A debt collector may not use obscene or profane language or language likely to abuse the hearer or reader. This includes abusive language includes religious slurs, profanity, obscenity, calling the consumer a liar or a deadbeat, and the use of racial or sexual epithets.

Illinois Notice to Debt Collector - Use of Abusive Language

Description

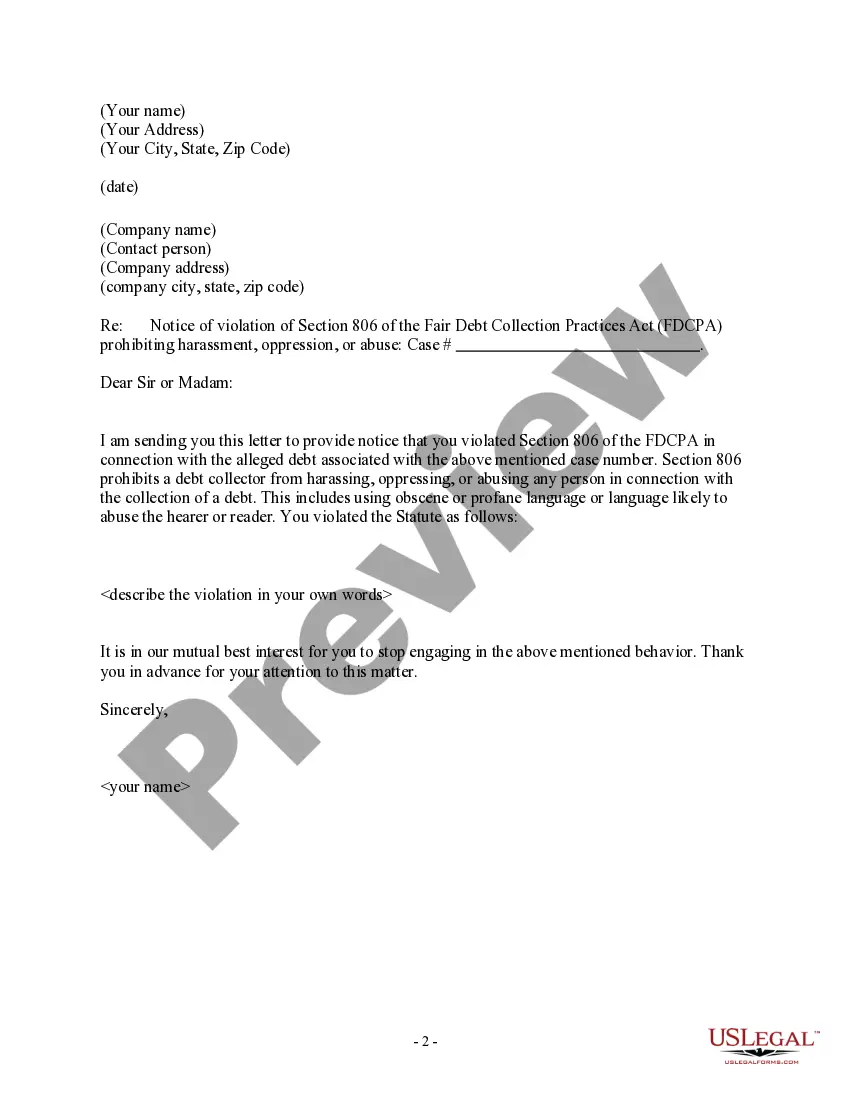

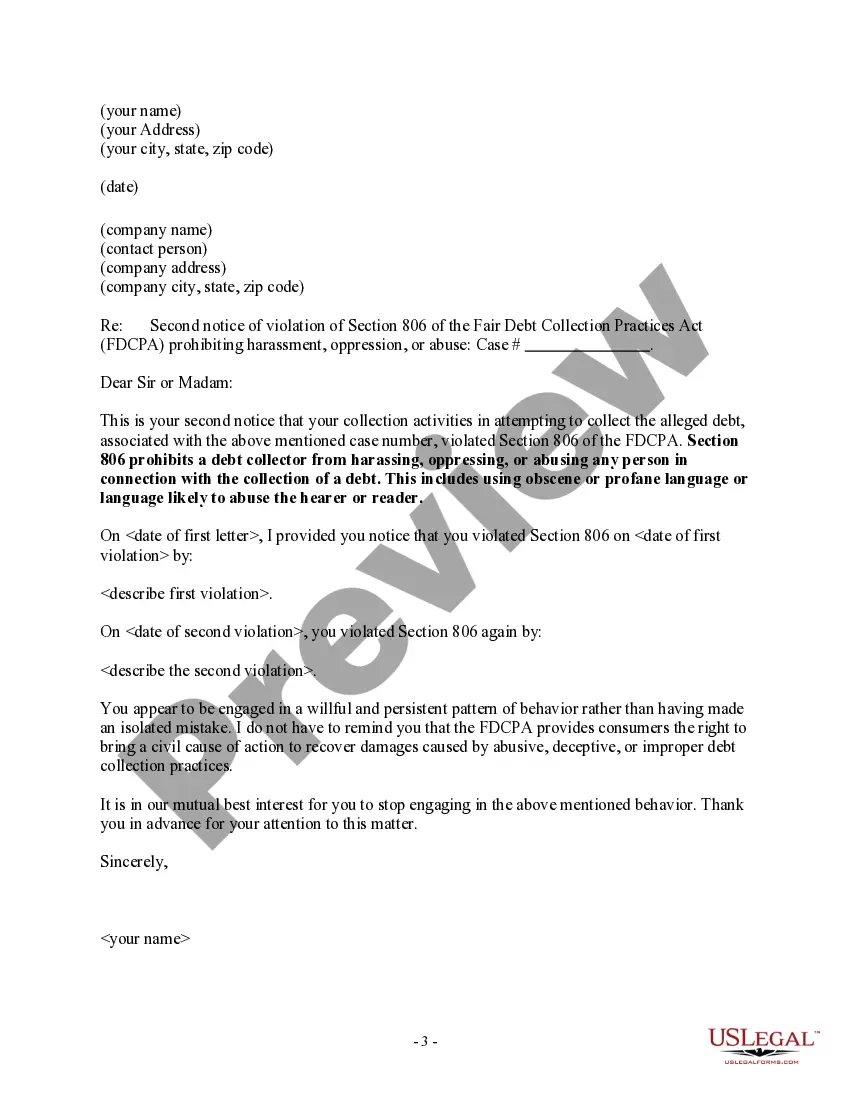

How to fill out Notice To Debt Collector - Use Of Abusive Language?

If you desire to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the leading selection of legal documents available online.

Employ the site’s straightforward and efficient search function to locate the materials you need.

An assortment of templates for business and personal purposes are sorted by categories and regions, or keywords and phrases.

Step 4. Once you have identified the form you need, click on the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Illinois Notice to Debt Collector - Use of Abusive Language with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Illinois Notice to Debt Collector - Use of Abusive Language.

- You can also access forms you have previously acquired within the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your relevant area/country.

- Step 2. Use the Preview option to review the form’s details. Remember to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of your legal document template.

Form popularity

FAQ

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Yes. The federal Fair Debt Collection Practices Act specifically gives you the right to sue a debt collector for harassment. If a debt collector is found to have engaged in harassing behavior, you are entitled to up to $1,000 in damages, along with court costs and attorney fees.

Ignoring or avoiding the debt collector may cause the debt collector to use other methods to try to collect the debt, including a lawsuit against you. If you are unable to come to an agreement with a debt collector, you may want to contact an attorney who can provide you with legal advice about your situation.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.

How to Deal With Rude and Aggressive Debt CollectorsKnow Your Rights.Take Notes.Keep Your Emotions Under Control.Stop Trying to Explain Yourself.End the Call.Don't Pick Up the Phone.Make Them Stop Calling.Dispute the Debt.More items...

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.