Illinois Sales Prospect File

Description

How to fill out Sales Prospect File?

US Legal Forms - among the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can access or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can locate the most recent versions of forms such as the Illinois Sales Prospect File in moments.

If you already hold a membership, Log In to retrieve the Illinois Sales Prospect File from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously obtained forms within the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Illinois Sales Prospect File. Each template you have added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the Illinois Sales Prospect File with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the correct form for your locality/county.

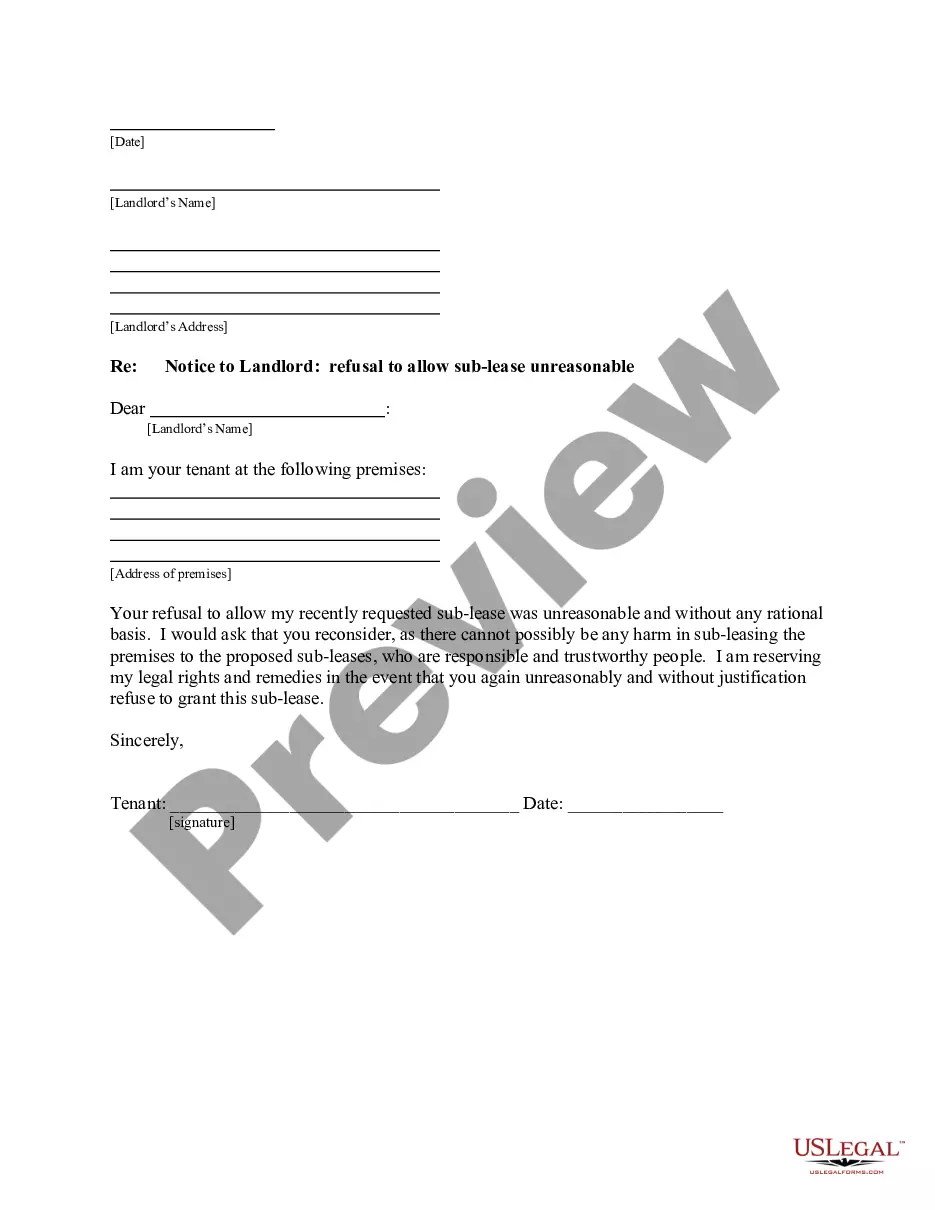

- Click the Preview button to review the content of the form.

- Examine the form details to confirm that you have chosen the appropriate document.

- If the form does not meet your requirements, utilize the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

No, a sales tax ID number is not the same as an EIN. While both are important for business operations, the sales tax ID number is specific to collecting sales tax, whereas the EIN serves as a tax identification number for your business in general. It is crucial to understand these differences to manage your Illinois Sales Prospect File effectively and ensure compliance with local tax laws.

You can obtain your Illinois tax pin number by registering your business with the Illinois Department of Revenue. If you lose or forget your pin, you may retrieve it by using the online portal or by contacting the department directly. Your tax pin number is essential for accessing your Illinois Sales Prospect File, helping you manage your tax obligations efficiently.

Yes, most businesses operating in Illinois are required to have a sales tax license. This license permits you to collect sales tax from customers, ensuring compliance with state regulations. Without it, you may face penalties and fines, which could negatively impact your Illinois Sales Prospect File and overall business operations.

To obtain an Illinois sales tax ID number, you need to register your business with the Illinois Department of Revenue. This can usually be done online, where you'll fill out the required forms with your business information. After completing the registration, you will receive your sales tax ID number, which is vital for your Illinois Sales Prospect File, as it allows you to legally collect sales tax.

No, a sales tax permit and an Employer Identification Number (EIN) are different. A sales tax permit, also referred to as a sales tax ID number, allows businesses to collect sales tax from customers in Illinois. An EIN, on the other hand, is a unique identifier for business entities and is used primarily for tax purposes. Understanding the distinction is important for managing your Illinois Sales Prospect File effectively.

To calculate tax, multiply the taxable amount by the sales tax rate. For example, if your item costs $100 and the sales tax rate is 6.25%, your total tax would be $6.25. Understanding tax calculations is essential for accurate budgeting, and the Illinois Sales Prospect File can be a helpful resource for examples and documentation.

In Illinois, the frequency of sales tax filing depends on your sales volume. Businesses may file monthly, quarterly, or annually based on their reported sales. Avoid penalties by staying organized and on schedule. The Illinois Sales Prospect File offers templates and tools to ensure you meet your filing requirements on time.

Illinois periodically updates its sales tax rates to reflect economic changes. Recent adjustments can affect various products and services, so staying informed is crucial. For the latest sales tax information and how it may impact your business or purchases, the Illinois Sales Prospect File provides timely updates and comprehensive insights.

If you are receiving communication from the Illinois Department of Revenue, it could be regarding your tax filings, notices about owed taxes, or updates on tax laws. It's essential to review these documents carefully, as they may contain actionable information. For clarity and additional resources, the Illinois Sales Prospect File can be your go-to for understanding your obligations.

To avoid paying car sales tax in Illinois, you may consider various exemptions, such as transferring a vehicle from a family member or qualifying for a trade-in. However, you must adhere to specific eligibility criteria. The Illinois Sales Prospect File can guide you in identifying applicable exemptions and steps to successfully register your vehicle without additional taxes.