Illinois Reduction in Authorized Number of Directors

Description

How to fill out Reduction In Authorized Number Of Directors?

Finding the right lawful file template can be a struggle. Of course, there are a lot of templates available on the net, but how will you find the lawful develop you want? Use the US Legal Forms website. The service offers thousands of templates, for example the Illinois Reduction in Authorized Number of Directors, that can be used for company and private demands. Each of the types are examined by pros and satisfy state and federal demands.

If you are already registered, log in for your bank account and click the Download button to find the Illinois Reduction in Authorized Number of Directors. Make use of bank account to check with the lawful types you may have acquired earlier. Proceed to the My Forms tab of the bank account and obtain an additional duplicate from the file you want.

If you are a whole new consumer of US Legal Forms, here are easy recommendations for you to follow:

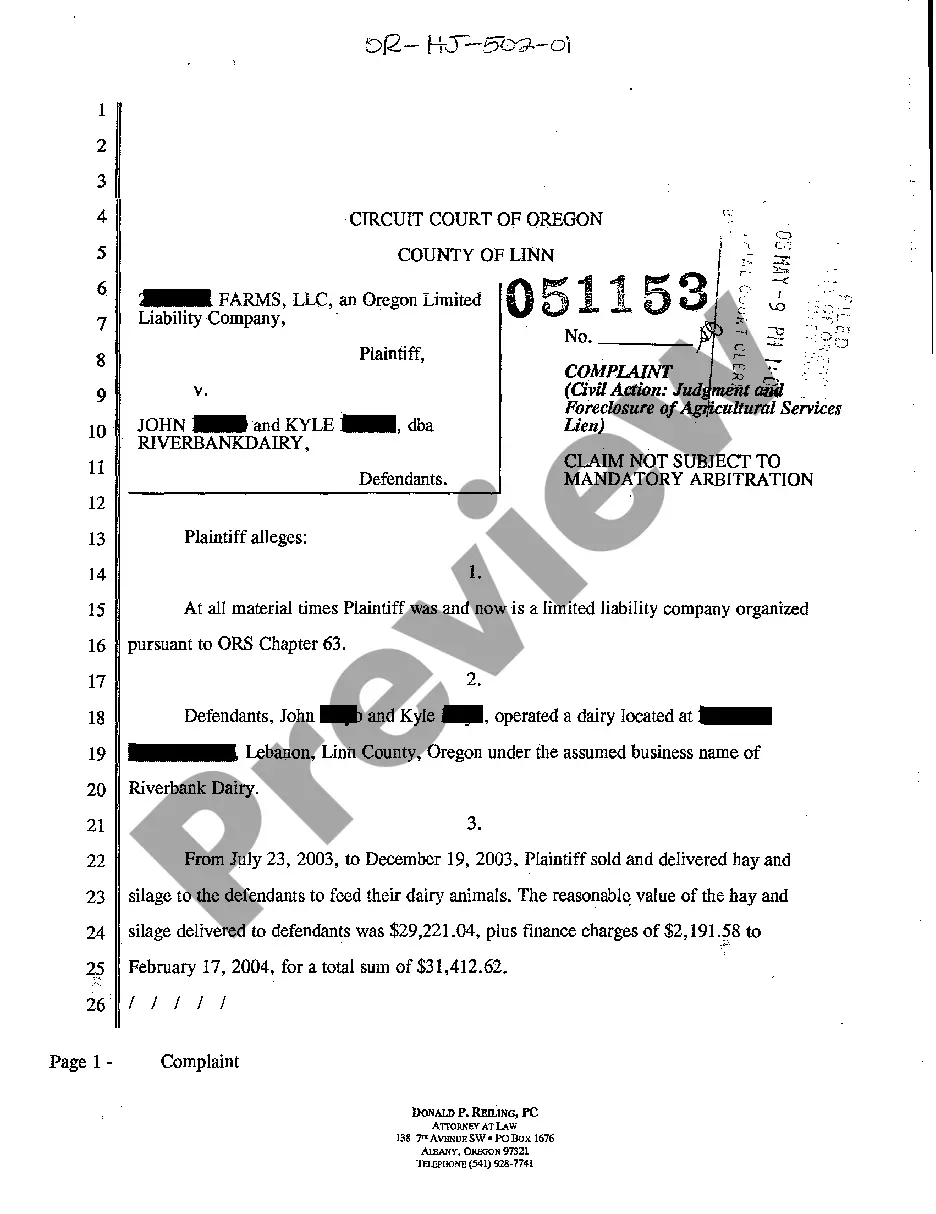

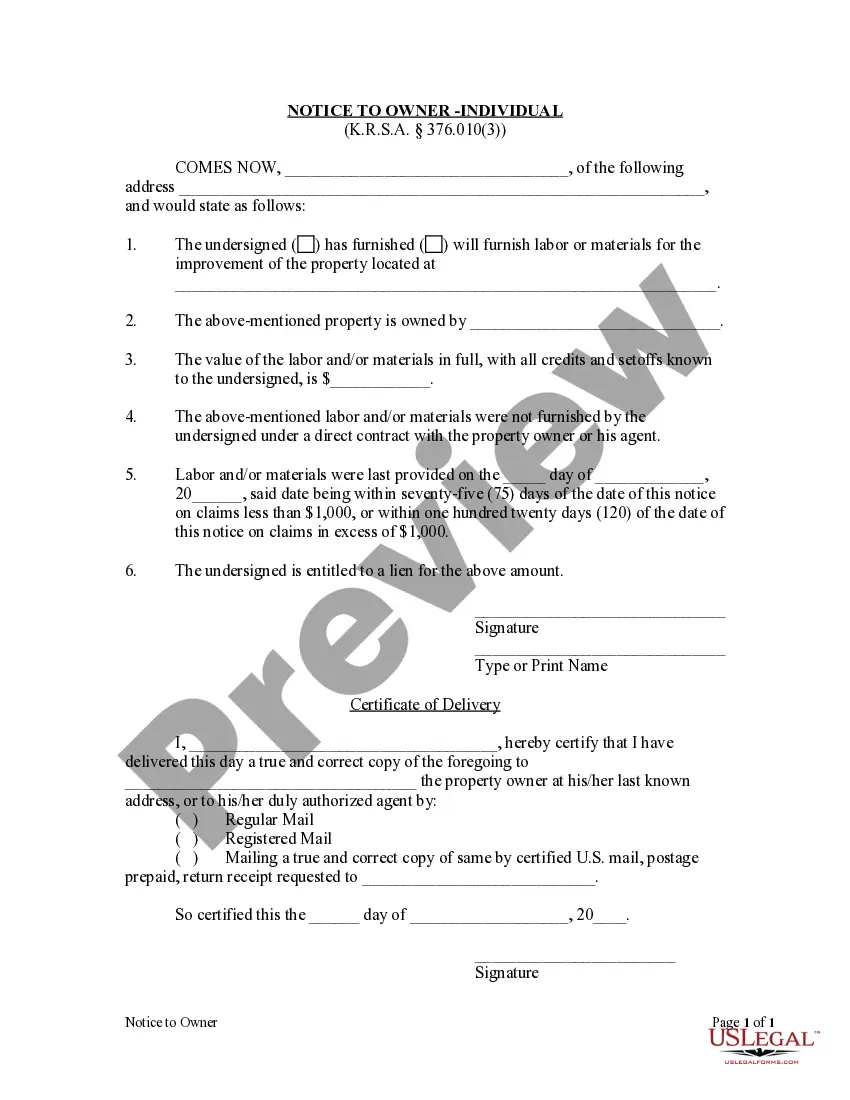

- Initial, ensure you have chosen the right develop to your city/region. You may examine the form making use of the Review button and browse the form outline to guarantee this is basically the best for you.

- In case the develop fails to satisfy your preferences, take advantage of the Seach area to get the right develop.

- When you are positive that the form would work, select the Acquire now button to find the develop.

- Pick the rates prepare you would like and enter the essential info. Design your bank account and purchase the order with your PayPal bank account or charge card.

- Opt for the data file formatting and down load the lawful file template for your product.

- Total, modify and produce and indication the attained Illinois Reduction in Authorized Number of Directors.

US Legal Forms may be the largest collection of lawful types that you can see a variety of file templates. Use the company to down load appropriately-created paperwork that follow condition demands.

Form popularity

FAQ

9.20. Reduction of paid-in capital. bankruptcy that specifically directs the reduction to be effected. (b) Notwithstanding anything to the contrary contained in this Act, at no time shall the paid-in capital be reduced to an amount less than the aggregate par value of all issued shares having a par value.

(b) Any person who is a shareholder of record shall have the right to examine, in person or by agent, at any reasonable time or times, the corporation's books and records of account, minutes, voting trust agreements filed with the corporation and record of shareholders, and to make extracts therefrom, but only for a ...

Directors. There must be at least three directors. They do not have to be Illinois residents or corporation members. You may list between three and seven directors on the Articles of Incorporation.

9.05. Power of corporation to acquire its own shares. (a) A corporation may acquire its own shares, subject to limitations set forth in Section 9.10 of this Act.

The duty of loyalty often arises in circumstances involving conflicts of interest, corporate opportunities, and competing with the corporation. Under Illinois law, an officer must not engage in self-dealing, take secret profits that belong to the corporation, or seize corporate opportunities.

12.10. Voluntary dissolution by written consent of all shareholders. Dissolution of a corporation may be authorized by the unanimous consent in writing of the holders of all outstanding shares entitled to vote on dissolution.

(b) Any person who is a shareholder of record shall have the right to examine, in person or by agent, at any reasonable time or times, the corporation's books and records of account, minutes, voting trust agreements filed with the corporation and record of shareholders, and to make extracts therefrom, but only for a ...

9.05. Power of corporation to acquire its own shares. (a) A corporation may acquire its own shares, subject to limitations set forth in Section 9.10 of this Act.