Illinois Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

US Legal Forms - one of many greatest libraries of legitimate forms in the United States - gives a wide range of legitimate document templates you may obtain or printing. Making use of the web site, you may get 1000s of forms for business and personal purposes, categorized by categories, suggests, or key phrases.You will discover the newest variations of forms like the Illinois Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 in seconds.

If you already have a membership, log in and obtain Illinois Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 from the US Legal Forms catalogue. The Acquire option can look on each kind you view. You have accessibility to all earlier acquired forms from the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, allow me to share simple guidelines to get you started out:

- Make sure you have picked the best kind to your area/region. Click the Preview option to analyze the form`s content. Read the kind description to ensure that you have chosen the proper kind.

- When the kind does not satisfy your needs, use the Research discipline towards the top of the monitor to get the one who does.

- When you are pleased with the form, validate your selection by clicking the Buy now option. Then, opt for the pricing plan you like and supply your references to sign up to have an profile.

- Procedure the financial transaction. Make use of bank card or PayPal profile to complete the financial transaction.

- Find the file format and obtain the form on your own gadget.

- Make changes. Fill out, modify and printing and indicator the acquired Illinois Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005.

Each and every template you put into your account lacks an expiration particular date and is yours permanently. So, in order to obtain or printing yet another copy, just proceed to the My Forms segment and then click on the kind you require.

Get access to the Illinois Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 with US Legal Forms, by far the most extensive catalogue of legitimate document templates. Use 1000s of skilled and condition-specific templates that meet up with your company or personal requires and needs.

Form popularity

FAQ

The filing fee for Chapter 7 is $335, and the cost for filing Chapter 13 is $310. DebtStoppers is the only firm in Illinois that will advance the court your Chapter 7 filing fee, allowing you to get the relief you need at no upfront cost to you.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

Additional Property Exemptions Necessary clothing. Title certificate for a boat over 12 feet in length. Bibles. School books. Family photos. Health aids. Proceeds from the sale of exempt property. Illinois College Savings Pool or ABLE accounts.

? income can vary month to month, and the means test finds the average. Your figure should include not only your wages, but also rental income, child support, alimony, pension or other regular monthly income. Social Security income does not count.

Chapter 7 is a ?liquidation? bankruptcy that doesn't require a repayment plan but does require you to sell some assets to pay creditors. Chapter 11 is a ?reorganization? bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors.

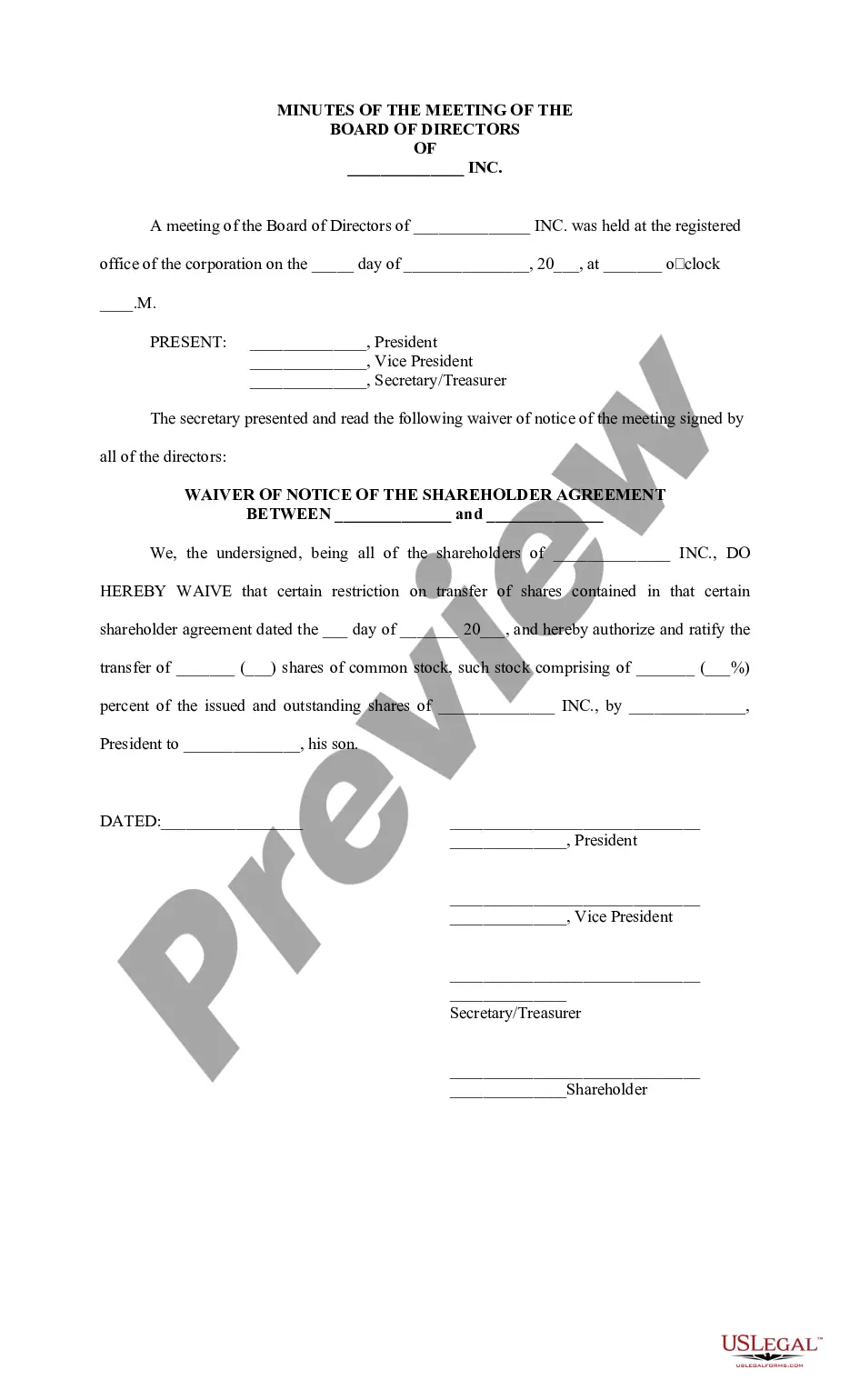

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.