Illinois Assignment of Commercial Leases as Collateral for Commercial Loan

Description

How to fill out Assignment Of Commercial Leases As Collateral For Commercial Loan?

If you have to comprehensive, download, or printing lawful file web templates, use US Legal Forms, the largest variety of lawful kinds, which can be found on the web. Use the site`s simple and easy practical look for to find the files you will need. A variety of web templates for organization and individual uses are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to find the Illinois Assignment of Commercial Leases as Collateral for Commercial Loan in a number of clicks.

Should you be presently a US Legal Forms client, log in in your account and then click the Acquire option to obtain the Illinois Assignment of Commercial Leases as Collateral for Commercial Loan. Also you can accessibility kinds you formerly saved within the My Forms tab of your respective account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

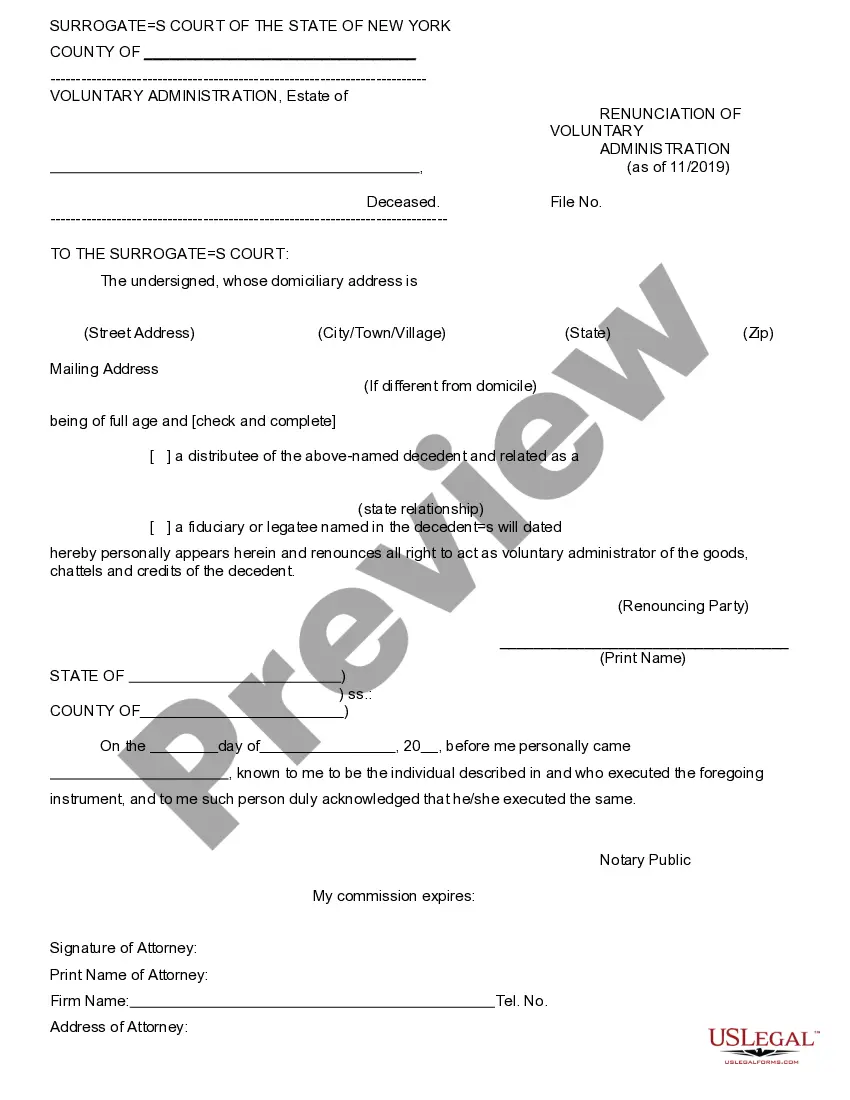

- Step 1. Make sure you have chosen the form for your proper town/country.

- Step 2. Make use of the Preview choice to look over the form`s content. Don`t forget about to read through the explanation.

- Step 3. Should you be unsatisfied using the form, use the Look for discipline on top of the display to get other versions from the lawful form format.

- Step 4. When you have discovered the form you will need, select the Purchase now option. Pick the costs strategy you favor and put your accreditations to register on an account.

- Step 5. Approach the deal. You may use your credit card or PayPal account to perform the deal.

- Step 6. Select the file format from the lawful form and download it on your product.

- Step 7. Total, edit and printing or indication the Illinois Assignment of Commercial Leases as Collateral for Commercial Loan.

Every single lawful file format you purchase is your own property eternally. You have acces to each form you saved within your acccount. Click the My Forms section and select a form to printing or download yet again.

Compete and download, and printing the Illinois Assignment of Commercial Leases as Collateral for Commercial Loan with US Legal Forms. There are millions of expert and condition-certain kinds you may use for your organization or individual demands.

Form popularity

FAQ

A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.

Key Purposes of a Collateral Assignment Collateral assignment concerns allocating a property's ownership privileges, or a specific interest, to a lender as loan collateral. The lender retains a security interest in the asset until the borrower entirely settles the loan.

?Collateral assignment of life insurance is typically associated with business loans and mortgages,? says Martinez. If you're launching a small business and applying for a loan to help you get started, the bank might request that you include your life insurance policy as collateral.

Collateral assignment concerns allocating a property's ownership privileges, or a specific interest, to a lender as loan collateral. The lender retains a security interest in the asset until the borrower entirely settles the loan.

This is a standard form of Collateral Assignment of Acquisition Agreements between a grantor and a secured party. It is intended to create a security interest in the grantor's contracts rights under a specified acquisition agreement under UCC Article 9.

You have a whole life insurance policy with a cash value of $65,000 and a death benefit of $300,000, which the bank accepts as collateral. So, you then designate the bank as the policy's assignee until you repay the $50,000 loan.

Gross Leases: Commercial tenants often prefer this type of lease because the tenant is only responsible for the rental value of the property. The landlord pays the property insurance, taxes, maintenance or repair fees, and some of the utilities (heat, water, electricity).

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.