Illinois Contract for the Sale of Fine Art Photography

Description

How to fill out Contract For The Sale Of Fine Art Photography?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal template formats that you can purchase or print.

Through the website, you can access countless forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent versions of forms such as the Illinois Contract for the Sale of Fine Art Photography within seconds.

If you already have a subscription, Log In and obtain the Illinois Contract for the Sale of Fine Art Photography from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously acquired forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Illinois Contract for the Sale of Fine Art Photography. Each format added to your account does not have an expiration date and is yours indefinitely. So, to acquire or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Illinois Contract for the Sale of Fine Art Photography with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize a variety of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you’ve selected the correct form for your city/state.

- Click the Preview button to view the form's content.

- Read the form description to confirm you have the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are pleased with the form, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

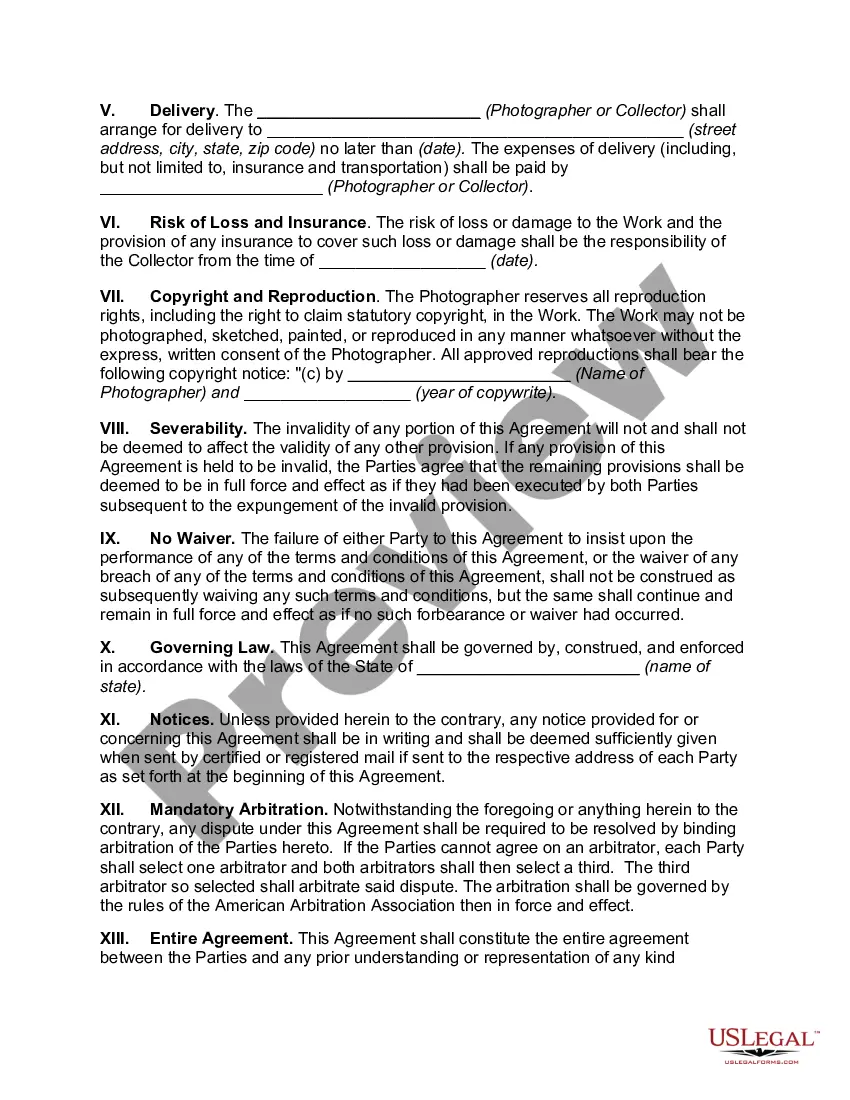

POINTS TO INCLUDE ON YOUR COMMISSION AGREEMENT CONTRACT:A loose description of the project. Use this description to list what aspects of the work are agreed upon in advance, such as size, colours, materials, etc.Payment terms.Deadlines.Framing.Delivery of the work.Installation of the work.Copyright.

Most artists charge a fixed price per square inch on the canvas and multiply that dollar amount by the size of the canvas. For example, an average price point is $1 per square inch. If you request a 16" x 20" art piece, that is an area of 320 inches. 320 x $1 per square inch is $320.

A Commission Contract generally includes:An Introduction that explains the project, defines the artist and commissioned, and details the specific work that is being commissioned.Payment Terms and Agreement that specify the agreement for payment installations.More items...

Typically, fees for commercial gallery representation range between 20% and 60% per piece, though commissions are generally around 50%.

An art gallery is one of the types of dealers. Art dealers are taxed in the same way as any other retail operation. As such, all income including income from the sale of art is taxed as ordinary income (IRC Sections 61, 64). Expenses, if ordinary and necessary, are deductible under IRC Sections 162.

You should have a contract in place between you and the artist before work begins. The contract should include the price, with all applicable expenses associated with creating the piece, and payment terms. Many artists will also ask for fifty-percent up front or some sort of deposit.

The art sold by artists and dealers is considered inventory, which means sales are taxed generally at rates of up to the highest ordinary income tax rate, which is currently 39.6%. When investors sell works of art, they are acquiring gains on their investments, similar to selling stock for a profit.

Where to sell your Fine Art PhotographyIs your work sellable? Finding your market.Sell your photography online. Automated online stores. Limited Edition and online art stores. Your website.Sell your photography at Art Exhibitions. Art Fairs. Commercial fine art Galleries. Individual art dealers. Auctions.Think Outside the box.

To help you get started, take a look at a few basic components to include in your contract so you can better protect your art business.Client Info.Project Info and Terms.Project Timeline.Costs and Payment Terms.Itemization.Artist's Rights.Cancellation Terms.Acceptance of Agreement.

Buying art to avoid taxes They are known as 1031 exchanges and this is how they work. Many wealthy art collectors can, and do, save millions in taxes by essentially rolling over their profits from selling their collection pieces into buying more art.