Illinois Balance Sheet Deposits

Description

How to fill out Balance Sheet Deposits?

Selecting the optimal legal document format can be a challenge. Obviously, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. This service offers a vast array of templates, such as the Illinois Balance Sheet Deposits, suitable for both business and personal needs. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already a registered user, Log In to your account and click the Download button to obtain the Illinois Balance Sheet Deposits. Use your account to search through the legal forms you have previously purchased. Go to the My documents section of your account and download another copy of the document you need.

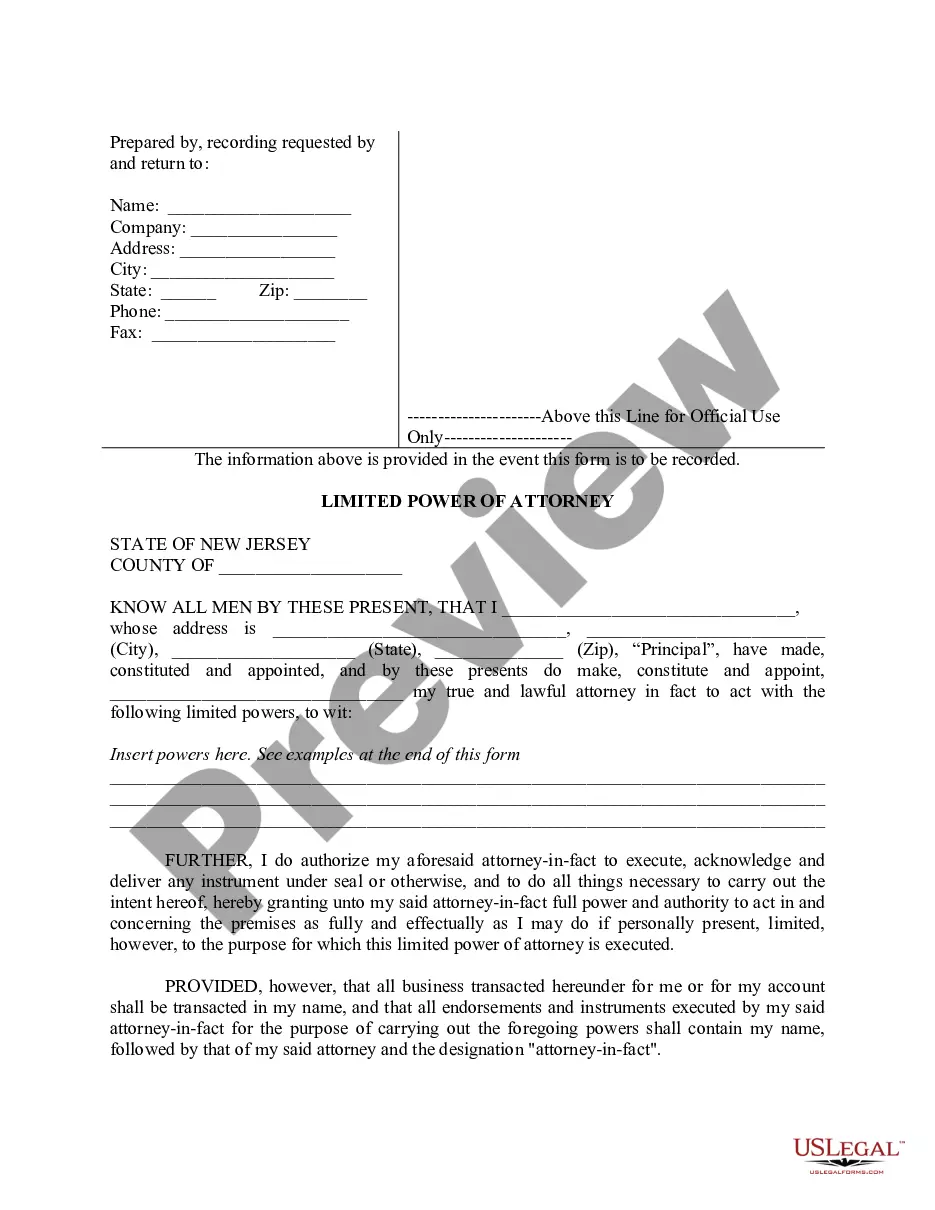

If you are a new user of US Legal Forms, here are simple guidelines for you to follow: First, ensure you have chosen the correct form for your city/region. You can view the form using the Review option and read the form description to confirm it’s suitable for your needs. If the form does not meet your specifications, use the Search box to locate the correct form.

US Legal Forms is the largest collection of legal forms where you can find an extensive array of document templates. Take advantage of this service to download professionally crafted documents that comply with state requirements.

- Once you are confident that the form is appropriate, click the Get now button to obtain the form.

- Choose your payment method and enter the required details.

- Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document format to your device.

- Complete, edit, print, and sign the acquired Illinois Balance Sheet Deposits.

Form popularity

FAQ

Customer deposits are listed under the liabilities section of the balance sheet. This placement indicates the bank's responsibility to return these funds to customers. By examining Illinois Balance Sheet Deposits, you can better grasp how banks structure their financial obligations.

Deposits is a current liability account in the general ledger, in which is stored the amount of funds paid by customers in advance of a product or service delivery. These funds are essentially down payments.

The deposit itself is a liability owed by the bank to the depositor. Bank deposits refer to this liability rather than to the actual funds that have been deposited.

Deposits as Assets When a business places a security deposit that is, it gives someone else money to hold against possible future charges the deposit is listed as an asset on its balance sheet.

A bank's balance sheet is different from that of a typical company. You won't find inventory, accounts receivable, or accounts payable. Instead, under assets, you'll see mostly loans and investments, and on the liabilities side, you'll see deposits and borrowings.

The volume of business of a bank is included in its balance sheet for both assets (lending) and liabilities (customer deposits or other financial instruments).

However, for a bank, a deposit is a liability on its balance sheet whereas loans are assets because the bank pays depositors interest, but earns interest income from loans.

A bank's balance sheet is a snapshot of its finances at a certain point in time, and represents activities like making loans to households, businesses and, taking deposits. There are three main parts to a balance sheet: Assets, Liabilities and Equity.

In either case, on a bank's T-account, assets will always equal liabilities plus net worth. When bank customers deposit money into a checking account, savings account, or a certificate of deposit, the bank views these deposits as liabilities.

Cash and cash equivalents under the current assets section of a balance sheet represent the amount of money the company has in the bank, whether in the form of cash, savings bonds, certificates of deposit, or money invested in money market funds. It tells you how much money is available to the business immediately.