Illinois Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock

Description

How to fill out Notice And Proxy Statement To Effect A 2-for-1 Split Of Outstanding Common Stock?

You are able to commit time online searching for the legal document template that fits the federal and state demands you require. US Legal Forms offers 1000s of legal varieties that are analyzed by pros. You can actually down load or produce the Illinois Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock from my support.

If you have a US Legal Forms account, you are able to log in and click the Down load option. Afterward, you are able to full, modify, produce, or signal the Illinois Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock. Each and every legal document template you purchase is the one you have eternally. To obtain another backup of the acquired type, visit the My Forms tab and click the related option.

If you use the US Legal Forms web site initially, follow the straightforward directions below:

- Initial, make sure that you have selected the right document template for the region/city of your liking. Look at the type outline to make sure you have chosen the right type. If available, utilize the Review option to search with the document template too.

- In order to locate another variation from the type, utilize the Lookup discipline to find the template that fits your needs and demands.

- When you have located the template you would like, just click Get now to proceed.

- Pick the prices prepare you would like, enter your credentials, and register for a merchant account on US Legal Forms.

- Complete the purchase. You can utilize your Visa or Mastercard or PayPal account to fund the legal type.

- Pick the format from the document and down load it to the product.

- Make modifications to the document if required. You are able to full, modify and signal and produce Illinois Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock.

Down load and produce 1000s of document themes utilizing the US Legal Forms website, which offers the most important variety of legal varieties. Use skilled and state-specific themes to deal with your company or person requirements.

Form popularity

FAQ

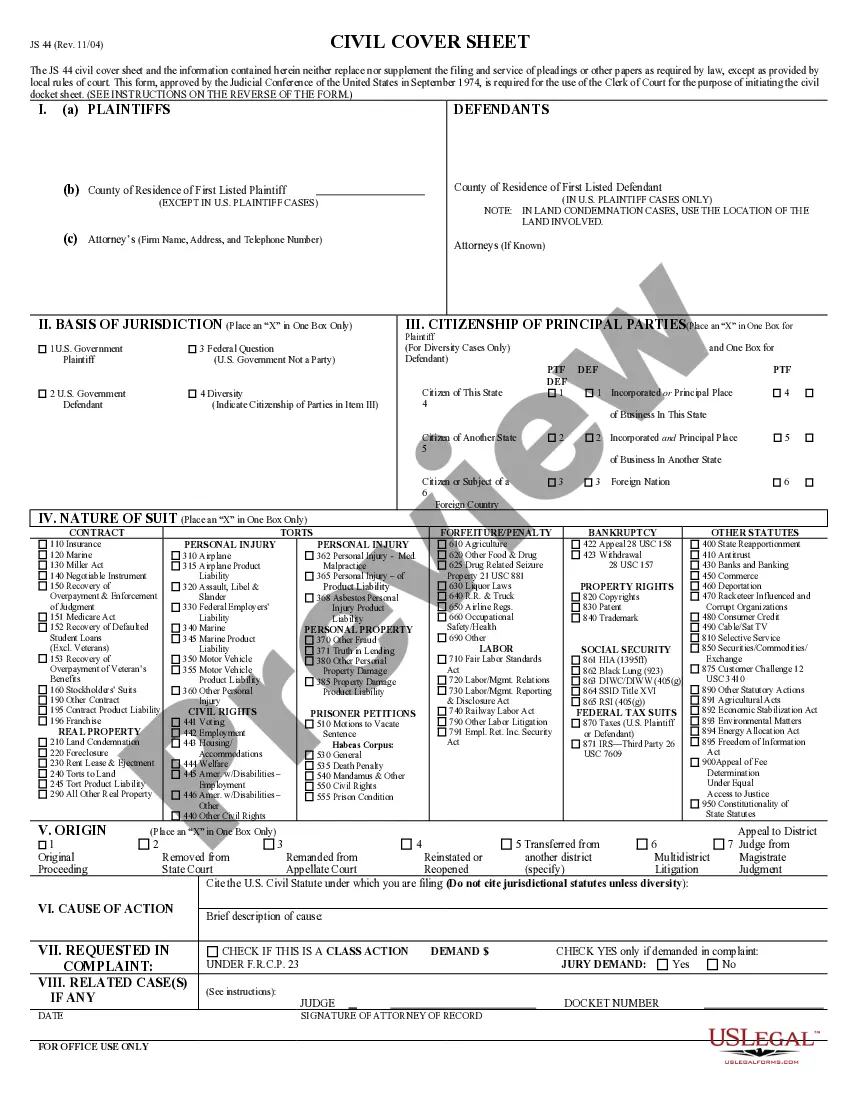

Proxy statements describe matters up for shareholder vote, and include management and executive compensation information if the shareholders are voting for the election of directors.

A proxy statement generally includes the names and short biographies of individuals on a company's board of directors, including those who are running for reelection and new candidates chosen by the board's nominating committee.

The proxy statement relating to a merger or acquisition will contain all the information listed, except the anticipated date on which the company plans on filing for an initial public offering.

A proxy statement is a document that public companies must provide their shareholders prior to a shareholder meeting. The Securities and Exchange Commission (SEC) requires companies to file their proxy statement in compliance with Schedule 14A. Companies file proxy statements on a Form DEF 14A.

Following are sample rules. Proxyholder Must be Present. Proxyholders must be present to vote. Voted as Designated. Proxyholders must vote as indicated on the proxy. Unsigned Proxies. Unsigned proxies are void. Unnamed Proxies. ... Undesignated Proxies. ... Attendance by Owner. ... Multiple Proxies. ... Alterations.

A proxy statement generally includes the names and short biographies of individuals on a company's board of directors, including those who are running for reelection and new candidates chosen by the board's nominating committee.

Proxy statements are intended for shareholders with voting rights, while annual reports are for anyone following the company. This may be shareholders, including potential investors, regulators, financial institutions and more.

On 2 November 2022, the U.S. Securities and Exchange Commission (SEC) voted 3?2, along party lines, to adopt a final rule and form amendments (together, the Final Rule) that would require additional disclosure on Form N-PX about a registered fund's proxy votes and require institutional investment managers to report on ...