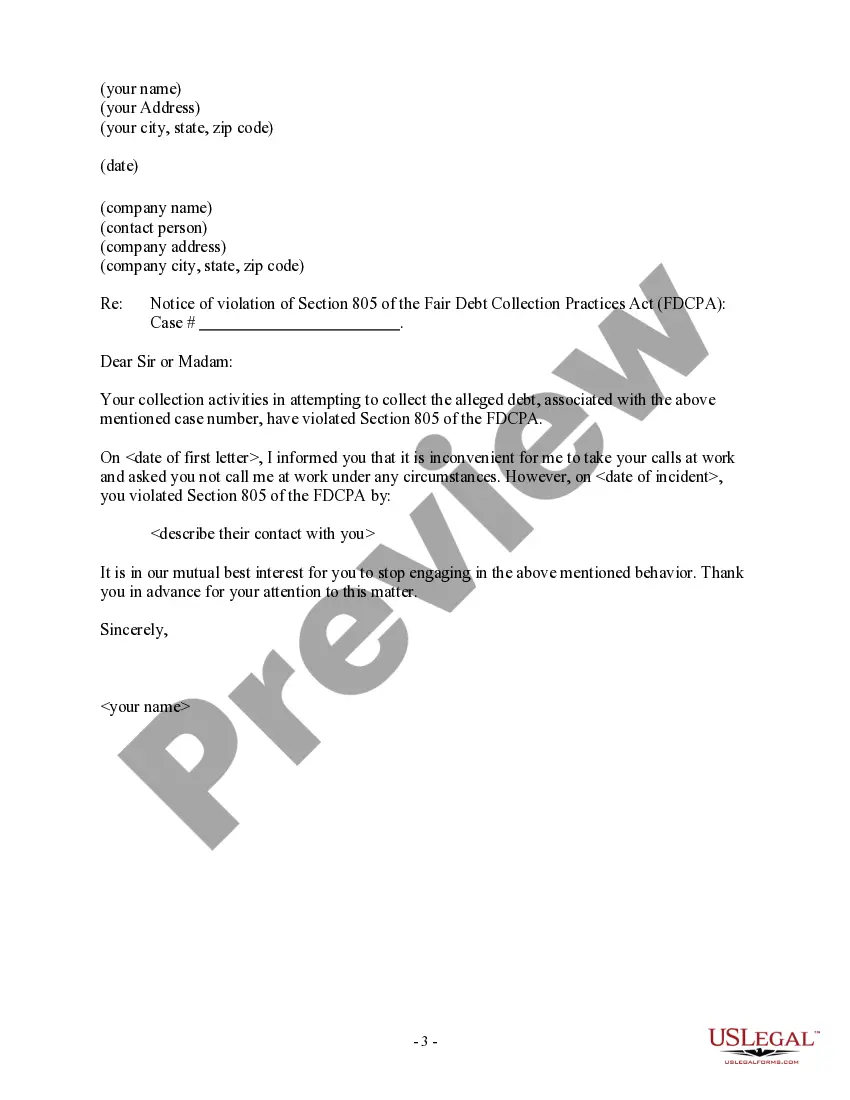

You can stop debt collectors from calling you at work fairly easily. Simply tell the debt collector that your employer doesn't want them calling your job or that you're not allowed to receive personal calls at work.

This means that debt collectors cannot harass you in-person at your work. However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

Once you dispute the debt, the debt collector can't call or contact you to collect the debt or the disputed part until the debt collector has provided verification of the debt in writing to you. Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt.

However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

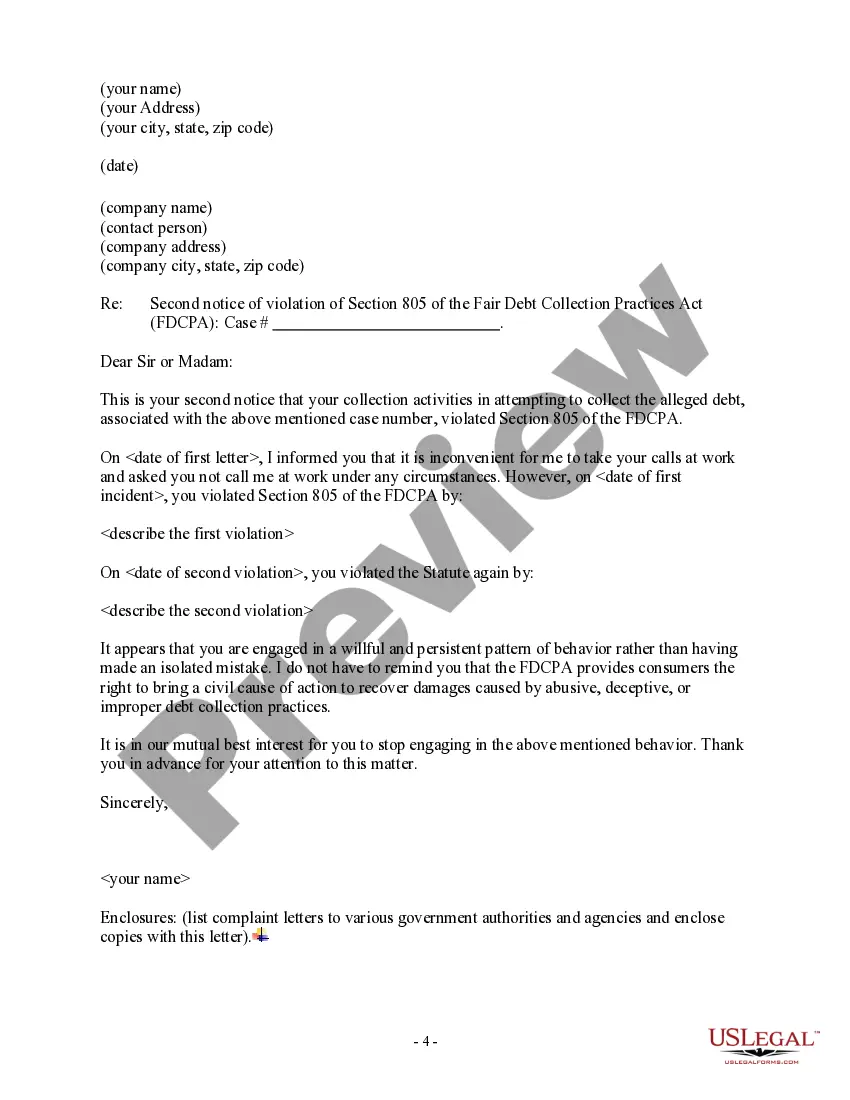

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.